Conversion of Public Limited Company to Private Limited Company

A company may amend its articles by special resolution, including amendments that result in the conversion of a public company into a private company, according to the requirements of the Companies Act 2013 and any restrictions set forth in its memorandum, if any. Any modification that results in the conversion of a public company into a private company must first receive approval from the central government in the form of an order, which must be issued in accordance with any applicable regulations. This is stated as per Section 14(1) of the Companies Act, 2013.

Rule 41 for the conversion of public companies into private companies was added by MCA on December 18, 2018, and its authority to approve the conversion of public companies into private companies was delegated to the regional director, of the Companies (Incorporation) Rules, 2014.

What Are Legal Provisions Related To The Conversion Of Public Company Into Private Company?

Companies Act, 2013 and the Incorporation of Companies Rules, 2014 both mentions on the conversion of Public Limited Company into Private Limited Company. Ministry of Corporate Affairs on 18th December 2018 has by its notification amended the Companies (Incorporation) Rules, 2014 by introducing Companies (Incorporation) Fourth Amendment Rules, 2018.

Rule 41 has been added in the rules which provides for making application for conversion for public limited company into private limited company in accordance with the regulation.

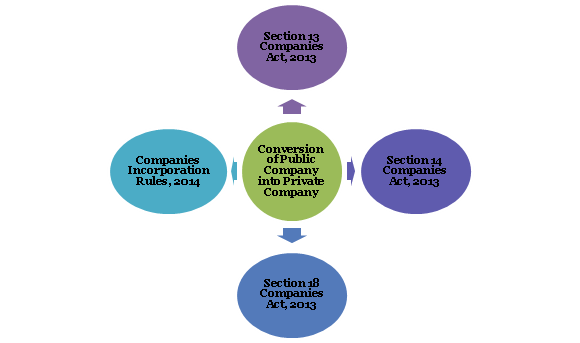

The following provisions are related to Conversion of Public Company into Private Company:

- Section 13 of Companies Act, 2013, provides for the Alteration of Memorandum of Articles (MoA) of Company. The Conversion of Public Company into Private Company can be done if the Memorandum allows for the Conversion. Hence, to convert the Company into Private Company, the alteration of MoA is necessary.

- Section 14 of Companies Act, 2013, provides for Alteration of Articles of Association (AoA) for Conversion of Public Company into Private Company.

- Section 18 of Companies Act, 2013, provides for Conversion of Companies which are already registered. Section 18 provides for converting of any class of Company into another class by doing Alteration in MoA and AoA of the Company.

- The Companies Incorporation (Fourth Amendment) Rules, 2014, the Conversion of Public Company into Private Company is explained. The Central Government has wide powers to amend the said rules.

Conditions for Applying Conversion

- The term “Private” has to be added to the name clause of the memorandum, by removing the word “Public” from the name clause.

- The Company’s Articles must be appropriately modified to include any limiting clauses that apply to Private Companies. Adopting new articles that are appropriate for a private company is advised.

- It should also be ensured that the company has not missed a deadline for completing any required paperwork with the Registrar, including annual returns, financial statements, or other forms as required by Companies (Incorporation) Rules, 2014, Rule 29(1).

- Lastly, they need to ensure that the company hasn’t fallen behind on paying interest or maturing deposits or debentures, either as stated in the Companies (Incorporation) Rules, 2014, Rule 29(1).

Procedure for Conversion of Public Company into Private Company

a. Give at least seven days’ notice of the board meeting to all of the company’s directors at addresses on file with the company. In the event of an urgent matter, a shorter notice may be given.

b. Include the following:

- Notice’s Agenda,

- Agenda Notes, and

- Draft Resolution.

- Call a meeting of the company’s board of directors to debate and approve the conversion agenda.

- Adopt the board resolution

- for accepting the plan to convert a private company and recommending that the shareholders at the company’s general meeting approve it.

- to determine the day, time, place, and general meeting’s date

- to accept the proposed notice for the General Meeting, as well as the explanation statement attached to the notice, in accordance with Section 102 of the Companies Act of 2013,

- to accept the draft of a new set of articles of association that satisfies the requirements for a private company and to suggest that shareholders approve them.

