GST Rule for Aadhaar Authentication While Registration

The 39th GST Council Meeting was held on March 14, 2020, In which, the council agreed on the operationalization of Aadhaar authentication for new taxpayers. However, as per sources in the Finance Ministry, the implementation of the process was postponed amid a lock-down caused by the coronavirus outbreak.

With a gap, finally, the implementation process of the same facility started on August 21, 2020. Aadhar authentication for new registration has been brought into the light to improve the smoothness of doing business for genuine businesses. As per the ministry sources, Aadhar will be authenticated within 3 working days for the person opting for Aadhar authentication for the new GST registration if no notice is issued.

GST Rule for Aadhaar Authentication While Registration

During the time of GST enrollment, every applicant could choose the Aadhaar authentication. The exceptions are the individual exempted by the central government beneath the CGST act or those who should mandatorily proceed with the Aadhaar authentication beneath section 25(6C) of the CGST Act, listed down in the next section.

The rule to opt-in or not for Aadhaar authentication is subjected to apply for the applications made on or post to the date 21st August 2020. But between 1st April 2020 and 20th August 2020, all the applicants who submit the enrollment application beneath GST need to proceed with the Aadhaar authentication to receive the enrollment.

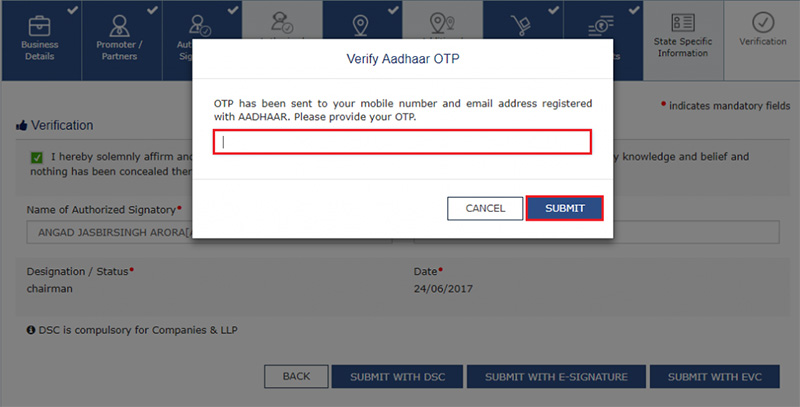

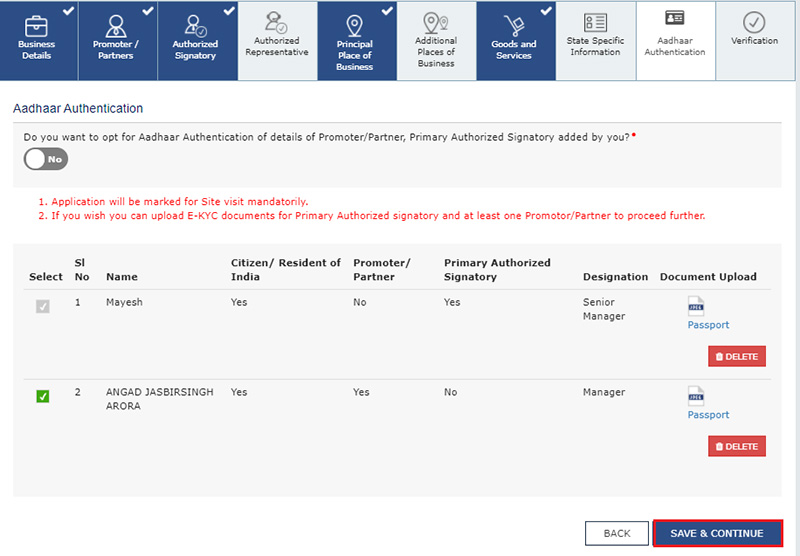

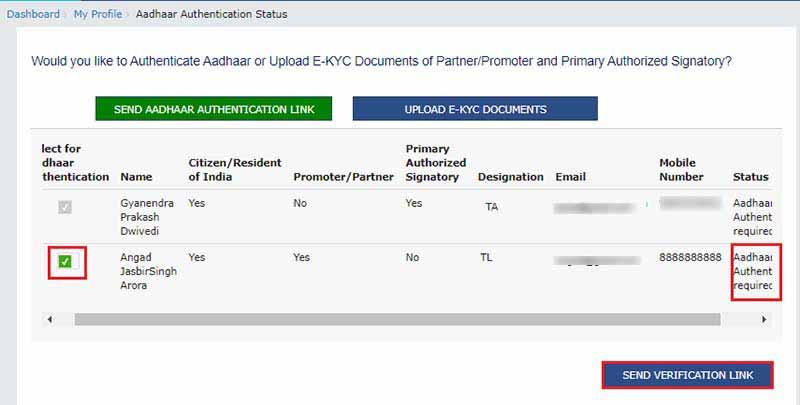

The applicants who opt for it should submit their Aadhaar number as well as the application for enrollment beneath GST. Post to this, they are required to e-verify that on the GST portal through the authentication link sent on the mobile number and the email-id associated with the Aadhaar. The same comprises the OTP that should be inserted on the portal and it gets e-validated. The Aadhaar authentication of the main authorized signatory and at least one promoter or partner is needed.

Note that for the cases of company/LLP/foreign company/AOP/Society/ Trust/Club, Aadhaar authentication of only the primary authorized signatory will be fine.

Post to that, whenever an assessee furnishes his returns or uses any services on the GST portal, an OTP would be sent on the mobile number and the email id, which is associated with the Aadhaar number. Only post to entering the OTP an assessee would move further to furnish the return.

