Address Change in PAN Card Steps Online

A PAN Card is a critical document that every responsible Indian citizen must possess. You can use PAN Card to avail different services that include banking services, purchasing a vehicle, making investments, etc. Your PAN Card also serve as proof of identity and age when applying for a driving licence, passport and Voter ID.

Change Address in Pan Card India Online

Tin-NSDL

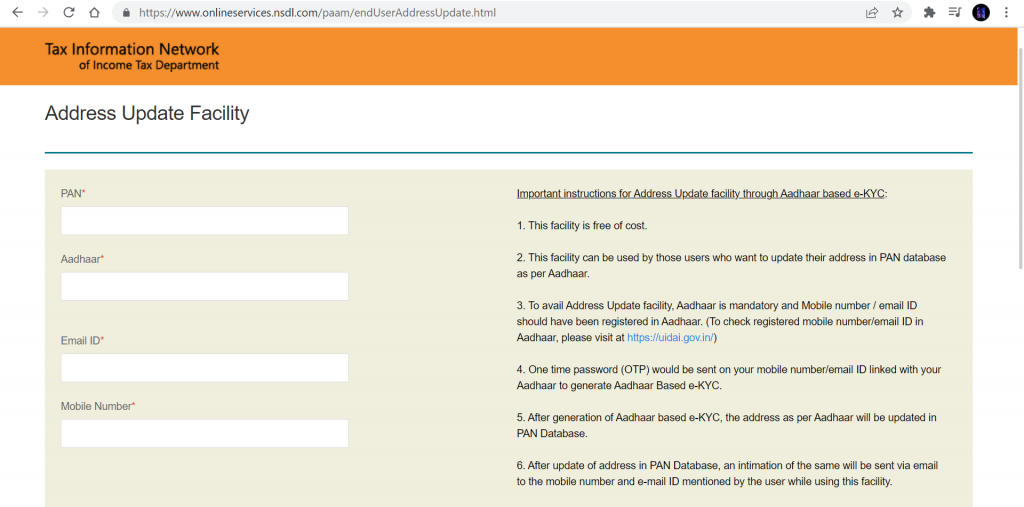

Aadhaar Based e-KYC

- Search ‘ Address Update Facility for NSDL’ in your web browser and select the onlineservices.nsdl.com.

- Fill in your PAN number, Aadhar number, Email ID and Mobile number( registered with your Aadhaar) and submit.

- Select Continue with eKYC to generate the OTP with your registered mobile number.

- Post submitting the OTP, the Request for Address Update page will open. You will see that your address details will come pre-filled as per the one in your Aadhaar.

- Then, verify the details and then verify & get OTP on your Mobile and Email.

- Then, enter the respective OTPs and click on Generate and Save/Print to download the acknowledgement receipt.

