How to Cancel GST Number Online?

Cancellation of GST Application: Complete Guide

In 25 steps learn How can you cancel GSTIN registration yourself.

The taxpayers must follow the below following steps for the Cancellation of GST Registration:

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal for the Cancellation of GST Registration.

Step 2: Click on the ‘Login’ button to access the username and password page.

Step 3: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and click ‘login’.

Step 4: Click on the Application for Cancellation of Registration link under the services tab that is visible on the home page.

Step 5: The portal displays various tabs for the cancellation of the registration form. There are three tabs such as Basic Details, Cancellation Details and Verification. Click on each tab to enter the details.

Provide Basic Details

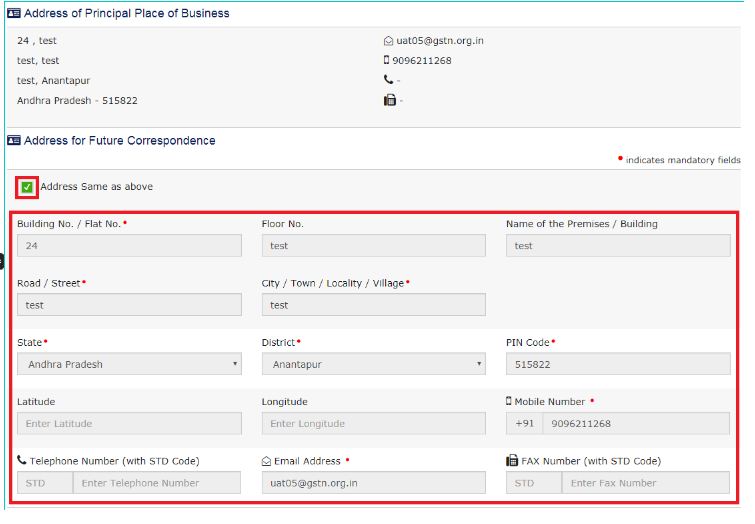

Step 6: The Basic Details tab displays the pre-filled information in the sections of Basic Details and Address of Principal Place of Business.

Step 7: The applicant must fill the address manually for future correspondence, or check the Address option same as the above to copy the same address as in the Address of Principal Place of Business field.

Step 8: Then click on the “Save and Continue” button. A blue tick will appear on the Basic Details section indicating the completion of the Basic details. Now proceed with the next tab.

Step 9: The next tab Cancellation Details will get active after filling-in all the mandatory fields under the Basic Details tab.

Provide Cancellation Details

Step 10: Select a suitable reason from the Reason for Cancellation drop-down list.

Step 11: The below following five reasons are available in the drop-down list for the selection:

- Change in the constitution of business leading to change in PAN

- Ceased to be liable to pay tax

- Discontinuance of business / Closure of business

- Others

- Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise.

Change in the constitution of business leading to change in PAN

On selecting the Change in the constitution of business, leading to a change in PAN option, the applicant should enter the following details:

- The required date for cancelling the registration.

- Then enter the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. The system will validate the same, and based upon its Legal Name of Business, will auto-populate the Trade Name.

- Then click on the “Save and Continue” button.

Ceased to be liable to pay tax

On selecting the Ceased to be liable to pay the tax option, enter the following details:

- The required date for cancelling the registration.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires for offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction

- Click on the “Save and Continue” button.

Discontinuance of business/Closure of business

On selecting the Discontinuance of business/Closure of business option, Enter the following details:

- The required date for cancelling the registration.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction.

- Click on the “Save and Continue” button.

Others

On selecting the Discontinuance Others option, enter the following details:

- Specify a proper reason for the GST cancellation.

- Enter the value of stock and also the corresponding tax liability on the stock.

- Basis the entered stock details, manually enter the value to offset the liability that requires for the offset from either the Electronic Credit Ledger, or the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, or the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction

- Click on the “Save and Continue” button.

Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise.

On selecting the “Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise” option, enter the following details:

- The required date for cancelling the registration.

- Enter the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. The system will validate the same, and based upon its Legal Name of Business, will auto-populate the Trade Name.

- Click on the “Save and Continue” button.

Step 12: The next tab verification Details will get active after filling-in all the mandatory fields under the Cancellation Details tab.

Verification Tab

Step 13: Check the Verification statement box to declare that all the information provided in the form stands legally correct.

Step 14: Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

Note: The system auto-populates the authorised signatory’s designation or status.

Step 15: Enter the Place of making this declaration.

Step 16: Sign the form by using either the Digital Signature Certificate (DSC) or the EVC option. On selecting any of these below options, the registered user receives an OTP.

Using DSC Option

Step 17: If using a DSC, the user shall select the registered DSC from the emSigner pop-up screen and then proceed from there accordingly.

Using EVC Option

Step 18: Enter the OTP and then click on the Validate OTP button.

Generate ARN

Step 19: On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

Step 20: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 21: After this process, the concerned Tax Official will review the application and make a decision accordingly.

Now Track and Check Application Status

Step 22: To view the ARN, click on the “Track Application Status” under the services tab that is visible on the home page.

Step 23: Select the Submission Period radio button.

Step 24: Enter the From and To dates as mentioned in the form for cancellation of registration.

Step 25: Click the Search button. On clicking on the ‘search’ button, will display the ARN corresponding to the filled application along with the status.

Related Articles

Cancellation of registration under GST-Why & How?

Cancellation of registration under GST- Why & How? In case you want to cancel your GST registration because GST does not apply to you or you are shutting down your business or profession, or the tax officer calls for cancellation, this article will ...How to Revoke GST Cancellation Application if already filed?

Revocation of GST Registration Cancellation The GST Act is comprehensive and covers various situations a taxpayer may face with provisions and procedures. This article looks at the process for revocation of GST registration cancellation order along ...How to Download Gst Cancellation Certificate

A GST (Goods and Services Tax) cancellation certificate is a document issued to businesses or individuals who have cancelled their GST registration. To cancel GST registration, businesses or individuals need to file an application for cancellation on ...GST Applicability & Tax Rates on Export of Goods & Service

GST Applicability & Tax Rates on Export of Goods & Service As of my last knowledge update in September 2021, I can provide you with information on the applicability of Goods and Services Tax (GST) and tax rates on the export of goods and services in ...GST Applicability & Tax Rates on Export of Goods & Service

India continues to be a global powerhouse when it comes to export of goods and export of services. Indian businesses who export goods and services are considered as a zero-rated supply under goods and services tax (GST) - no GST is levied on such ...