How to Surrender or Cancel the GST Number?

Cancellation of GST Application: Complete Guide

The taxpayers must follow the below following steps for the Cancellation of GST Registration:

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal for the Cancellation of GST Registration.

Step 2: Click on the ‘Login’ button to access the username and password page.

Step 3: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and click ‘login’.

Step 4: Click on the Application for Cancellation of Registration link under the services tab that is visible on the home page.

Step 5: The portal displays various tabs for the cancellation of the registration form. There are three tabs such as Basic Details, Cancellation Details and Verification. Click on each tab to enter the details.

Provide Basic Details

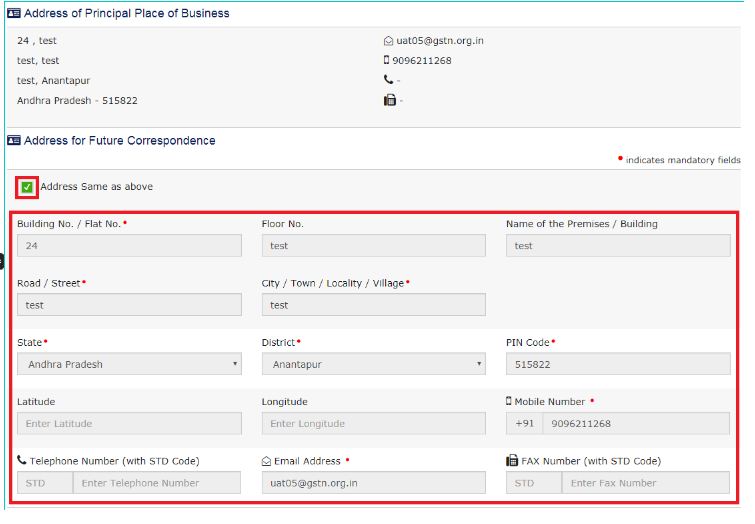

Step 6: The Basic Details tab displays the pre-filled information in the sections of Basic Details and Address of Principal Place of Business.

Step 7: The applicant must fill the address manually for future correspondence, or check the Address option same as the above to copy the same address as in the Address of Principal Place of Business field.

Step 8: Then click on the “Save and Continue” button. A blue tick will appear on the Basic Details section indicating the completion of the Basic details. Now proceed with the next tab.

Step 9: The next tab Cancellation Details will get active after filling-in all the mandatory fields under the Basic Details tab.

Provide Cancellation Details

Step 10: Select a suitable reason from the Reason for Cancellation drop-down list.

Step 11: The below following five reasons are available in the drop-down list for the selection:

- Change in the constitution of business leading to change in PAN

- Ceased to be liable to pay tax

- Discontinuance of business / Closure of business

- Others

- Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise.

Change in the constitution of business leading to change in PAN

On selecting the Change in the constitution of business, leading to a change in PAN option, the applicant should enter the following details:

- The required date for cancelling the registration.

- Then enter the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. The system will validate the same, and based upon its Legal Name of Business, will auto-populate the Trade Name.

- Then click on the “Save and Continue” button.

Ceased to be liable to pay tax

On selecting the Ceased to be liable to pay the tax option, enter the following details:

- The required date for cancelling the registration.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires for offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction

- Click on the “Save and Continue” button.

Discontinuance of business/Closure of business

On selecting the Discontinuance of business/Closure of business option, Enter the following details:

- The required date for cancelling the registration.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction.

- Click on the “Save and Continue” button.

Others

On selecting the Discontinuance Others option, enter the following details:

- Specify a proper reason for the GST cancellation.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires for the offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction

- Click on the “Save and Continue” button.

Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise.

On selecting the “Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise” option, enter the following details:

- The required date for cancelling the registration.

- Enter the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. The system will validate the same, and based upon its Legal Name of Business, will auto-populate the Trade Name.

- Click on the “Save and Continue” button.

Step 12: The next tab verification Details will get active after filling-in all the mandatory fields under the Cancellation Details tab.

Verification Tab

Step 13: Check the Verification statement box to declare that all the information provided in the form stands legally correct.

Step 14: Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

Note: The system auto-populates the authorised signatory’s designation or status.

Step 15: Enter the Place of making this declaration.

Step 16: Sign the form by using either the Digital Signature Certificate (DSC) or the EVC option. On selecting any of these below options, the registered user receives an OTP.

Using DSC Option

Step 17: If using a DSC, the user shall select the registered DSC from the emSigner pop-up screen and then proceed from there accordingly.

Using EVC Option

Step 18: Enter the OTP and then click on the Validate OTP button.

Generate ARN

Step 19: On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

Step 20: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 21: After this process, the concerned Tax Official will review the application and make a decision accordingly.

Now Track and Check Application Status

Step 22: To view the ARN, click on the “Track Application Status” under the services tab that is visible on the home page.

Step 23: Select the Submission Period radio button.

Step 24: Enter the From and To dates as mentioned in the form for cancellation of registration.

Step 25: Click the Search button. On clicking on the ‘search’ button, will display the ARN corresponding to the filled application along with the status.

Who are Entitled to File GST Cancellation Application

The CGST Act entitles the following persons to apply for a cancellation of registration:

- All registered taxpayers other than persons regulated under rule 12, which covers registered persons requiring to deduct or collect tax at source, and Taxpayers granted with UIN.

- The legal heir of a registered person.

Who Can Cancel GST Registration?

- An Officer under GST can either on his own accord or

- an application filed by the registered person or

- by legal heirs of the registered person, in case of death of such person, can cancel a GST registration.

However, a person who obtained GST registration voluntarily cannot apply for GST Registration cancellation before the expiry of a 1 year from the effective date of registration.

