What is Director KYC (DIR-3 KYC) & How to File It?

What is Director KYC (DIR-3 KYC) and Procedural Norms of Filing E-Form DIR-3 KYC With MCA?

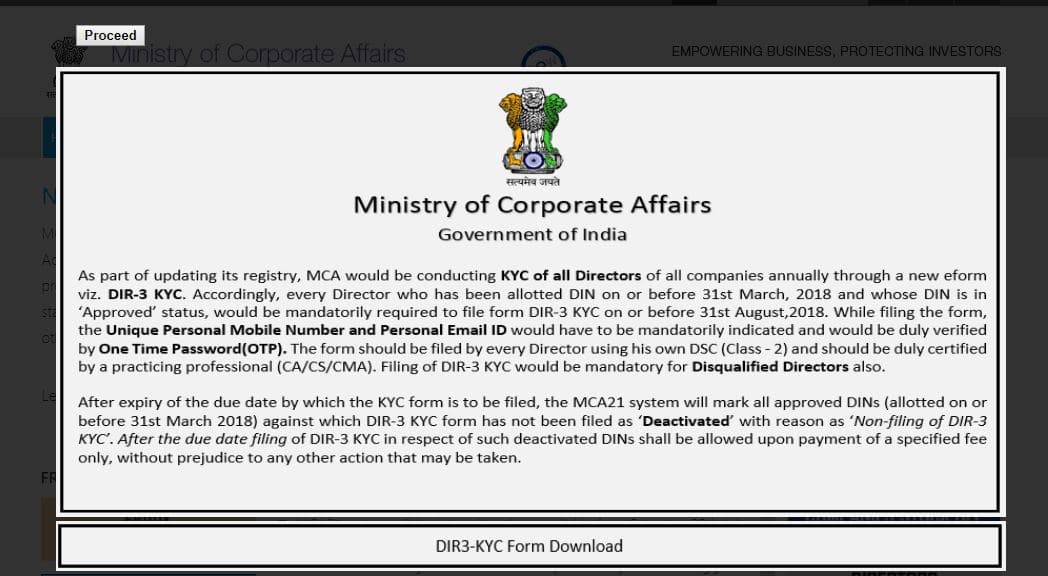

Introductory Norms of E-form DIR-3 KYC

Why has E-form DIR-3 KYC been introduced by the Central Government?

Who is required to file e-form DIR-3 KYC?

What is the due date of DIR-3 KYC?

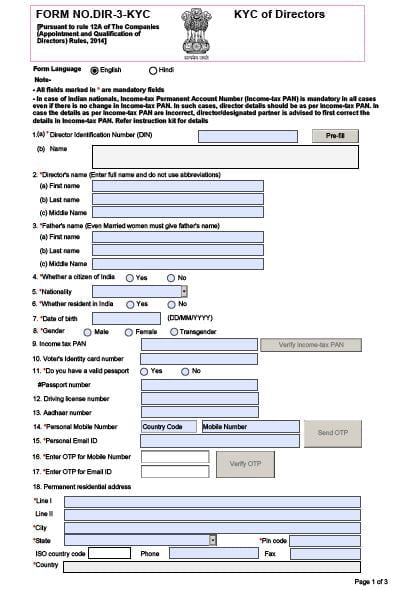

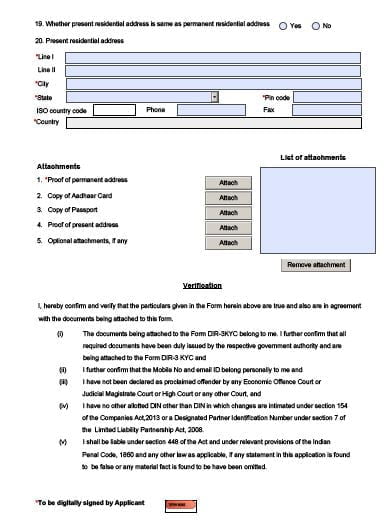

What are the documents required to file E-form DIR-3 KYC?

- PAN for Identity Proof

- Aadhar Card for Address Proof (Provided mobile number must be updated with UIDAI)

- Latest passport size Photograph

- Personal Mobile Number and E-mail ID of director for the purpose of OTP Verification

- DSC (Digital Signature Certificate of the director) which must be registered on MCA Portal.

- Passport is mandatory in case of foreign national only

Who will certify the E-form DIR-3 KYC?

What is the fee of filing E-form DIR-3 KYC?

If the e-form is required to be filed till the 30th April of every financial year, then there will be no fee however if one has to file e-form DIR-3 KYC up to 31st August, 2018 but not able to file the same till the last date then RS.5000/- shall be payable after 31st August 2018.

Does the DIR 3 KYC form is also applicable on LLP?

It is mandatory for all the partner/designated partner of an LLP to file e-form DIR-3 KYC on or before the due date 31st August 2018 who are holding a valid DIN before the 31st March 2018.

What if the director fails to file e-form DIR-3 KYC?

