conversion of private company into OPC

Conversion of Private Company into OPC: Step by Step Procedure

What are a Private Company and a One Person Company (OPC)?

Private Company

The liability of each member is limited to their shares only. The Shareholder can sell their own shares in case the Company faces loss. Private Company keeps in the existence of law forever, even in case of death, bankruptcy, or insolvency of any of its members.

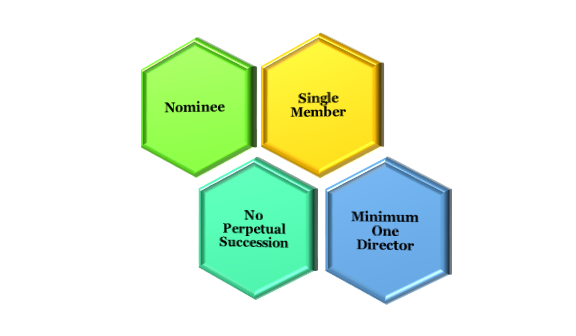

One Person Company

The unique feature of One Person Company (OPC) is that the sole member of the Company has to mention a nominee while registering for OPC. So, in case of death of a sole member, the nominee has the right to choose or reject to become a sole member of OPC.

OPC enjoys several privileges and exemptions under the Companies Act, 2013, as compared to the other classes of Companies.

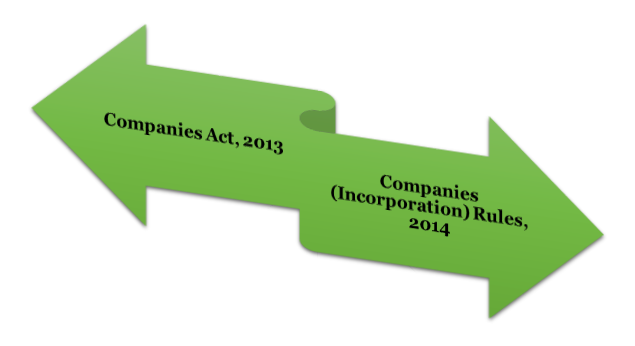

What are the legal provisions governing the Conversion of a Private Company into OPC?

The legal provisions governing the Conversion of a Private Company into OPC are as follows:

- Section 18 of the Companies Act, 2013.

- Rule 7 of the Companies (Incorporation) Rules, 2014.

What are the conditions for the Conversion of a Private Company into OPC?

The following are the conditions for the Conversion of a Private Company into OPC:

- The paid-up share capital of the Company is less than 50 lakh Rupees.

- In the past 3 consecutive years, the annual turnover of the Company should not be less than 2 crores Rupees.

- The Shareholder of the new OPC should have Indian nationality.

- The Shareholder of the new OPC should be a resident person of India. A person becomes a resident if he/she stays in India for a period of 180 days of one calendar year.

- The Shareholder should not be holding any other OPC, or he/she should not be a member of any other OPC.

- A minor cannot be a part or a member of OPC.

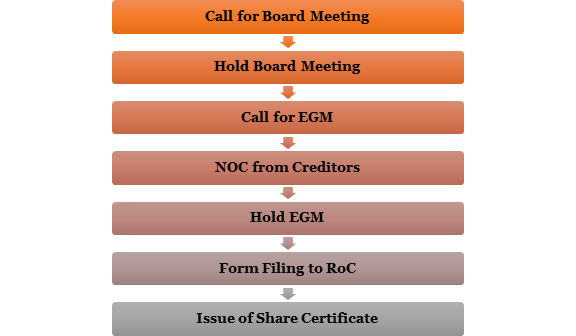

What is the procedure for the Conversion of a Private Company into OPC?

The procedure followed for the Conversion of a Private Company into OPC is as follows:

Call for Board Meeting

The notice for the Board Meeting should be sent to all the members at least 7 days before the date of the Board Meeting. The agenda of the Board Meeting should be mentioned in the notice.

Hold Board Meeting

The Board Meeting should be held for the following purposes:

- For the approval from the Directors for the Conversion of Private Company into OPC.

