Company Tax Return Penalties In India

The taxpayers have to file the income tax return of their income earned up to 31st July of the assessment year relevant to the financial year, unless extended.

The government gives a four-month window every Assessment Year (A.Y.) for taxpaying citizens to consolidate their income details for the relevant financial year and file income tax returns. The said four-month period starts on 1st April and ends on 31st July (unless extended).

It takes only a few minutes to file your ITR, therefore this is more than reasonable. In addition to paying taxes on time, we must file returns by the due date or suffer penalties. This post will go over the consequences of filing an ITR late and what to do if you fail to file an ITR.

Due date for filing ITR for AY 2022-23

For the Assessment Year 2022-23, the due date for return filing as per section 139(1) is 31st July 2022, unless extended by the government.

Many taxpayers believe that they have no further obligation if they have paid their taxes. However, missing the ITR filing deadline has legal consequences. Effective from the financial year 2017-18, a late filing fee is applicable for filing returns after the due date.

| Sr. No. | Particulars | Due Date |

| 1 | ITR filing for individuals and entities not liable for tax audit | 31st Jul 2022 |

| 2 | ITR filing for taxpayers covered under the tax audit (other than transfer pricing cases) | 31st Oct 2022 |

| 3 | ITR filing for taxpayers covered under transfer pricing | 30th Nov 2022 |

| 4 | Due date for revised return/belated return of income for FY 2021-22 | 31st Dec 2022 |

Late filing fees u/s 234F

Effective from FY 2017-18, a late filing fee will be applicable for filing your returns after the due date under Section 234F.

For instance, the due date for filing returns for FY 2021-22 is 31st July 2022. If you miss filing ITR by the due date, you can file the belated return by 31st December 2022. However, you are required to pay the penalty for late filing.

The maximum penalty of Rs 5,000 will be levied if you file your ITR after the due date of 31st July 2022 but before 31st December 2022.

However, there is a relief given to small taxpayers – if their total income does not exceed Rs 5 lakh, the maximum penalty levied for delay will be Rs 1,000.

To summarise the Section 234F

| Late Filing Fee Details as per Section 234F | ||

|---|---|---|

| e-Filing date for individuals/HUF | Total income below Rs 5 lakh | Total income above Rs 5 lakh |

| Up to 31st July 2022 | Rs 0 | Rs 0 |

| Between 1st August 2022 to 31st December 2022 | Rs 1,000 | Rs 5,000 |

Benefits of filing ITR on time

Filing your ITR on time does make you feel responsible and good about yourself, but the benefits don’t end there. Filing your ITR on time can benefit you in more ways:

Easy Loan Approval

Filing the ITR will help individuals when they have to apply for a vehicle loan (2-wheeler or 4-wheeler), house loan, personal loan, etc.

Claim Tax Refund

If you have paid excess tax to the income tax department, you should file your income tax return as early as possible to process the return and receive a tax refund.

Income & Address Proof

You can use the income tax return as proof of your income and address, which is mandatory when applying for a loan or visa.

Quick Visa Processing

Most embassies & consulates require you to furnish copies of your tax returns for the past couple of years at the visa application.

Carry Forward Your Losses

If you file the income tax return within the due date, you will be able to carry forward losses to subsequent years. You can use such losses to set off against your future income.

Avoid Penalty and Prosecution

You can avoid the income tax department initiating prosecution proceedings as discussed in the below section.

Consequences of not filing by the due date

Prosecution

The income tax officer can initiate proceedings for prosecution if the person willfully fails to file a return even after issuing notices. The imprisonment can be for a term of three months to two years with a fine.

If the tax you owe to the income tax department is higher, the prosecution period may extend to seven years.

Penalty

Further, the income tax officer may impose a penalty of up to 50% of the tax due in case of underreporting income.

Apart from the penalty levied by the IT department, there are other consequences that a taxpayer may face for late filing of returns:

Unable to set off losses

Losses incurred (other than house property loss) are not allowed to be carried forward to subsequent years. You cannot set off these losses against future gains if the return has not been filed within the due date. However, if there are losses under house property, carrying forward losses is permitted.

Interest in the delay of filing the return

Apart from the penalty for late filing, interest will be charged under Section 234A at 1% per month or part thereof on tax due until the payment of taxes.

It is important to note that you cannot file ITR unless you pay taxes. The interest calculation under the said section will start from the date falling immediately after the due date, i.e. 31 August 2022 for FY 2021-22. So, the longer you wait, the more you pay.

