Form INC-22A – ACTIVE Company Tagging

The government has recently unveiled the address validation form as per the FORM INC-22A (ACTIVE) included in the Companies (incorporation) Rules, 2014, after rule 25 which has to be further followed.

What is MCA New E-Form INC 22A (Active)?

The ministry of corporate and affairs under the company law requires the companies to fill out the E-form INC-22A for the address validation while the form has the name tag applicable tagging identities and verification (ACTIVE). This new form is applicable for all the registered companies under the companies act 2013.

Applicability of Form INC-22A (Active) by MCA

The latest revision of rule has been applied on the companies incorporate on or before the 31 December 2017 has to file the details of the company and its relevant registered office.

Important Point Under Notification for INC 22A

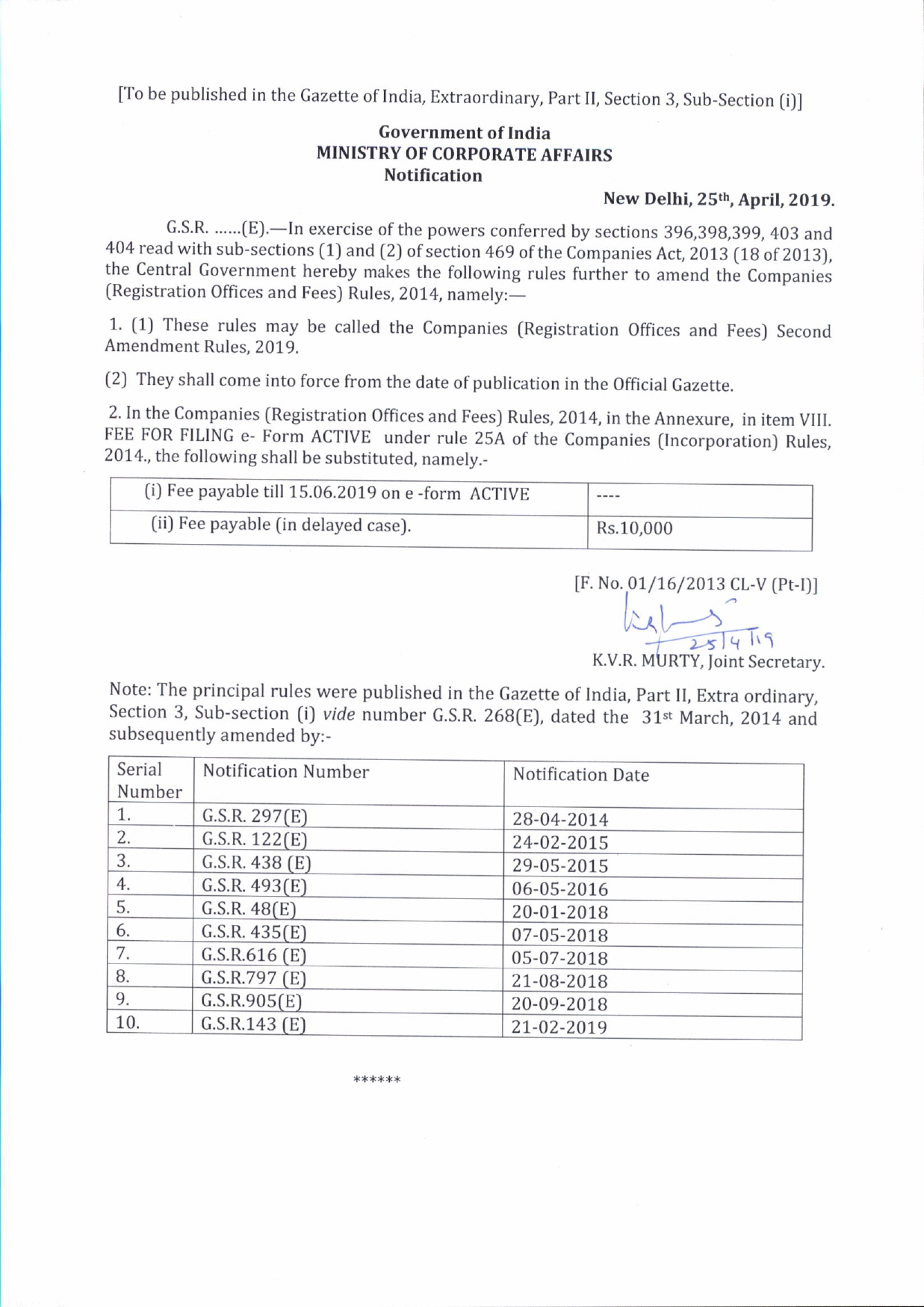

- Notification Date: 21st February 2019

- Effective Notification Date: 25th February 2019

- Companies Applicability: Companies incorporated on or before 31st December 2017