- approving the signing and issuance of the notice of general meeting by the director or company secretary. The Special Resolution for the Company’s conversion into a Private Company and the ensuing amendment to the Company’s Memorandum and Articles of Association must be included in the notice of general meeting.

- to provide permission to the company secretary or any one director to sign, certify, and submit the requisite form with the registrar of companies, as well as to carry out any other actions that may be required to give effect to the proposed conversion.

- Within 15 days following the conclusion of the board meeting, draught minutes should be prepared and distributed to all directors for feedback via hand delivery, speed post, registered mail, courier, or email.

Within seven days following Board of Directors’ approval of transfer of shares, companies whose shares are held in physical form must enter information in the Register of Members using Form MGT-1 to limit the number of members to no more than 200.

- hand,

- regular mail,

- express mail,

- registered mail,

- courier,

- fax,

- email,

- another electronic method, or

- a shorter method. With the approval of at least a majority in number and 95% of the paid-up share capital of the firm granting a right to vote at such a meeting in line with Section 101, notice may be given.

- All directors, members, the company’s auditors, the secretarial auditor, the trustees of debt obligations, and anyone else entitled to notice of the general meeting shall get notice.

- The notice must include a statement about the business that will be discussed at the meeting as well as the day, time, and complete address of the meeting’s location.

Hold the general meeting on a designated day and adopt a special resolution to change the company’s status from public to private, amend the articles of association and memorandum of association, and add restrictive clauses that are appropriate for private companies. Check the Quorum as well, and if not, see if the auditor is present. A leave of absence is thereafter either denied or approved.

Within 30 days of reaching such a resolution, the company must submit Form MGT-14 to the ROC together with the provided papers as an attachment.

- copy of the extraordinary resolutions that have been certified as being true, together with an explanation

- Members received a copy of the meeting notice and every annexure.

- a printed copy of the articles of association and memorandum

- a copy of the attendance list of people who attended the general meeting

consent for a shorter notice, if any.

At least twenty-one days before the application’s filing date, the firm must

- serve individual notices on all of the company’s debenture holders and creditors by registered mail with acknowledgment required.

- send a notice by registered mail with acknowledgement required on the regional director, the registrar, and the regulatory agency, if the firm is currently subject to any legal regulations.

Within 60 days of the passing of the Special Resolution, a Regional Director must receive an application for the conversion of a Public Company into a Private Company in e-Form RD-l along with the fee specified in the Companies (Registration Offices and Fees) Rules, 2014, and the documents required for the conversion listed below:

- a draft of the articles of association, including the amendments made in accordance with section 2(68), and the memorandum of association.

- a copy of the minutes from the general meeting that approved the special resolution approving the change, including the names of the dissenters and the number of votes cast in favour or against.

- a copy of the Board resolution or Power of Attorney, as applicable, that authorises the application for the conversion and is dated no earlier than thirty days.

- a statement from a key managerial employee declaring that the company restricts the number of its members to 200 in accordance with Section 2(68) and that no deposit has been taken by the company in contravention of the Act and any rules imposed thereunder.

- a statement from a key managerial employee stating that the provisions of sections

- 73 to 76A,

- 177,

- 178,

- 185,

- 186, and

- 188 of the Act and the rules issued thereunder have all been followed.

The Company was never listed in any Regional Stock Exchanges, and if it had been listed there, all necessary procedures were followed to completely delist the shares in accordance with the rules and regulations set forth by the Securities Exchange Board of India. This declaration was made by a key managerial employee in accordance with sub-section (3) of section 179. However, the aforementioned statements must be made by any director in the event of such Companies where no Key Managerial Personnel is required to be hired.

- a list of Debenture Holders and Creditors as of a date that was not more than 30 days before to the application’s submission to the Regional Director, including the information below:

- Every creditor’s and debenture holder’s name and address

- Types of obligations, claims, and liabilities owed to them, as well as the quantities

- the value, to the extent that it may be reasonably assessed, of any contingent or unascertained debt.

