Login Page To Check GST Return

There are two types of GST login procedures for www.gst.gov.in. One is for existing users, and another is for new users. Let’s see in detail about both the procedures.

Steps to GST login for an existing user

Step 1: Visit www.gst.gov.in or the official GST website and click on ‘Login’ appearing on the right-hand corner of the homepage.

Step 2: Enter the username, password, captcha code and then click on the ‘LOGIN’ button.

Step 3: You will see your dashboard upon a successful GST login. You can view a summary of the GST credits that you have, ‘FILE RETURNS’ tab, ‘PAY TAX’ tab, Annual Aggregate Turnover (AATO) along with notices/orders received and saved forms.

Steps to GST login for a new user

Step 1: Click on the Login link given in the top right-hand corner of the GST Home page

Step 2: Click on the here link in the instruction at the bottom of the page that says “First time login: If you are logging in for the first time, click here to login”.

Step 3: Enter the provisional ID/GSTIN/UIN and password received on your e-mail address. Also, input the given captcha and then click on “Login”.

Step 4: The new credentials page is displayed. Enter the username and password of your choice. Re-confirm the password and then click on “Submit” button.

Step 5: A success message is displayed once the username and password have been created. You can now login to the GST official Portal using these credentials.

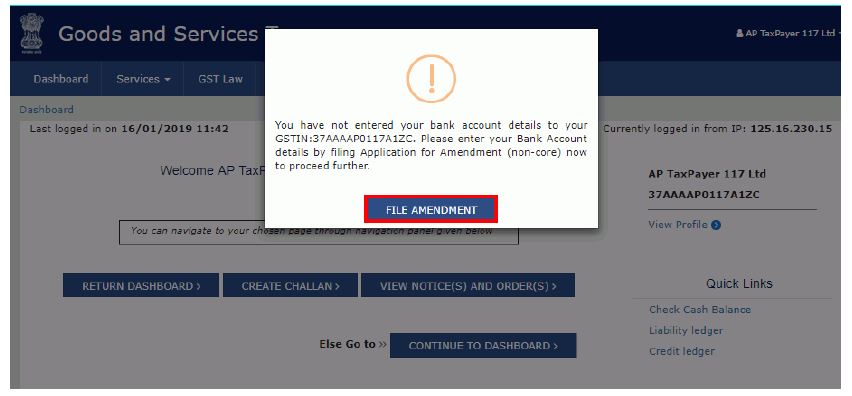

Step 6: When you login for the first time on the official GST website, you will be prompted to file a non-core amendment application to submit bank accounts details. Click on ‘FILE AMENDMENT’ button.

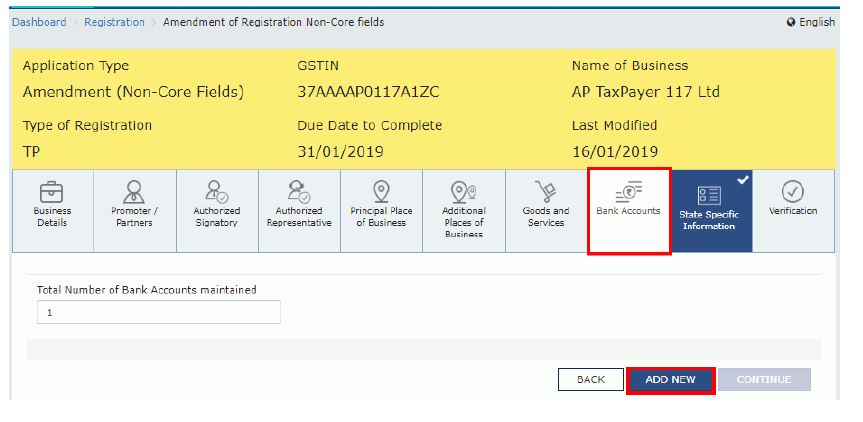

Step 7: The application form for editing is displayed and non-core fields is available in editable form. Edit the details in the bank accounts tab by clicking ‘ADD NEW’ button and submitting the application.

Created & Posted By Aashima

Accounts Executive at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

LUT (Letter of Undertaking) in GST

Letter of Undertaking - Brief Description In order to give boost to exports, the government provided certain facilities to the exporters under GST. As per section 16 of the IGST Act, 2017, export of goods and services is treated as Zero Rated Supply. ...GST Registration Eligibility & Online Filing Process

GST Registration - An Overview The goods and services tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It is a destination based tax on consumption of goods and services. GST is to be charged at every ...How to Check GSTIN Number Validity?

GST Registration Check – How to Check GSTIN Validity? GST Registration Validity GST registration for regular taxpayers do not have an expiry date and is valid until it is surrendered or cancelled. Only the GST registration for non-resident taxable ...GST temporary registration number login

To obtain a temporary registration number, follow these steps: Step 1: Go the official website of GST and choose services, click on registration and then on new registration. Step 2: Enter all the required information, PAN number, mobile number, and ...How to Check GST Cancellation Status

How to check GST registration cancellation status There is a difference between cancelling a GST registration and modifying a GST Registration. We’ll go through the steps involved in cancelling your GST registration in this article. # What Is ...