- E-Form Applicability: INC-22A (Also known as e-Form ‘ACTIVE’)

- DIN Status: Status of DIN of directors must be ‘Approved’ at the time of filing

- Last date of Filing of Form: 15th June 2019

- Form Filing Fees: NIL

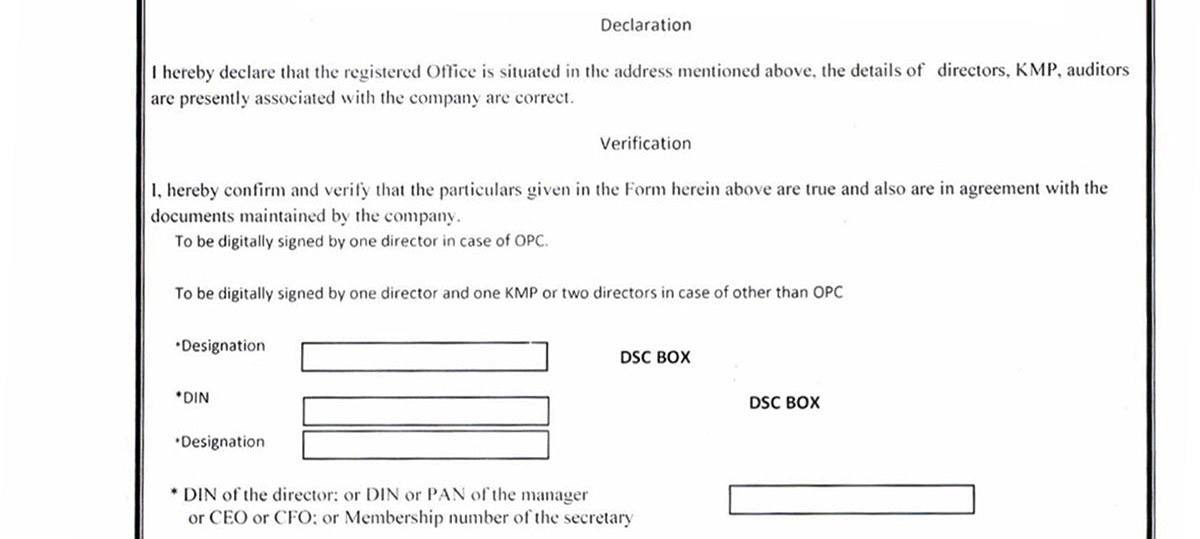

- DSC (OPC): One director

- DSC (Other than OPC): Two Directors / One Director and One KMP

- Rule Applicability: Rule 25A of Companies (Incorporation) Rules, 2014

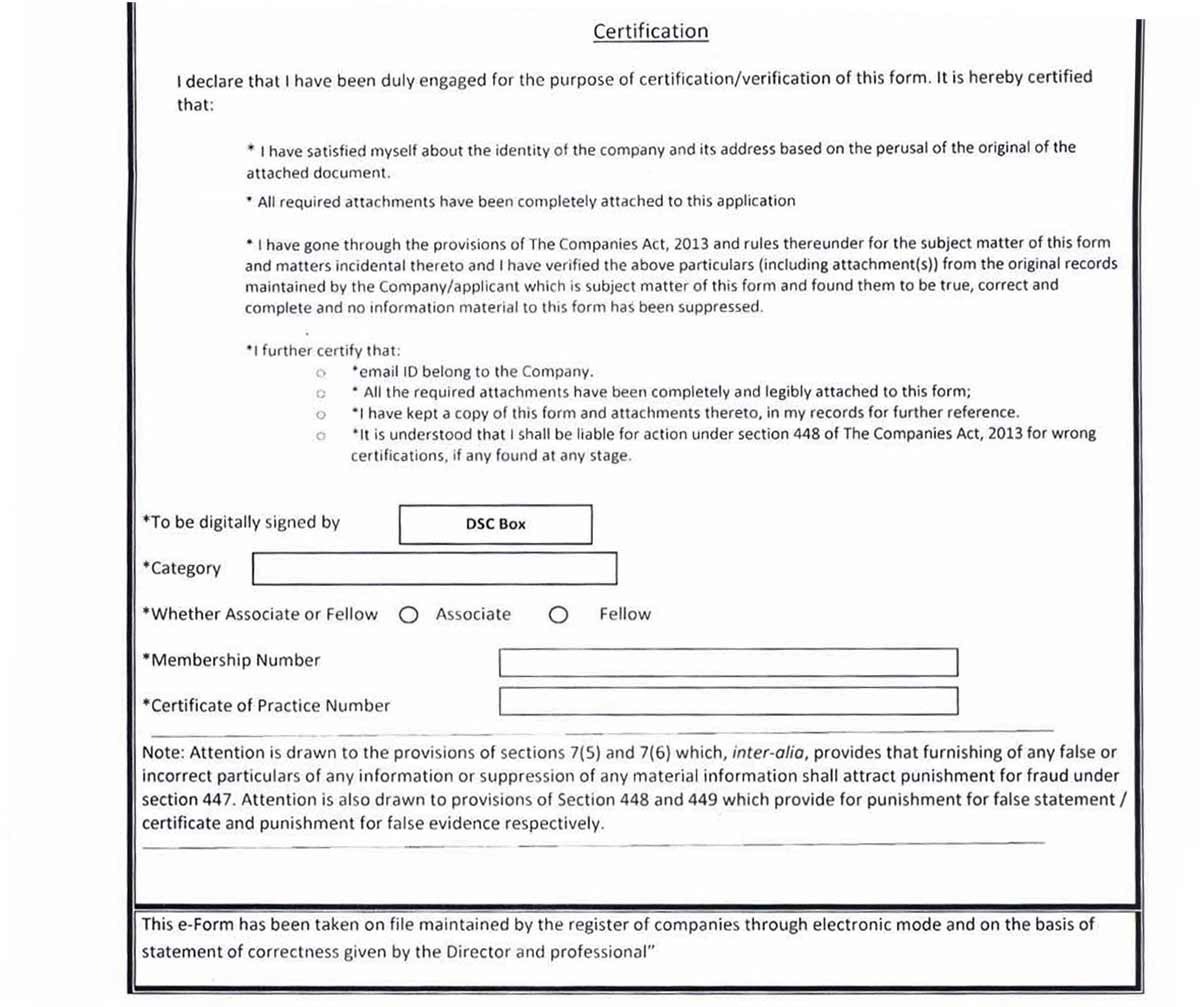

- Certification: Professionally certified form necessary

Due Date of Form INC-22A (Active) by MCA with Penalty

Note: The due date is extended till 15th June 2019 by the government.

Non Consideration of Forms if INC 22A Filing Missed

In case a company does not file the INC-22A (ACTIVE) form, the government will not be accepting certain forms including:

- SH-07 (Change in Authorized Capital)

- PAS-03 (Change in Paid-up Capital)

- DIR-12 (Changes in Director except for cessation)

- INC-22 (Change in Registered Office)

- INC-28 (Amalgamation, de-merger)

