Can a One Person Private Limited Company have more than one director?

✅Understanding the Legal Possibilities & Practical Implication

The

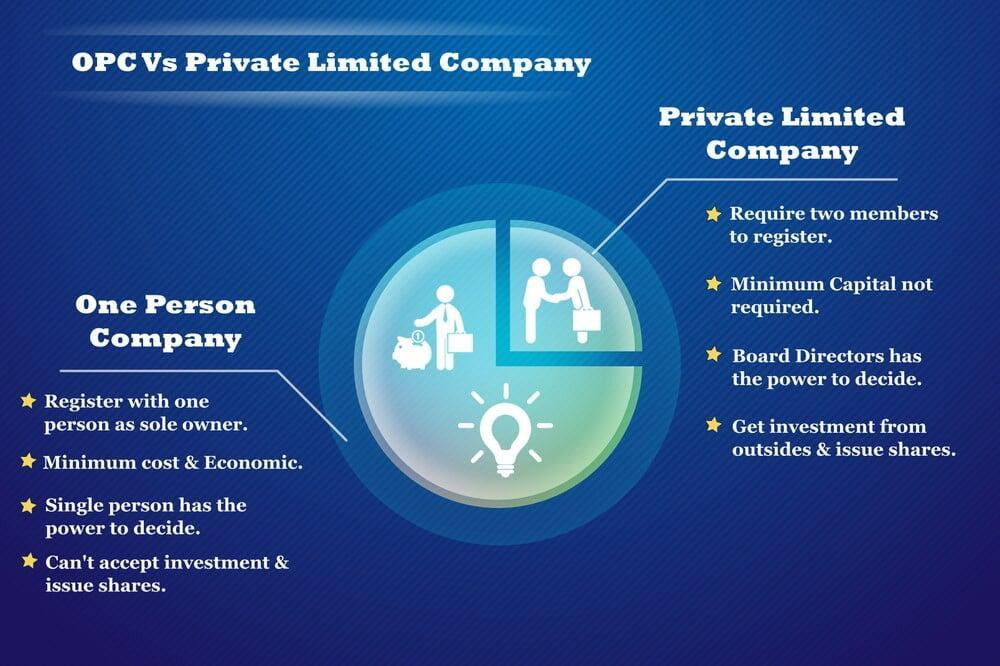

One Person Company (OPC) structure has emerged as a revolutionary concept for

entrepreneurs who wish to venture alone without the complexities of a

traditional Private Limited Company. Introduced under the Companies Act, 2013,

OPC offers the benefits of limited liability, corporate structure, and legal

recognition — all while allowing a single individual to operate the business.

However,

one of the frequently asked questions regarding OPCs is:

"Can a One Person Private

Limited Company have more than one director?"

This article provides a

comprehensive answer, supported by legal provisions, expert opinions, and

practical insights.

What is a One Person Private Limited Company (OPC)?

A One Person Company is a type of

private limited company that can be incorporated with only one member or

shareholder. It is governed by the Companies Act, 2013 and regulated by

the Ministry of Corporate Affairs (MCA) in India.

Key

Features of OPC:

✔ Only one shareholder (mandatory)

✔ Limited liability protection

✔ Separate legal entity status

✔ Tax benefits similar to Private Limited Companies

✔Lower compliance requirements than traditional companies

✔ Limited liability protection

✔ Separate legal entity status

✔ Tax benefits similar to Private Limited Companies

✔Lower compliance requirements than traditional companies

Minimum & Maximum Director Requirement for OPC

What

the Law Says:

According to Section 149(1)

of the Companies Act, 2013:

- Every company shall have a Board of Directors.

- Minimum one directoris required in an OPC.

- Maximum of 15 directorsare allowed in any private company, including OPCs.

Thus, while an OPC must have at

least one director, the law does not restrict the appointment of more

than one director. The shareholder (member) remains one, but the board may

consist of more directors for operational and managerial purposes.

Difference Between Shareholder and Director

Many people confuse the terms shareholder

and director, but they are distinct roles:

|

Aspect |

Shareholder |

Director |

|

Ownership |

Owns the company |

Manages and runs the company |

|

Minimum Required |

Only 1 in OPC |

Minimum 1, Maximum 15 allowed |

|

Appointment Basis |

Owns shares |

Appointed by shareholder(s) or themselves |

|

Role |

Investor, entitled to profits |

Day-to-day decision-making & governance |

Thus, an OPC can have only one

shareholder but is legally allowed to have more than one director.