- For fixing the date, place, time, and day of the Extraordinary General Meeting (EGM).

- For the approval of notice for EGM along with the agenda and Explanatory Statement.

- To authorize any of the Directors to issue the approved notice of the EGM.

Call for EGM

A notice for an Extraordinary General Meeting (EGM) should be sent to all the members, directors, and auditors of the Company. The notice for EGM should be sent at least 21 days before the date of the EGM.

NOC from Creditors

Before passing the Special Resolution in the EGM, the Company should get a No Objection Certificate (NOC) from the existing shareholders and creditors. The No objection Certificate (NOC) should be in writing.

Hold EGM

The EGM is convened for the following purposes:

- Check for the Quorum of the Meeting.

- Check for the presence of the Auditor of the Company. If not present check for Leave of Absence is granted or not as per Section 146 of the Companies Act, 2013.

Form Filing to RoC

For the Conversion of a Private Company into One Person Company (OPC), certain e-Forms are to be filed with the concerned Registrar of Companies (RoC). The forms to be filed with the concerned Registrar are as follows:

Form MGT-14

After passing the Special Resolution in EGM, Form MGT-14 should be filed with the RoC. The Form MGT-14 should be filed with RoC within 30 days of passing the Special Resolution. The following attachments should be made with the Form MGT-14:

- The notice of EGM with the copy of the explanatory statement.

- A true certified copy of the Special Resolution.

- The Altered Memorandum of Association (MoA) and Articles of Association (AoA) of the Company.

- A true certified copy of the Board Resolution.

- Note: Form MGT-14 should be filed first as the form number of MGT-14 is used in Form INC-6.

Form INC-6

The application for the Conversion of a Private Company into OPC should be filed to the RoC. The application should be filed in Form INC-6 with the following attachments:

- The total list of members and creditors

- The latest balance sheet of the Company

- The copy of the No Objection Letter

- An affidavit of the declaration of the Directors of Company that all the creditors and shareholders have given consent for the Conversion of Private Company into OPC, the paid-up capital of the Company is 50 lakh rupees or less, and the turnover of the Private Company is less than 2 crore rupees.

Issue of Share Certificate

The Registrar of Companies (RoC) will verify all the e-Forms submitted and all attached documents filed by Private Company for Conversion of Private Company into OPC. Once the Registrar of Companies (RoC) is satisfied that the Private Company has complied with the prescribed requirements, should Issue a Share Certificate for the Conversion of the Private Company into OPC.

Conclusion

One Person Company (OPC) can be easily managed with very fewer compliances to be followed as compared to a Private Company. The Conversion of a Private Company into OPC will benefit most people associated with the Company. The process of Conversion of a Private Company into OPC is long-lasting and lengthy. We at Corpbiz have experienced professionals who will assist you with the process of Conversion of a Private Company into OPC. Our professionals will help you and will assure the successful completion of your work.

Related Articles

Conversion of Partnership into Private Limited Company

Convert Partnership Firm into Private Limited Company (PLC) The major benefit of registering a Private Limited Company is that it has the status of a separate legal entity that a Partnership firm does not have. Private Limited Company has Limited ...Conversion of private Company into LLP

Several businesses started in India as Limited Liability Partnership (LLP), may now wish to convert into a private limited company for more growth in business or for infusing equity capital. An LLP can be converted into a Pvt. Ltd. company as per the ...Conversion Of Private Limited Company Into LLP

Procedure for Conversion of Private Limited Company into LLP Under Sec 56 of LLP Act along-with schedule 3 deal with the conversion of Private Limited to LLP PRE-REQUISITES: > Every member of the company must agree with the decision of conversion. > ...Definition of private limited company

What Is a Private Company? A private company is a firm held under private ownership. Private companies may issue stock and have shareholders, but their shares do not trade on public exchanges and are not issued through an initial public ...Definition of one person company & its features

The Companies Act, 2013 completely revolutionized corporate laws in India by introducing several new concepts that did not exist previously. On such game-changer was the introduction of One Person Company concept. This led to the recognition of a ...