Ineligible Companies Under the INC-22A Form

- Struck off companies

- Companies under the process of striking off

- Companies under liquidation

- Amalgamated or Dissolved companies

Information required to file E-Form INC – 22A

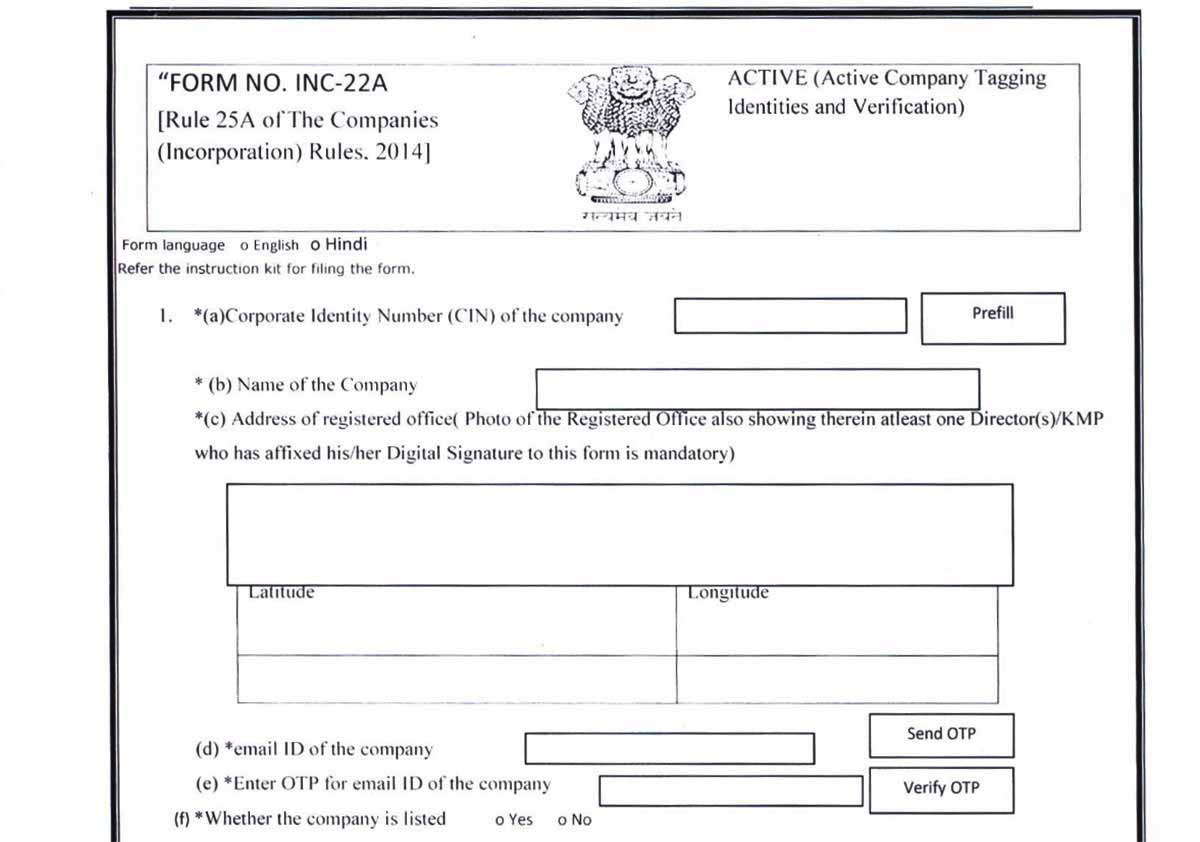

Prior to filing INC–22A, all compliances with regard to the filing of Financial Statements (Section 137) and Annual Returns (Section 92) for the financial year 2017-18 must be completed by the company. The following information must be furnished in the e-form ACTIVE 22A:- Name of the company

- Company Identification Number (CIN) – This shall be obtained from the Certificate of Incorporation issued to the company.

- Registered office address with Pincode – The address of the company will be auto-filled on submission of CIN

- The location of the registered office on Map defining latitude/longitude – These details can be obtained from maps

- Email and Mobile Number for receiving One Time Password Verification – Once the form is filled up and error-free the ‘Send OTP’ button will be activated.

