Documents required in Spice+ form

Conversion of Partnership Firm to Private Limited Company

Converting a partnership firm to a private limited company involves several legal and procedural steps. This transformation allows the firm to benefit from the advantages of a corporate structure, such as limited liability, perpetual succession, and easier access to capital. In this article, we will discuss the process of converting a partnership firm to a private limited company in detail. Converting a Partnership firm to a private limited company, which becomes a separate legal entity, reduces the risk of liability, and the personal assets will remain untouched except in case of fraud. The incorporation and compliance procedure of a private limited company is as per the Companies act, 2013, and the shares are held privately.

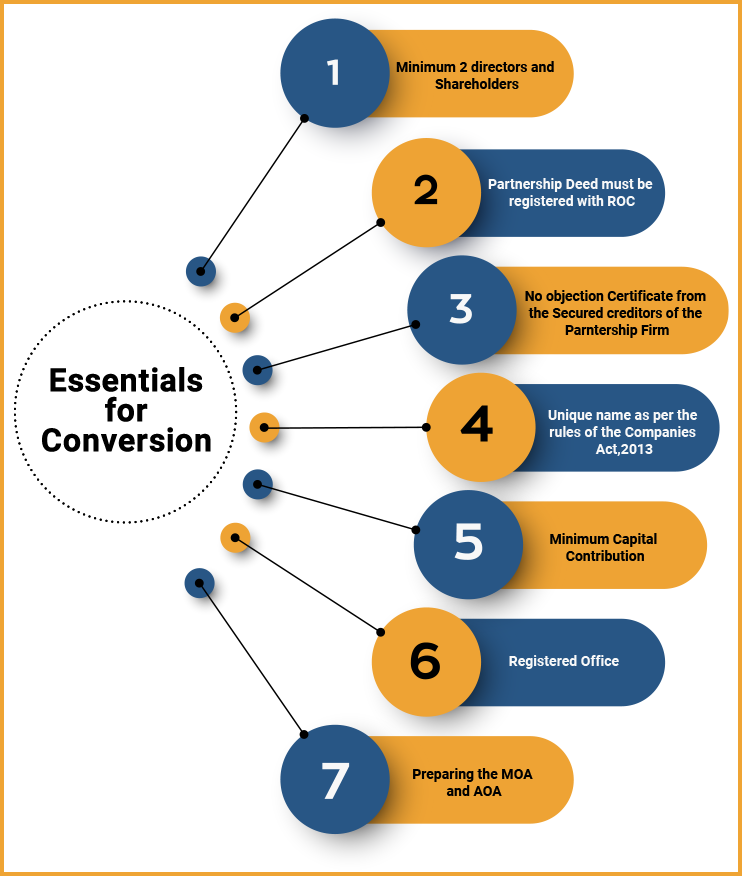

Essentials for Converting the Partnership firm into a Private Limited Company

The essential pre-requisite conditions for converting the Partnership firm into a Private Limited Company are-

- The Partnership deed must be registered with the Registrar of companies.

- The No Objection Certificate must be obtained from the secured creditors of the partnership firm.

- The partnership firm must obtain a unique name, and the name should end with Pvt. Ltd.

- There should be the contribution of the minimum capital.

- There should be a registered office of the partnership firm.

- After completing the appropriate procedure of conversion,

- the company should form their MOA and AOA for Incorporation.

Benefits of Converting a Partnership firm into a Private Limited Company

- Copy of ID and Address proof of the shareholders and directors,

- NOC from the owner of the property,

- Proof of Commercial address (Rent Agreement or lease deed),

- Copy of the utility bills (not older than two months)

The procedure of Conversion of a Partnership Firm into a Private Limited Company

Requisite steps to be followed for the conversion of a Partnership Firm into a Private Limited Company are:

Step 1-Conducting a meeting of the partners for the Conversion of the Partnership Firm into a Private Limited Company

Apply For DSC And DIN For All Proposed Directors and Shareholders of The Company- It is one of the pre-requisites to apply for DSC and DIN of the proposed directors and shareholders.

Step -2 Obtain name Approval in the RUN form.

File an application in the RUN form on the MCA website click here to get the Incorporation done for the proposed company after conversion.

A Partnership firm can apply for the same name, provided the name should be unique as per the rules of the Companies Incorporation Rules 2014 and subject to the availability of the name.

The proposed director or shareholder shall provide the necessary attachments along with the proposal for the conversion of the partnership firm.

Step -3 File Form URC-1

File Form URC-1 within 30 days of name approval along with the necessary documents in the form of attachments with ROC.

Step - 4 Publish an advertisement in Two Newspaper

As per section 374(b) of the Companies Act, 2013 firm opting for Incorporation under the provision of Part I of Chapter XXI shall publish an advertisement about Incorporation.

An advertisement shall be in Form No. URC-2. Further, the advertisement shall be published in 2 newspapers-

- in English and,

- The other is in the principal vernacular language of the district.

Step – 5 Draft MOA and AOA

Once the Name and E-FORM URC-1 are approved by the Registrar, the applicant company is required to draft the Memorandum and Articles of Association and other relevant documents required for Incorporation.

Step -6 Issue of Certificate of Incorporation

File SPICE+ along with the required documents and if the Registrar is satisfied with the documents and information filed by the applicants. The Registrar shall issue a COI (Certificate of Incorporation) to the applicant company.

Corpbiz assistance in Converting Partnership Firm into Private Limited Company

- Purchase a Plan for Expert Assistance

- Add Queries Regarding the conversion

- Provide Documents to Corpbiz Expert

- Proper Assistance and advisory for conversion.

- Complete all other required Actions

- Get your work done!

Conclusion

Related Articles

Conversion of Private Limited Company in India

Introduction A Private Limited Company is a small business which is maintained privately, it is one of the highly recommended businesses in India especially for startups. The registration of the private limited company is governed by The Companies ...Conversion Of Private Limited Company To Trust

In India there are some definite rules that you need to follow in order to change the kind of company that you are looking for. There are forms need to be filed and documents that have to be provided. Then, there are authority bodies whose rules and ...Private Limited Company

One of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners ...How to start a partnership firm in Bangalore?

Starting a business in Bangalore, India's Silicon Valley, offers immense opportunities for growth and success. If you're planning to establish a partnership firm in Bangalore, it's essential to understand the legal, regulatory, and procedural ...Conversion of Private Limited Company to LLP in Bangalore

Introduction Limited Liability Partnership has become a very popular business type after the introduction of Companies Act, 2013. It is also called an LLP. It is a kind of partnership in which the liabilities of the partners are limited. In this ...