Delayed refunds

In case you’re entitled to receive a refund from the government for excess taxes paid, you must file the returns before the due date to receive your refund at the earliest.

What if ITR is not filed for the previous financial years?

If you missed filing ITR for previous years, you can apply for condonation of delay and file an online return.

For example, if you missed filing ITR for FY 2020-21 by 31st March 2022, you can request for a condonation of delay through an e-filing portal and file an online return.

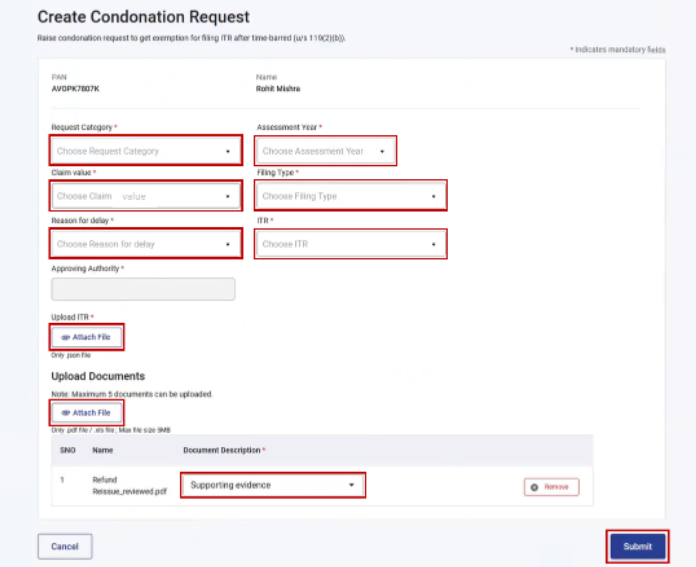

Steps to place condonation of delay request to file previous years return:

Step 1: To do the same log in to your e-filing account.

Step 2: On the ‘Services’ tab, click on ‘Condonation Request’.

Step 3: Select ‘Allow ITR filing after time barred’ and click on the ‘Continue’ button.

Step 4: On the next page, click on ‘Create Condonation Request’.

Step 5: Now enter the relevant details, upload the ITR and submit.

Step 6: After successful submission, you can choose the option to e-verify. The ITR will be processed subject to the approval of the condonation request. You can track the status of the condonation request sent.

Note: If some users are not finding this in their IT account, there can be a technical issue in the portal for which he/she can raise a grievance.

They can also visit the respective Assessing Officer and submit a letter seeking condonation of delay and then do online ITR filing.

Filing Return Through Paper Mode (Offline) for Previous FY After the Due Date

Paper return is not an accepted mode of submission in normal cases. It is accepted where the taxpayer is older than 80 years of age or the area in which the taxpayer resides has significant infrastructure deficiency & many are affected by e-filing. In such cases, the government will come out with explicit notifications with SOP on paper filing submissions.

Penalty Consequences and Other Losses

Yes, the late filing penalty under Section 234E discussed above, interest (where applicable) will be levied, and the return will be processed under best judgement assessment.

Accountant at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

What are the penalties for late filing of LLP documents?

Limited Liability Partnerships (LLPs) in India enjoy simplified compliance compared to companies. However, non-compliance with statutory filing requirements can attract hefty penalties and additional fees. Every LLP registered under the Limited ...🗂️ Annual Filing Requirements for LLPs in India

✅ Introduction A Limited Liability Partnership (LLP) is a popular business structure in India that offers the benefits of limited liability with the operational flexibility of a partnership. However, like all registered entities, LLPs must adhere to ...What are the compliance requirements for LLPs in India?

Compliance Requirements for LLPs in India: A Complete Guide Limited Liability Partnerships (LLPs) have become a popular business structure in India due to their hybrid nature—combining the benefits of a company and a partnership. While LLPs enjoy ...Annual Compliance Checklist for One Person Company

Annual Compliance for OPC One Person Company means a company that is wholly managed and controlled by a single person. The management of OPC comprises only one person which consists of 100% of shares in that company. All the important decisions ...Shareholder Filing With MCA In India

Shareholders play a crucial role in the governance and decision-making processes of a company. In India, the Ministry of Corporate Affairs (MCA) is responsible for regulating corporate affairs and maintaining a database of registered companies and ...