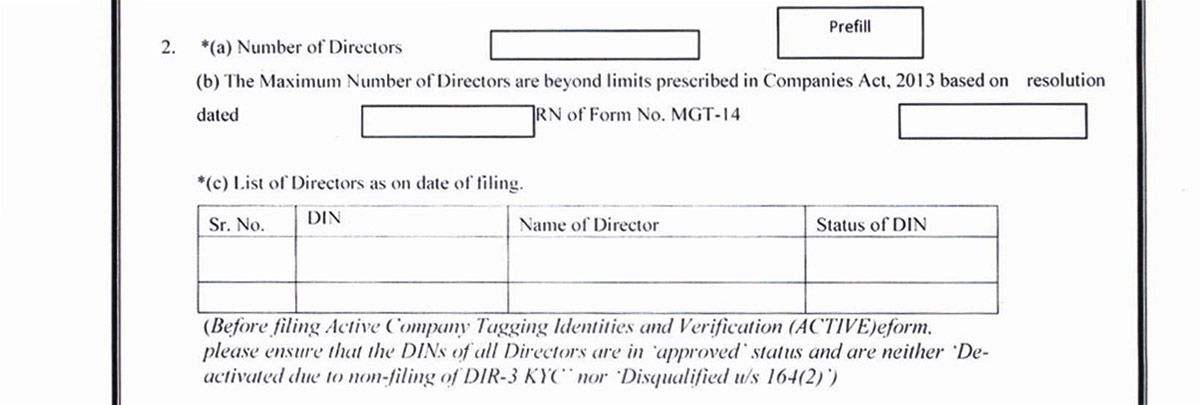

- Number of Directors

- DIN

- Status of DIN

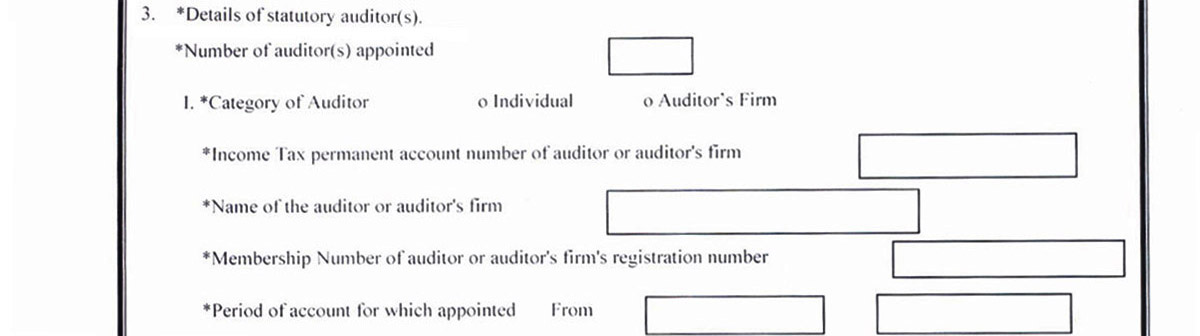

- PAN

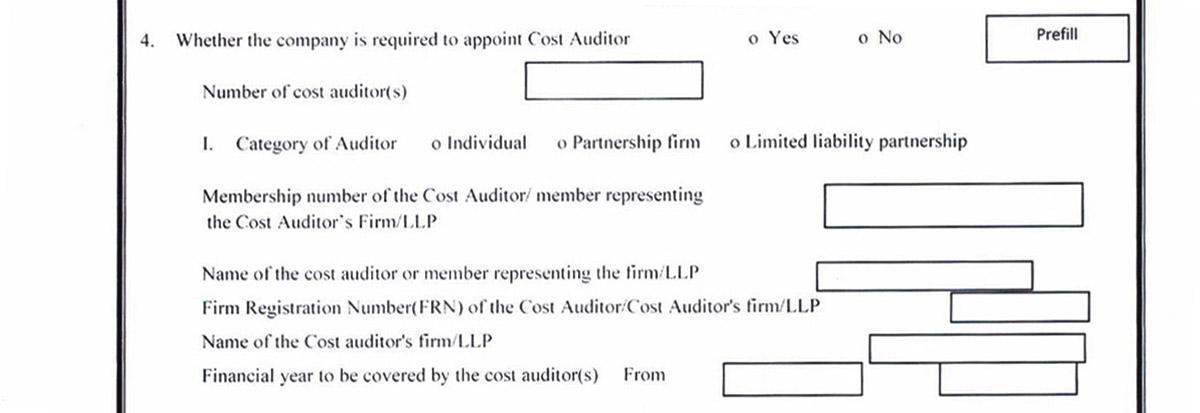

- Firm Registration Number

- Period of appointment

- Name of the firm

- Name of individual/firm/llp

- Membership number / Firm Registration number as the case may be

- Financial year to be covered

- Name

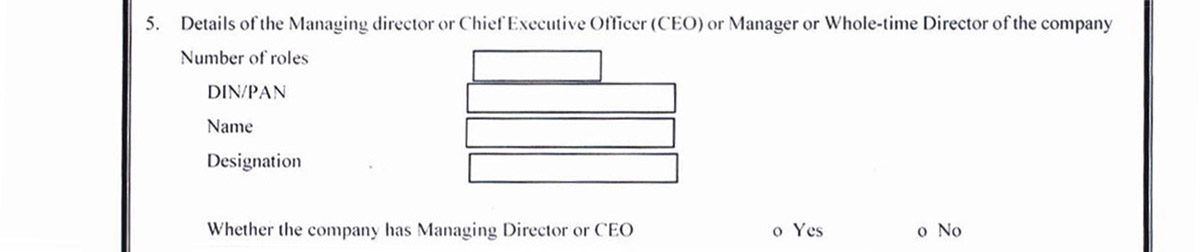

- DIN/PAN

- Designation

- Name

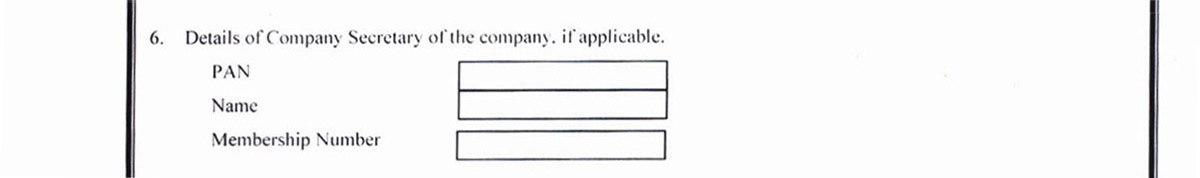

- DIN/PAN

- Membership Number

- Name

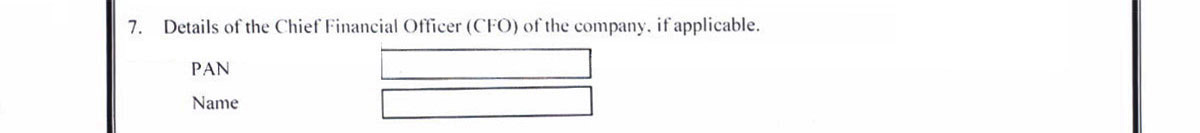

- PAN

- DSC of certifying authority

- Membership number

- CA/CS/Cost Accountant

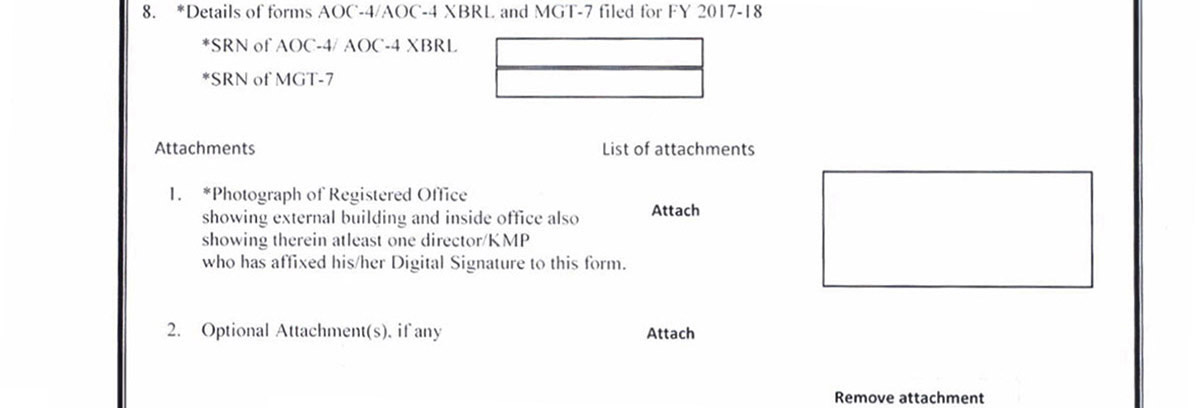

- SRN for both AOC- 4 and MGT – 7 must be furnished with this form. In order to have an SRN, both the forms must be filed within the specified time period.

- Enter the latitude and longitude in which the registered office is situated, which shall be obtained using maps.

Step by Step Process to File MCA E-Form INC-22A with Format

The INC-22A (ACTIVE) form includes various sections and is described as per the sequence, Procedure to file and content of the INC-22A (ACTIVE) form are as follows:

Step 1: Basic details of the form including company name, registered address, registered email id

Related Articles

Tax Compliances for Private Limited Company