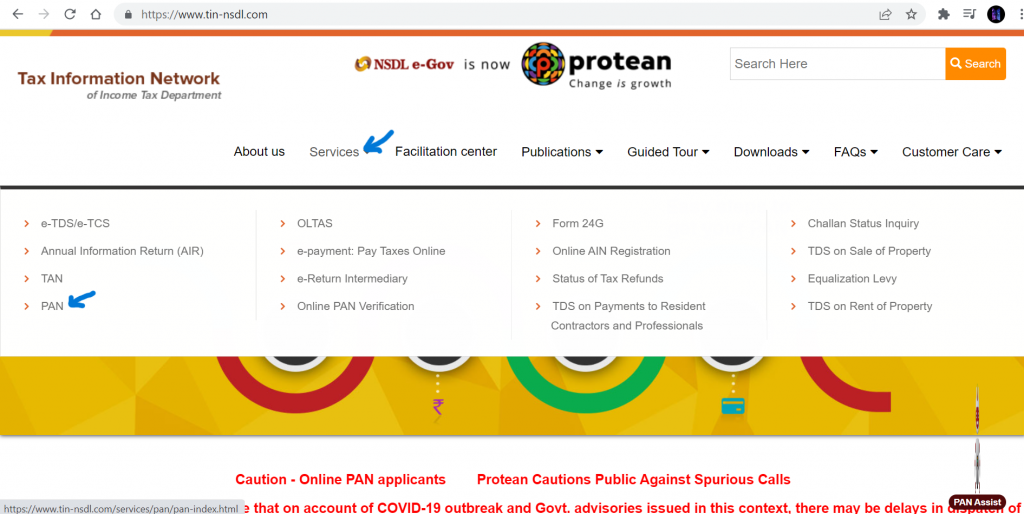

Without Aadhaar eKYC

- If you don’t wish to change address in PAN Card with Aadhaar, you can opt for this method to avail of the service.

- First, log on to tin-nsdl.com and click on the top-right 3-line menu on mobile to select Services for pan card address change. Then, select the option PAN. Alternatively, you can choose Online PAN Services from the Quick Links and then select Apply for PAN online.

- Secondly, scroll down and choose Apply link under the Change/Correction in PAN Data.

Online PAN Application

How to change address in pan card India online

- Now, the Online PAN Application will open. Now, choose the application type as Changes or Correction in the Existing PAN Data option from the drop-down list and proceed with the

- Then, select Individual in the category from the drop-down. Afterwards, fill in your Applicant Information carefully, check in the declaration and then submit after filling the Captcha code.

Selection of the Document Upload Method

- Read the guidelines and then select the method via which you want to submit the documents required for PAN Application.

- Select Submit scanned images through the e-Sign option, read instructions and then select whether you want a physical PAN Card or not. Herein, you can view fees from the fees applicable option for both the physical/ online PAN Card services.

- Then fill in the necessary details including, the first four digits of the Aadhaar card number and, submit.

Select Information you Want to Update/Correct.

- Check in only the boxes you want to make corrections in the information type and then select the Next option.

- Select the checkbox beside Address for Communication and select the Office/ Residential address you want to change.

- Then, fill in the correct address details and select Next to change address in pan.

Documents Selection

Document selection for how to change address in pan card India online.

- Now, select the documents required you want to upload for proof of identity, address and date of birth. Furthermore, you can optionally upload proof of PAN if available.

- Finally, fill out the declaration and enter the count of documents you uploaded with the application.

- Then, you have to upload your photo, signature and the documents required for address change in PAN card for PAN details correction.

Fees Payment

- Now, verify your details and enter the last eight digits of your Aadhar number to proceed.

- Finally, payment of the fees using any of the available payment options after ticking the Terms of Services.

- Select the Continue option after the Payment Receipt page shows up.

Created & Posted By Aashima Verma

Accounts Executive at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLPAddress: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

What are the Documents Required for Pan Card?

Documents Required for PAN Card Application Whether you are applying for a new PAN card or willing to reissue or want to correct data in the existing PAN, you have to submit a Form 49A or Form 49AA, along with a list of documents. The documents ...How to obtain the Income Certificate Online?

Income certificate is an official document issued by the State Government which certifies an annual income of a family. Income certificate includes details about the income of an individual or a family that is earned from various sources. In this ...Apply for Caste Certificate Online

Caste certificate is an important legal document that validates that a person belongs to a particular religion, community and caste. Citizens of Delhi can obtain a caste certificate to avail of the numerous kinds of facilities offered by the ...How to Apply PAN Card for company?

PAN Card for Company A Permanent Account Number known as PAN is a vital document for any taxpayer. It is a unique 10-character string of letters and digits. PAN card requirements are detailed in the Income Tax Act of 1961. A PAN card is a mandatory ...Steps for TDS Payment Online to Government

Procedure for making online TDS Payment To make online TDS Payment, logon to the e-Tax Payment System and follow the steps below: Select the relevant challan online, as applicable Income Tax Challan No ITNS 281 Choose “0020” if you are deducting TDS ...