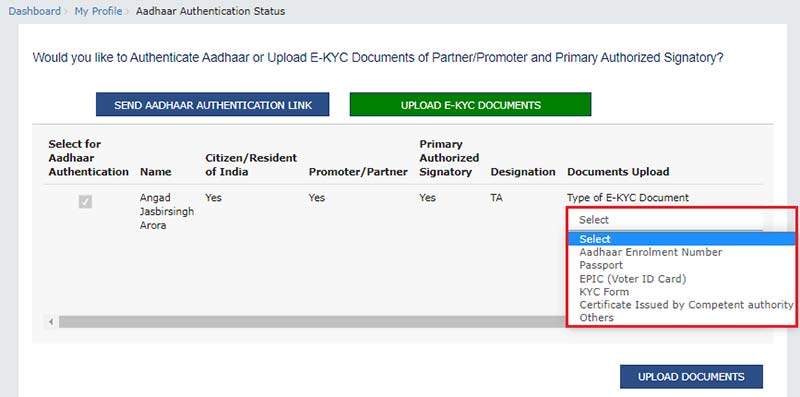

When individual losses to do an Aadhaar authentication when chosen or has chosen for that, move to file the application without the Aadhaar authentication steps mentioned above. The enrollment would be given only post to the physical verification has been done of the principal place of business via the GST officer. The office would rather check the e-KYC documents of the main authorized signatory and any one of the promoters or partners received permission from the officer, not under the rank of the Joint commissioner and in writing.

Towards these cases, a notice in form GST REG-3 in 21 working days from the date of submitting the application. The submission date of the application is earlier than the below two:

- Date of Aadhaar authentication

- Date after counting 15 days from the submission of Part B of Form GST REG-01, being the registration application.

The taxpayer should answer in 7 working days from the receipt date of notice in form GST REG-4. Once he answers, the officer should validate in the subsequent 7 working days to approve the grant of enrollment. When the answer is not obtained in 7 working days from the applicant or he does not agree with the obtained reply, then the GST officer could refuse the grant of enrollment in REG-05. When the officer is unable to act in the mentioned period, the enrollment is considered to be allotted.

Before that, the enrollment will be provided on the grounds of the physical verification of the principal place of business 60 days from the application date.

When there is no allocation of an Aadhaar number to the specific person who applies for the enrollment beneath the GST, then another means of identification is made available to him such as physical verification of the place of the business under the CGST rules.

Obligatory Cases of Aadhaar Authentication While GST Registration

Under section 25(6C) of the CGST Act, the Aadhaar authentication is essential for the mentioned class of individuals under Rule 8 of the CGST act so as to become qualified for the GST enrollment:

- Authorized signatory of all kinds

- Managing/authorized partners of a partnership firm

- Karta of a Hindu Undivided Family

Exceptions

The exception is if a person is not an Indian citizen or he is a person other than the one prescribed below:

- Individual

- Authorised signatory of all types

- Managing/authorised partners of a partnership firm

- Karta of a Hindu Undivided Family

Application of GST Registration Cases Via Officer

The application is considered to be approved via officer if the officer losses to choose the action in the provided duration given with respect to the mentioned cases:

| Case | Timeline |

|---|---|

| The individual who has finished the Aadhaar authentication or the individual is privileged from the Aadhaar authentication need. | Three working days from the date of application submission. |

| An individual who has chosen but losses to complete the Aadhaar authentication | 21 working days from the submission date of application to furnish the notice in form REG-3 |

| Person would not choose for Aadhar authentication | 21 working days from the date of submitting an application |

| The individual who has chosen but looses to complete Aadhaar authentication, notice is provided in form GST REG-3 and the individual has answered in REG-4. | 7 working days from the receipt of the response, the information, or the needed documents. |

Step-by-Step Procedure for GST Registration Via Aadhaar Authentication

- Open a browser and head-up to www.gst.gov.in.

- Here either click on REGISTER NOW link or navigate to Services > Registration > New Registration option.

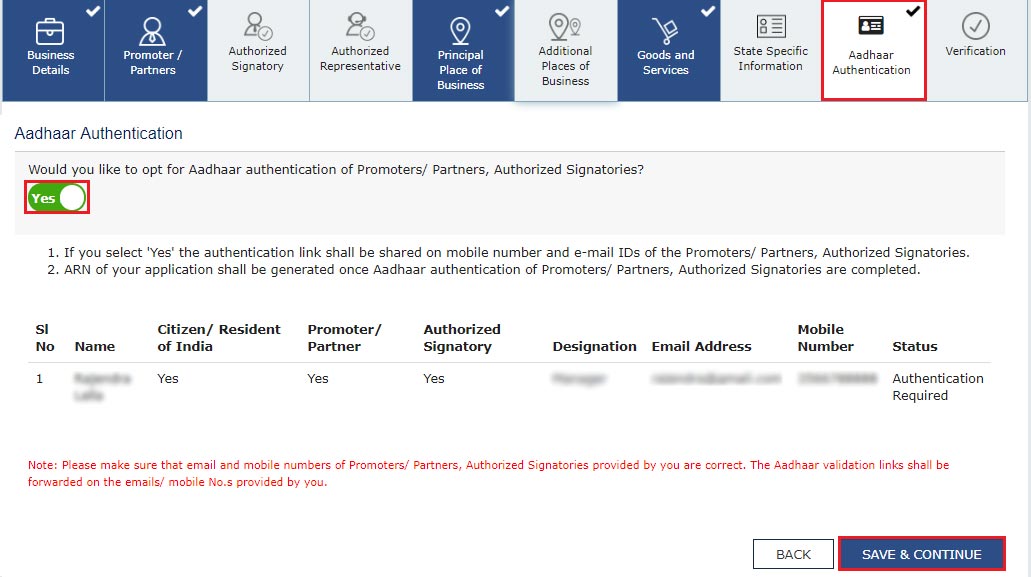

- During the usual procedure of GST Registration opt for Aadhaar authentication, by clicking on the Aadhar Authentication Tab.

- Here the applicant will get an option to select if you wish to authenticate Aadhaar or not.

- You can select YES or NO for Aadhaar Authentication, as per your choice.

- If you clicked on YES, an authentication link will be sent on the registered mobile number and e-mail IDs of the Promoters/ Partners and Authorized Signatories.

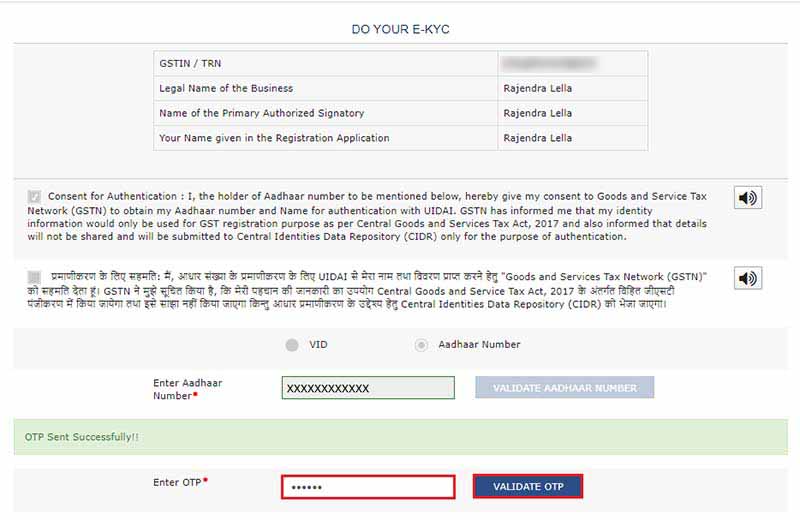

- Upon clicking on the link, a declaration will appear on the screen, here you have to enter your Aadhaar number and then click on “validate”.