- The company must file an affidavit stating that it has conducted a thorough investigation into its business affairs and has come to the conclusion that the list of creditors and debenture holders is accurate and that the estimated value stated in the list of debts or claims payable on contingent payments is accurate. This affidavit must be signed by the company’s Company Secretary, if any, and at least two directors, one of whom must be the managing director, where there is one.

The concerned Regional Director shall pass an order approving the application within thirty days of the date of receipt of the application if no objection has been received from any person in response to the advertisement or notice referred to above and the application is complete in all material respects.

The Regional Director shall hold a hearing or hearings within a thirty-day period as necessary and direct the company to file an affidavit to record the consensus reached at the hearing. Upon signing the affidavit, the Regional Director shall pass an order either approving or rejecting the application in the event that an objection has been received or the Regional Director upon reviewing the application has specific objection under the provisions of the Act.

Conversion is permitted following the conclusion of any inquiry, inspection, or investigation for which no prosecution is planned or ongoing.

Within fifteen days of receiving approval, the company must submit the Regional Director’s order to the Registrar in Form lNC-28 along with the required fee as outlined in the 2014 Companies (Registration Offices and Fees) Rules.

Within fifteen days of receiving the order, the company must file Form INC-27 with the Registrar, along with a copy of the Central Government order approving the article’s alteration and the printed version of the altered article.

- Shops & Establishment Act

- Factories Act

- Inter-State Migrant workmen Act

- Private Security Agency Act

- EPF

- ESI

- Other Labour Laws

- Industry Specific Laws

- Print new copies of the amended articles of association and bylaws together with a new certificate of incorporation.

- Set up new rubber stamps bearing the new name of the company and all stationery with the new name.

- If the new name has already been printed on the Blank Share Certificates sample, replace it.

- On the outside of every office, building, etc., the new name of the company has been painted beside the previous name that was altered as per Section 12(3)(a) and Section 12(3)’s First Proviso.

- Establish a new common seal with the new name inscribed on it and adopt it at the Board of Directors meeting (Common Seal is optional now) as per Section 12(3)(b)

- Get the new name printed alongside the old name on all of your company’s correspondence, letterheads, billheads, invoice forms, receipt forms, and other official publications as per Section 12(3)(c) and Section 12(3)’s First Proviso.

- Have bills of exchange, coins, and promissory notes all printed with the organization’s new name as per Section 12(3)(d).

- Notify all relevant parties and government agencies, including the Chief Inspector of Factories, the Regional Provident Fund Commissioner, the Central Excise Authorities, the Customs Authorities, the Sales Tax Authorities, and the Service Tax Department, etc., about the conversion of the company.

- Inform all the banks where the company has bank accounts about the conversion and submit the relevant paperwork, as needed by the bank, regarding changes to the account holder’s name and status.

- To arrange a new Permanent Account Number (PAN) and Tax Deduction and Collection Account Number, submit an application to Income Tax Department (TAN).

- Update new company name to include names of utility service providers, such as those for electricity, telephone, and internet connections.

- Inform all other businesses with which the company has entered into any kind of agreement, taken out a loan, purchased insurance, or made an investment, as well as all stakeholders.

Conclusion

Related Articles

Conversion Of Private Limited Company To Trust

In India there are some definite rules that you need to follow in order to change the kind of company that you are looking for. There are forms need to be filed and documents that have to be provided. Then, there are authority bodies whose rules and ...Conversion of LLP to Private Limited Company

Several businesses started in India as Limited Liability Partnership (LLP), may now wish to convert into a private limited company for more growth in business or for infusing equity capital. An LLP can be converted into a Pvt. Ltd. company as per the ...Conversion of OPC to Private Limited Company

INTRODUCTION One Person Company (OPC) refers to a form of company that has only one person as a member, unlike a private company where the minimum number of members is two or a public company where the minimum number of members is seven. Section 18 ...What is LLP and PVT LTD.

Private Limited Company vs LLP There are many business structures in India from which an entrepreneur can choose to establish a business or company. Private limited companies and Limited Liability Partnerships (LLPs) are two such business structures. ...Conversion of Private Limited Company to Public Limited Company

Introduction The conversion of a private limited company to a public limited company is a significant step in the growth and development of a business. It allows the company to raise additional capital from the public by offering shares through a ...