Mandatory Tax Compliance Checklist for Private Limited Company A business registered in India is required to comply with the various annual legal company compliance laid down by the corporate laws such as the Companies Act, 2013. Since a majority of ...How to upload DIR-3 KYC Form on MCA?

A Director identification number (DIN) is a unique identification number given to a person wanting to be a director or an existing director of a company. In this digitalized era, application in eForm DIR-3 was sufficient to obtain DIN. This was a ...What is the due date for DIR3 Directors KYC Filing?

Filing of Director KYC 2022 (DIN-3 KYC) With ROC Director’s KYC Filing is an annual activity and applies to every person who was allotted a DIN (Director Identification Number) on or before 31st March 2022. The purpose of filing the DIR-3 KYC form to ...What is Director KYC (DIR-3 KYC) & How to File It?

What is Director KYC (DIR-3 KYC) and Procedural Norms of Filing E-Form DIR-3 KYC With MCA? Before starting with DIR-3 KYC, it is important to get knowledge of some important terms. First, we will discuss the term DIN (Director Identification Number). ...Important Things while filing e-Form DIR-3 KYC

Director identification number (DIN) refers to a unique identification number allotted to an individual willing to be a director or an existing director of a company. DIN is obtained by filing an application in eForm DIR-3, which was initially a ...