Amendment to GST Registration - Non Core fields.....

Amendment to GST Registration - Non Core fields

Amendment to Non core fields in GST registration does not require approval of any Tax Officer or visiting the Tax Department. In other words, it is automatically approved without any need of processing by the Tax Officer.

Amendment in Non Core fields means amendment in the details of Authorised Signatory, Telephone Number, Email ID, details of partner, karta etc.

The procedure for the amendment of Non Core fields is as follows:

- Login to the GST Portal with valid User ID and password.

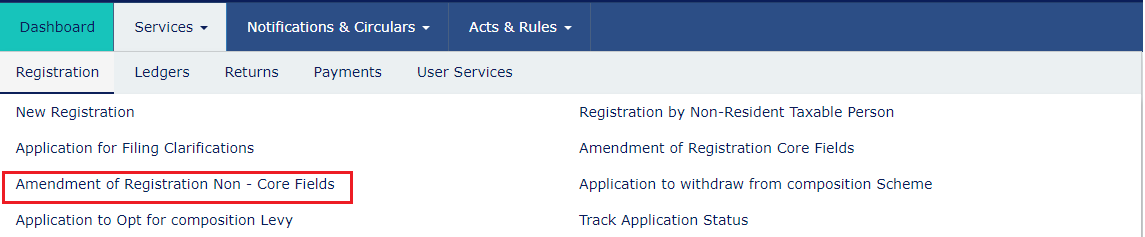

- Under Services tab, click Registration → Amendment to Registration Non - Core Fields.

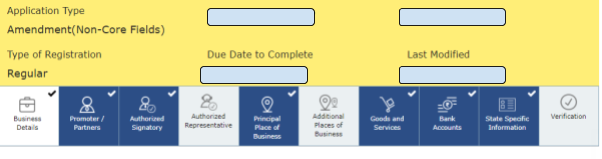

- The application for change is displayed and Non Core fields are available in editable form.

- Select the appropriate tab which you want to change / amend.

- After doing changes, click on Verification Tab.

- Select the Authorized Signatory from the drop down.

- Enter the Place.

- After the application is filled, you have to digitally sign the application using DSC or EVC.

A message will be displayed showing that the submission is successful.

You will receive an Acknowledgement within 15 minutes on registered Email ID and Mobile number. Also the email and message containing ARN and intimation about successful filing of application form for Amendment in Non Core fields will be sent to Primary Authorized Signatory.

Related Articles

Amendment to GST Registration - Core Fields

Amendment to GST Registration - Core Fields Amendment to Core fields in GST registration requires approval of Tax Officer. Amendment in Core fields means amendment in the details of: Any change in the name of business (if there is no change in the ...what are the process of name change under GST ?

Change of Firm Name in GST Registration Certificate In this article, we will discuss an important question that "Can we change name of firm in GST Registration". Though many people think that once GST Registration is obtained, it is not possible to ...How to amend Core & Non-Core Fields of GST Registration ...

Page Contents A. FAQs on Amendment of Registration – Core and Non-Core Fields Q.1 Can amendments be made to the information submitted in the Registration Application? Q.2 Who can file the Application for Amendment of Registration? Q.3 What are core ...How to do Self GST Number Registration

GST Registration process is online based and must be carried out on the government website gst.gov.in. Every dealer whose annual turnover exceeds Rs.20 lakh (Rs.40 lakh or Rs.10 lakh, as may vary depending upon state and kind of supplies) has ...How to Check GST Cancellation Status

How to check GST registration cancellation status There is a difference between cancelling a GST registration and modifying a GST Registration. We’ll go through the steps involved in cancelling your GST registration in this article. # What Is ...