In case of non-filing of DIR-3 KYC by the DIN holders (allotted on or before 2018), MCA will mark “deactivated”.

What will be the consequences of non-filing of e-form DIR-3 KYC?

In case of the filing of e-form DIR-3 KYC after 31st August 2018 then DIN holder has to pay a specified fee of Rs. 5,000 without prejudice to any other action that may be taken.

Is it still requires to file E-form DIR-3 KYC if a DIN holder is not holding Directorship in any company for a whole year or years?

Yes, even if the DIN holder is not holding directorship in any Company for a year or for more than one year, such person has to file e-form DIR-3 KYC every financial year on or before 30th April.

Is it mandatory to have DSC to file DIR-3 KYC?

Yes in order to file e-form DIR-3 KYC, it is mandatory to affix DSC of the applicant director.

Can I mention the email ID and Mobile Number of any other person in e-form DIR 3 KYC?

No, in e-form DIR-3 KYC specifically, the director has to give its own email Id and mobile number otherwise it will be considered as default under Rule 12.

What are the basic requirements for professionals?

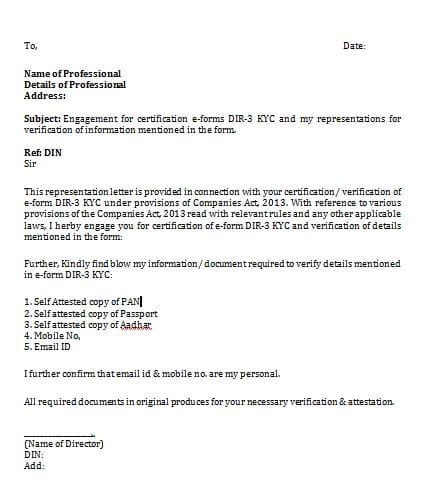

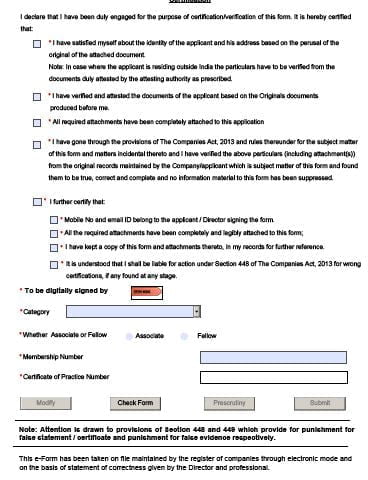

It is required for a professional to give a declaration that he/ she are engaged in Certification/verification of this e-form.

What will be the course of action for the professional to certify the e- form DIR-3 KYC?

- Professional must obtain the engagement Letter from the Director

- Professionals have to mention all the details mentioned in e-form DIR-3 KYC in the Engagement

- They have to confirm that the Mobile No. and email ID belongs to the applicant Director only

- Professionals should keep a copy of the form and attachments in their record

Format of Engagement Letter for DIR -3 KYC

DIR-3 KYC Requirements in Tabular Form

| Sr. No. | Particulars of E-form DIR-3 KYC | Description |

| 1. | Introduced on | 10th July 2018 |

| 2. | Filing Time | Annually |

| 3. | Due Date | 31st August 2018 for every director who has DIN on or before the 31st March 2018. 30th April of every year in any other case |

| 4. | Basic Requirements | The personal mobile number and email ID of director for the OTP verification. |

| 5. | Professional Certification | It will be certified by the practicing professional such as (CA/Cs/ CMA) |

| 6. | Consequences of Non-Filing | In case of non-filing DIN will be deactivated by the authority and it will get reactivated only after the filing of the prescribed e-form on the payment of Rs.5000/-. |

DIR-3 KYC Form

Related Articles

What is the last date for Form DIR-3 KYC?

DIR-3 KYC Application & for KYC of Directors DIR-3-KYC is a new E-form has launched by the Ministry of Corporate Affairs. This form will be used to update the KYC of all directors. Certification/ verification of e-form DIR-3 KYC is done under ...How to upload DIR-3 KYC Form on MCA?

A Director identification number (DIN) is a unique identification number given to a person wanting to be a director or an existing director of a company. In this digitalized era, application in eForm DIR-3 was sufficient to obtain DIN. This was a ...Important Things while filing e-Form DIR-3 KYC

Director identification number (DIN) refers to a unique identification number allotted to an individual willing to be a director or an existing director of a company. DIN is obtained by filing an application in eForm DIR-3, which was initially a ...What is the Fees for DIR 3 KYC Filing?

DIR 3 KYC Director identification number (DIN) refers to a unique identification number allotted to an individual willing to be a director or an existing director of a company. DIN is obtained by filing an application in eForm DIR-3, which was ...When is the due date to file DIR 3 KYC?

DIR 3 KYC Director identification number (DIN) refers to a unique identification number allotted to an individual willing to be a director or an existing director of a company. DIN is obtained by filing an application in eForm DIR-3, which was ...