E-way Bill New Registration

Types of Users for E-Way Bill Registration

Under the e-way bill system, every transporter/taxpayer is required to generate an eway bill before starting the movement of goods. The person in charge of the transportation of goods is required to carry a supply bill, delivery challan, and a copy of the e-way bill. E way bill registration is compulsory to generate an eway bill, there are three kinds of taxpayers/ users involved:

- Registered Suppliers

- Registered/ Unregistered Transporters

- Unregistered Suppliers

Eway Bill Registration Tabs

On the Eway Bill registration portal, you can find the following options:

- E-Way bill registration: This tab is meant for the E-way bill registration for GST Taxpayers (suppliers and recipients).

- Enrolment for transporters: This tab allows unregistered transporters to enrol for E-Way Bill.

- Enrolment for citizens: This tab allows non tax-paying stakeholders to register.

How to Register for an E-Way Bill?

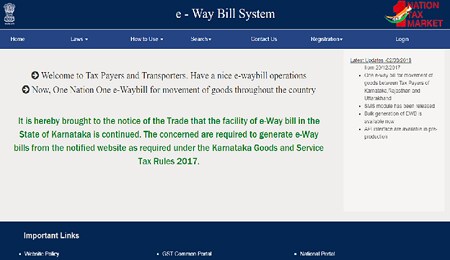

Registration of e-way bills can be done on the official website at ewaybillgst.gov.in. All traders and transporters need to register before April 1

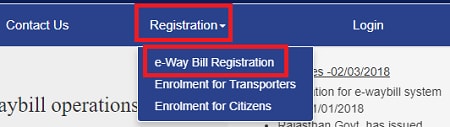

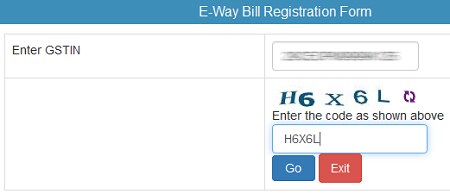

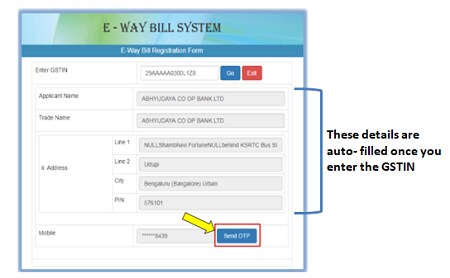

- For the first-time GSTIN (GST Identification Number) can register by clicking on the ‘e-way bill Registration’ link under registration option, the taxpayer/transporter will be redirected to the ‘e-Way Bill Registration Form’.

- For someone who doesn’t have GSTIN can enrol on the system by providing their business details.

Steps for E Way Bill Registration for Taxpayers/Registered Transporters

The following are the steps for e-way bill registration on the e-Way Bill portal:

- Step 1: Visit the official website ewaybillgst.gov.in.

- Step 2: On the homepage click on the ‘Registration’ tab and Click on ‘ e-Way Bill Registration ’ under it.

- Step 3: Now enter the GSTIN (Goods and Services Tax Identification Number) and the captcha code. Click on ‘Go’

- Step 4: Generate an OTP, the otp number will be sent on your registered mobile number, verify the same.

- Step 5: Create a new User ID and set the password. Once all the details are correctly filled, User ID and password will be created.

E-Way Bill Registration for GST Unregistered Transporters

What is a Transporter ID?

A transporter, even if unregistered, has to generate an E-way bill if the value of the goods exceeds ₹ 50,000. Unregistered transporters do not have a GSTIN, thus, authorities have introduced the idea of Transporter ID. Every unregistered transporter has to provide the Transporter ID when generating an Eway bill.

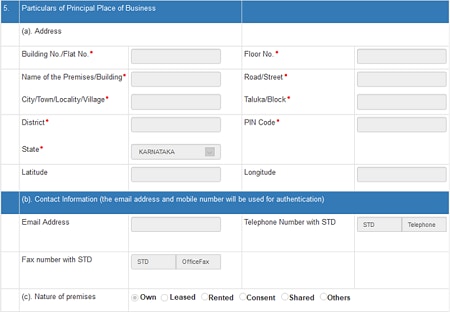

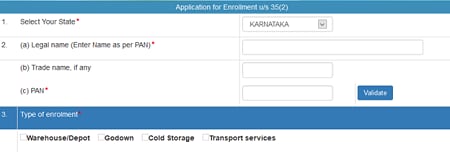

a) Fill in the Trade name, if any

b) Enter your PAN number

Select the relevant option:

- Warehouse

- Godown

- Cold storage

- Transport service

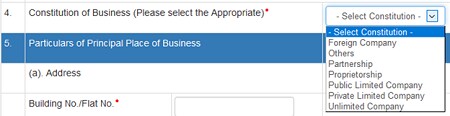

4. Constitution of Business*:

Select the relevant business form from the drop-down:

- Foreign company

- Partnership firm

- Proprietorship

- Private limited company

- Public limited company

- Unlimited company

- others( If HUF, AOP, BOI and so on)

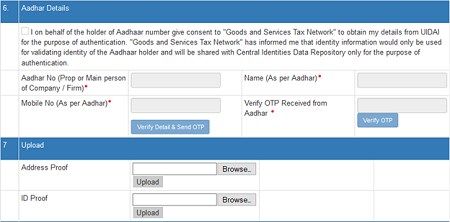

6. Aadhaar Verification

Tick mark the box to give your consent to the E-way Bill System/GSTN. Fill in the following required details with respect to the Authorised personnel of the Company/ Proprietor/ partner of the firm.

- The Aadhaar Card number, name of the personnel and mobile number mentioned in the Aadhaar.

- Once these details are entered, click on ‘Verify detail & Send OTP’ option.

- An OTP will be sent to the registered mobile number along with the Aadhaar.

- Enter it and click on ‘Verify OTP’ and your Aadhaar will get verified.

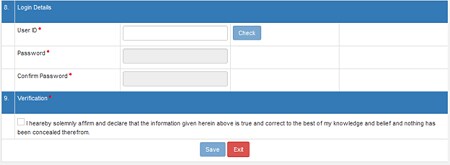

8. Login Details

Tick mark against the declaration confirming the authenticity of the information you provided on the application form and click ‘Save’.

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLPAddress: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

E Way Bill

Eway Bill – What is Eway Bill? E Way Bill System, Rules & Generation Process Explained 1. What is an eWay Bill? EWay Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot ...Transporter ID under GST E-Way Bill

Transport ID – GST E-Way Bill E-Way Bill Acts as a unique document or bill generated electronically by the supplier or transporter for a specific consignment/shipping of goods from one place to another. The bill shall apply for both inter-state or ...ISO Registration and Its benefits for New Businesses

Overview of ISO Certification ISO certificate is a certification that provides standards to the organizations and thus shows the way to innovation and development of trade. ISO Certification is mandatory to form certain standards that ensure products ...How To Start New Business for Retail & E-commerce

Starting your own e-commerce business is an exciting venture, especially if you’ve dreamed about the freedom of being your own boss. If you are crafty or have a knack for selling, then the entrepreneurial route could be a great choice for you. ...How to Start a New Business; Step by Step Guide

How to Start a Business: A Step-by-Step Guide Starting a new small business? Find out where to begin and how to achieve success. You want to make sure you prepare thoroughly before starting a business, but realize that things will almost certainly go ...