- After cross-checking the details in the registration form and the UIDAI, an OTP will be sent on their email and registered mobile number. You have to enter the OTP in the box visible at the validation screen. After it, a confirmation message will appear.

- For Successful Authentication, taxpayers need to ensure that they have updated registered mobile numbers and email in Aadhar.

- OTP for Aadhaar authentication will be sent on the mobile number and e-mail address registered with Aadhaar. Mobile number and email can be verified at https://resident.uidai.gov.in/verify.

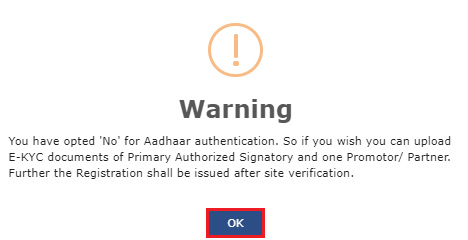

- If you choose NO for the Aadhar Authentication, then the GST registration application will be sent to the jurisdictional tax authority. And they will perform further steps which include documentary and/or physical site verification before approving the registration.

- If no action has been taken by the Tax Authority within 21 days then the GST registration application will be considered as approved.

Complete Process for Existing Taxpayers’ Aadhaar Authentication

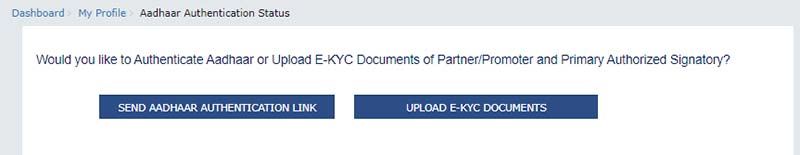

Step 1: Log in to the GST portal. Navigate to the “MY PROFILE” page. Proceed to Aadhaar Authentication Status. Two options emerge.

Step 2: Select one of the two options- Send an Aadhaar authentication link or upload e-KYC documents.

If the former opts, then tap on the links obtained on the email id and mobile number of the signatory and the specific promoter or partner, and finish the OTP verification.

If the latter opts, the documents would be approved or canceled by the tax officer. The assessee would acknowledge e-KYC authenticated and not Aadhaar authenticated.

GST Registration Facility Via Aadhar Authentication

As per the received information, for faster approval of the GST registration, all Indian Citizens can use this facility. It is not required for tax collectors, tax deductors, Online Information Database Access and Retrieval services (OIDARs), Taxpayers having a Unique Identification Number, and Non-resident taxpayers. You can get more details on the news and update section of GST Portal.

As sources informed, Whether a person chooses Aadhar Authentication or not, the officers have to act within the predefined time period Which are 3 days for persons opting for Aadhar authentication and 21 days for a person not opting for Aadhar authentication? After this predefined time, if the application neither accepted nor rejected, then the application will be considered approved.

Related Articles

GST Registration without Aadhaar Authentication

At the time of GST registration, every applicant can opt for the Aadhaar authentication. The exceptions are persons exempted by the Central government under the CGST Act or those who must mandatorily undergo the Aadhaar authentication under section ...How to do Self GST Number Registration

GST Registration process is online based and must be carried out on the government website gst.gov.in. Every dealer whose annual turnover exceeds Rs.20 lakh (Rs.40 lakh or Rs.10 lakh, as may vary depending upon state and kind of supplies) has ...Latest GST News, Information, Notifications & Announcements

This section contains the latest GST updates. We regularly publish all the GST news & related information here: Latest GST News GST Council Meet Recent Notification and Circulars Latest GST News 5th May 2020 A further extension granted for filing ...GST Registration Eligibility & Online Filing Process

GST Registration - An Overview The goods and services tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It is a destination based tax on consumption of goods and services. GST is to be charged at every ...How To Revoke GST Registration After 180 Days

Revocation of GST Registration Cancellation The GST Act is very comprehensive and covers various situations a taxpayer may face with provisions and procedures. In this article, we look at the procedure for revocation of GST registration cancellation ...