How can we file GST Return in Tally Software?

How can we file GST Return in Tally Software?

One of the key aspects of the GST era is that most of the indirect taxes - for which returns had to be filed separately for various businesses - have been subsumed. Today, irrespective of whether one is a trader, manufacturer, reseller or service provider, one needs to file GST returns online, in the prescribed formats.

Generate GSTR-1 returns in the JSON format

1. Go to Gateway of Tally > Display > Statutory Reports > GST > GSTR-1 .

2. F2: Period: Select the period for which returns need to be filed.

3. F12: Configure: To view the export options for HSN/SAC details, enable Show HSN/SAC Summary?

4. Press Ctrl+E .

5. Select JSON (Data Interchange) as the Format .

● Export HSN/SAC details even if UQC is not available? - Yes , to export transactions where UQCs are not available. For such transactions, you have to map the units of measurement of the stock items to related UQCs in the MS Excel or CSV file. For more details, click here .

● Export HSN/SAC details not included for other reasons? - Yes , to export transactions that are not included in the HSN/SAC Summary due to various reasons. You have to enter this data directly on the portal.

Note: The options Export HSN/SAC details even if UQC is not available? and Export HSN/SAC details not included for other reasons? will appear only when the option Show HSN/SAC Summary? is set to Yes in the GSTR-1 report.

If the data is exported without enabling the option Show HSN/SAC summary? in the configuration screen of the GSTR-1 report, the HSN summary of the exported output file will be blank.

● Allow Export of :

o All Vouchers: Select this option to export all the transactions that have been already filed on the GST portal.

o Only New Vouchers: Select this option to export the transactions that are not filed on GSTN portal.

6. Press Enter to export.

Upload the JSON file generated from Tally.ERP 9 to the portal for filing returns.

Upload of GSTR-1 JSON file fails when HSN summary has negative quantity

If the HSN summary of GSTR-1 has negative quantity, the upload of JSON generated from offline tool or from Tally.ERP 9 is failing. Until the issue is resolved by GSTN, you can do the following:

1. Open the JSON generated from Tally.ERP 9. You can open it in Notepad.

2. Go to the section "hsn" .

3. Go to the tag "qty" and remove the negative sign. Repeat this for each "qty" that has a negative sign for taxable value and tax amount.

4. Save the JSON.

5. Upload it to portal.

6. In the portal, go the section HSN Summary .

7. Add the negative sign against each of the quantities that has taxable value and tax amount (which was removed from JSON).

File GSTR-1 returns

1. Press Ctrl+O from GSTR-1 report.

2. Log in to the GST portal.

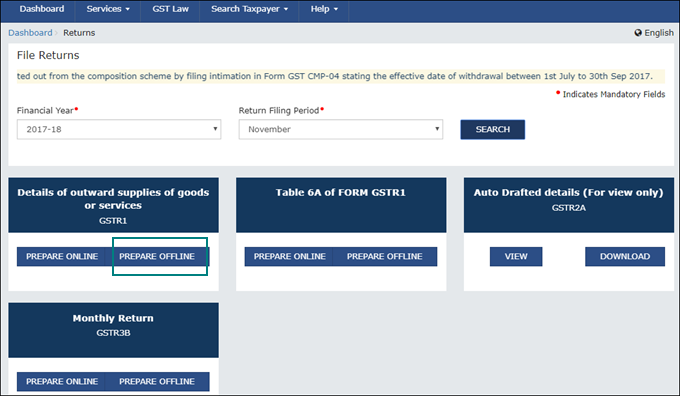

3. Click Services > Returns > Returns Dashboard .

4. Select the Return Filing Period , and click Search .

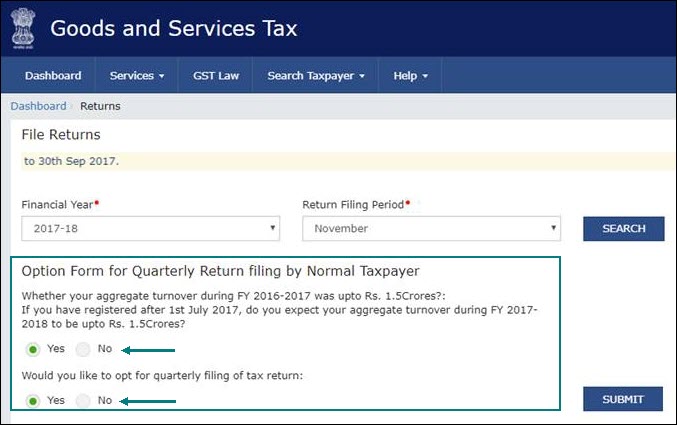

5. Select Yes or No based on your turnover to file Monthly or Quarterly returns. If you want to opt for quarterly returns, then set the 2nd option to Yes .

6. Click SUBMIT .

7. Click PREPARE OFFLINE .

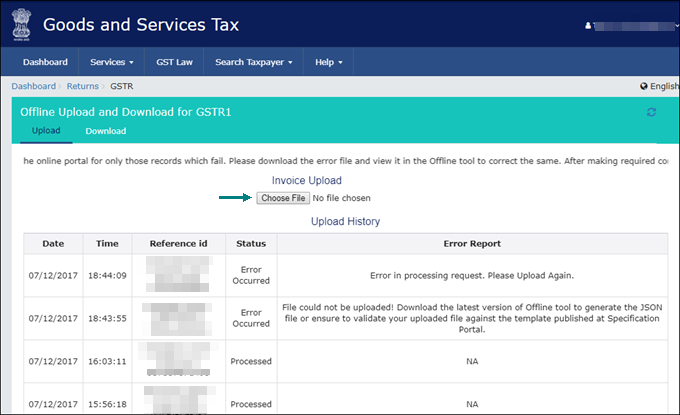

8. Click Choose File to import the JSON file generated from Tally.ERP 9 or the offline tool.

Once your JSON file is uploaded successfully, you will be notified by a message.

9. Verify the uploaded details after the time specified in the GSTR screen.

You have to manually enter the details for Nil Rated Supplies and Documents Issued by referring to the table-wise format of GSTR-1 , because these details do not get directly uploaded to the portal.

10. Go to Services > Returns > Returns Dashboard , and click Prepare Online .

11. Go to the 8A, 8B, 8C, 8D - Nil Rated Supplies page, and enter the details.

12. Go to the 13 - Documents Issued page, and enter the details.

13. Submit your returns and e-sign.

Created & Posted By Aashima

Accounts Executive at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

GST Compliance Software in India

GST compliance software refers to specialized digital tools designed to help businesses manage their GST-related activities effectively. These software solutions simplify various tasks such as GST registration, return filing, invoicing, ...How to file GST Return Online ?

From manufacturers and suppliers to dealers and consumers, all taxpayers have to file their tax returns with the GST department every year. Under the new GST regime, filing tax returns has become automated. GST returns can be filed online using the ...GST Applicability & Tax Rates on Software Development

GST Applicability & Tax Rates on Software Development Services in India The software development industry in India is a major contributor to the digital economy. Under the Goods and Services Tax (GST) regime, software development services are ...How to Calculate Turnover for GST Registration Threshold in India

If you’re running a business in India, one of the most crucial legal obligations you must be aware of is GST registration. Whether you're just starting out or scaling up, the Goods and Services Tax (GST) law mandates registration based on your ...GST Applicability & Tax Rates on Information Technology Services

? GST Applicability & Tax Rates on Information Technology (IT) Services in India With the rapid expansion of the digital economy, Information Technology (IT) services have become an integral part of business operations. The Goods and Services Tax ...