The officer shall cancel the GST registration granted to a person for:

- The taxable person under GST does not conduct any business from the declared place of business; or

- Issues invoice or bill without supply of goods or services in violation of the GST Act and/or GST rules.

Prior to the cancellation of registration, the officer would issue a notice to such person whose GST registration is liable to be cancelled, requiring show cause within seven working days from the date of service of such notice as to why the GST registration should not be cancelled. The registered person can reply to the show cause notice within the prescribed time, or the GST registration can stand cancelled.

Possible Reasons for GST Registration Cancellation

As per Section 29 of the CGST Act, the taxpayer can initiate apply for the cancelled GST registration under the following circumstances:

- Discontinuance or closure of a business.

- Transfer of business for reasons of amalgamation, merger, de-merger, sale, lease or other pertinent reasons.

- Change in the constitution of business, which results in a change of PAN.

- Taxpayers who are not under the mandatory net of GST.

- Death of the sole proprietor.

- Any other reason, the likes of which must be substantiated in the application.

Application Form for Cancellation of GST Registration

An application for cancellation is to be made in Form GST REG-16 on the common GST portal within 30 days of the “occurrence of the event warranting the cancellation.”

In certain scenarios where it is tough to identify the exact date of the event, the deadline can be interpreted in a liberal manner, in which case the application would not be rejected on the possible violation of the deadline.

Required Information Needed while filing for Cancellation of GST Registration

The following information must be mandatorily specified by the applicant while applying for cancellation in Form GST REG-16:

- Contact address, which includes the mobile number and e-mail address.

- Grounds of cancellation.

- The desired date of cancellation.

- Particulars of the value and the tax payable on the stock of inputs, the inputs available in semi-finished goods, inputs available in finished goods, the stock of capital goods/plant and machinery.

- Details of registration of the entity if the existing unit merged, amalgamated, or transferred.

- Particulars of the latest return filed by the taxpayer along with the ARN of the particular return.

Payment Requisites

While applying for a cancellation, the applicant is mandated to pay the input tax contained in the stock of inputs, semi-finished goods, finished goods, and capital goods or the output tax liability of such goods, whichever is higher.

The payment can be made through debiting either the electronic credit or cash ledger.

The obligation, though considered essential, may even be fulfilled during the submission of final return in GSTR-10.

Grounds of Non-acceptance of Application

The concerned officer may decide against accepting the application on the basis of the following:

- The submitted application is incomplete.

- Where in the event of transfer, merger or amalgamation of business, the new entity hasn’t registered with the tax authority prior to the submission of application.

In these situations, the concerned officer provides a written intimation to the applicant regarding the nature of the discrepancy. In which case, the latter is required to respond to the same within seven days of the date of receipt of the letter, failing which the concerned officer may reject the application after providing him/her with an opportunity to be heard. Reasons for the rejection must be recorded.

Final Return

Every person whose registration has been cancelled are required to file a final GST return in Form GSTR-10 within three months of the date of cancellation or the date of order of cancellation, whichever is later.

This is done to ensure that the taxpayer is devoid of liabilities which could have been incurred under Section 29 of the CGST Act.

The due date stipulated for the same is the 31st of December 2018. It may be noted that Input Service Distributors or non-resident taxpayers who are required to pay tax under section 10, section 51 or section 52 are exempted from this provision.

Final Return Not filed

If the final return isn’t filed in Form GSTR-10, the taxpayer will be issued a notice in GSTR-3A, prompting him/her to do the same within 15 days of the issue of such notice.

If the taxpayer fails to comply with the notice, initiatives will be taken to assess the liability of the taxpayer based on the information available with the concerned officer.

The assessing order will be withdrawn if the applicant files the return within 30 days of the issue of notice. However, the taxpayer wouldn’t be reprieved of remitting the late fee and interest.

How to Activate a Cancelled GST Registration?

Following information would be helpful to re-register your GST number after cancellation.

The taxpayer can apply for Revoking a Cancelled GST Registration application, if in the case that the GST officer cancelled involuntarily.

The applicant should file for the cancelled GST registration process in the GST portal within 30 days from the date of cancellation by the concerned officer.

However, upon cancellation of GST registration due to failure in filing GST returns, then the taxpayer can appeal for GST revocation only after filing the GST returns and pay the tax amount as required, along with any amount payable towards interest, penalty and late fee payable.

After filing the delayed GST returns and paying the penalty, an application can be made by a taxpayer for revocation of cancellation of registration.

The GST Officer would then verify the reasons for revocation of cancellation of registration, and if satisfied about the grounds for revocation of cancellation of registration, he would revoke the cancellation of registration.

Related Articles

How to Surrender or Cancel GST Number

Cancellation of Registration under GST You can cancel your GST registration if the GST rules don’t apply to you or you are shutting down your business or profession, or the tax officer calls for cancellation. This article will guide you through the ...GST Cancellation Process & Steps Online

What is the Cancellation of GST Registration? Certain companies must register for GST to operate. You will not be a registered person under the GST system and will no longer be required to pay or collect GST due to the cancellation of GST. When you ...How to surrender GST registration online?

A GST registration obtained in India can be cancelled by the registered person or by an officer, or by the legal heirs, in case of death of a person registered under GST. GST registration cancellation is different from the GST Registration amendment. ...How can we apply for GST Cancellation Online?

A new functionality has been introduced on the GST portal for the surrendering of GST Registration. If you want to cancel your GST registration, follow below steps: Step 1: Login into your account on gst.gov.in Step 2 : Go to Services >> ...How to Check GST Cancellation Status

How to check GST registration cancellation status There is a difference between cancelling a GST registration and modifying a GST Registration. We’ll go through the steps involved in cancelling your GST registration in this article. # What Is ...