Practical Scenarios Where More Than One Director is Appointed

In real-world business situations,

an OPC may appoint additional directors for:

✅ Bringing in expertise and experience

✅ Division of responsibilities

✅ Facilitating company operations

✅ Improving credibility with banks, clients, or vendors

✅Meeting statutory requirements, if applicable

✅ Division of responsibilities

✅ Facilitating company operations

✅ Improving credibility with banks, clients, or vendors

✅Meeting statutory requirements, if applicable

Example:

Suppose Mr. Raj owns an OPC, Raj Enterprises Private Limited. He is the

sole shareholder and director initially. As the business grows, he appoints Ms.

Priya as an additional director to handle marketing operations. The ownership

stays with Mr. Raj, but the company now has two directors for effective

management.

How to Appoint Additional Directors in an OPC?

The appointment of additional

directors in an OPC follows a formal process as per the Companies Act, 2013:

Step

1: Obtain DIN (Director Identification Number)

The proposed director must have a

valid DIN, which is issued by MCA.

Step

2: Obtain Consent in Form DIR-2

The person must provide written

consent to act as a director.

Step

3: Pass Board Resolution

The existing director(s) pass a

Board Resolution approving the appointment.

Step

4: File with ROC (Registrar of Companies)

The company files Form DIR-12

with the ROC within 30 days of appointment.

Limitations on Shareholding in OPC

While multiple directors are

allowed, shareholding is strictly restricted to one person only, who

must be:

✔ A natural person

✔ An Indian citizen

✔Resident in India (has stayed for at least 120 days in India during the financial year)

✔ An Indian citizen

✔Resident in India (has stayed for at least 120 days in India during the financial year)

Note:

A minor cannot be a member of an OPC.

Thus, even if multiple directors

manage the company, the ownership remains solely with the individual

shareholder.

Advantages of Having More Than One Director in an OPC

1.

Better Governance and Decision-Making

Multiple directors bring diverse

perspectives, improving the company's governance.

2.

Division of Responsibilities

Operational duties can be divided,

leading to better efficiency.

3.

Professional Expertise

Experts can be brought in as

directors for technical or strategic areas.

4.

Business Growth Support

Having multiple directors enhances

the company's ability to scale and manage growth effectively.

Things

to Keep in Mind

While appointing additional

directors in an OPC:

✔ They must comply with eligibility criteria under the

Companies Act.

✔ They must not be disqualified under Section 164 of the Companies Act.

✔ Their appointment must be properly documented and filed with ROC.

✔They do not become shareholders unless specifically allotted shares (which is not allowed in OPC beyond one member).

✔ They must not be disqualified under Section 164 of the Companies Act.

✔ Their appointment must be properly documented and filed with ROC.

✔They do not become shareholders unless specifically allotted shares (which is not allowed in OPC beyond one member).

Common

Misconceptions

Myth:

An OPC can have only one director.

Fact:

Only one shareholder is mandatory. Directors can be more

than one.

Myth:

Directors in OPC must also be shareholders.

Fact:

Only the shareholder must be one person. Other directors

may or may not be shareholders.

Conclusion

In conclusion, a One Person Private Limited Company can have more than one director, provided the ownership remains with a single individual. This flexibility allows entrepreneurs to enjoy the benefits of professional management while retaining full control of their business.

Created & Posted by Pooja

Income Tax Expert at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/3, UGF, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.co

Related Articles

CA Services for Compliance with the Companies Act

? Introduction The Companies Act, 2013, is the principal legislation that governs companies in India. Its aim is to ensure transparency, accountability, and good governance in corporate entities. However, with its complex provisions, adherence to ...What are the legal requirements for a One Person Private Limited Company?

? What Are the Legal Requirements for a One Person Private Limited Company? A One Person Company (OPC) is a unique business structure under the Companies Act, 2013, allowing a single individual to operate a corporate entity with limited liability. ...What are the compliance requirements for a One Person Private Limited Company?

What are the Compliance Requirements for a One Person Private Limited Company? Introduction One Person Company (OPC) is a unique concept introduced under the Companies Act, 2013, to encourage individual entrepreneurs to incorporate their businesses ...CA Services for Compliance in the Mining Sector

Empowering Mining Businesses with Expert Compliance Solutions The mining sector in India is a cornerstone of industrial growth and economic development. However, it also operates under a heavily regulated framework due to the environmental, safety, ...Mandatory Compliances for Private Limited Companies in Goa

? Introduction Goa, India’s smallest state by area but one of the most dynamic in terms of tourism and commerce, has been steadily attracting entrepreneurs and investors. The combination of a thriving tourism industry, a growing IT services sector, ...