How to Generate e way bill for multiple invoices?

How to Generate E-Way Bill for Multiple Invoices

Consolidated E-Way Bill (EWB-02) is a single document that contains details of all the E-Way Bills related to the consignments. If you are a transporter/ supplier who wants to transport multiple consignments of goods in a single conveyance or vehicle, you can use the Consolidated E-Way Bill feature available on the E Way Bill portal.

Note: You should be a transporter or should have generated the e-way bills at step-1 yourself to use the consolidated EWBs facility.

Latest Updates

29th August 2021

From 1st May 2021 to 18th August 2021, the taxpayers will not face blocking of e-way bills for non-filing of GSTR-1 or GSTR-3B (two months or more for monthly filer and one quarter or more for QRMP taxpayers) for March 2021 to May 2021.

4th August 2021

Blocking of e-way bills due to non-filing of GSTR-3B resumes from 15th August 2021.

1st June 2021

1. The e-way bill portal, in its release notes, has clarified that a suspended GSTIN cannot generate an e-way bill. However, a suspended GSTIN as a recipient or as a transporter can get a generated e-way bill.

2. the mode of transport ‘Ship’ has now been updated to ‘Ship/Road cum Ship’ so that the user can enter a vehicle number where goods are initially moved by road and a bill of lading number and date for movement by ship. This will help in availing the ODC benefits for movement using ships and facilitate the updating of vehicle details as and when moved on road.

18th May 2021

The CBIC in Notification 15/2021-Central Tax has notified that the blocking of GSTINs for e-Way Bill generation is now considered only for the defaulting supplier’s GSTIN and not for the defaulting recipient or the transporter’s GSTIN.

Prerequisites

- Registration on the EWB potal

- You should have the Invoice/ Bill/ Challan related to the consignment of goods.

- Transporter ID or the Vehicle number (for transport by road)

- Transporter ID, Transporter document number, and date on the document (for transport by rail, air, or ship).

- Apart from those, the taxpayer must have all the individual e-way Bill numbers of the consignments, to be transported in one conveyance.

Here is a step-by-step process to generate consolidated e-way bills

Step 1: Login to EWB Portal and Generate individual eway bills. Here is a step by step guide to generate eway Bill.

Step 2: Select ‘ Generate new ’ under ‘Consolidated EWB ’ option appearing on the left-hand side of the dashboard.

Step 3: The following details are required to be entered in this step:

- Select ‘Mode’ of transport- Rail/Road/Air/Ship

- Select ‘From State’ from the drop down

- In the ‘Vehicle Starts From, field enter the location from where the goods are being transported.

- Enter ‘Vehicle No.’

- Add the EWB no. (rest of the fields are auto-populated based on this)

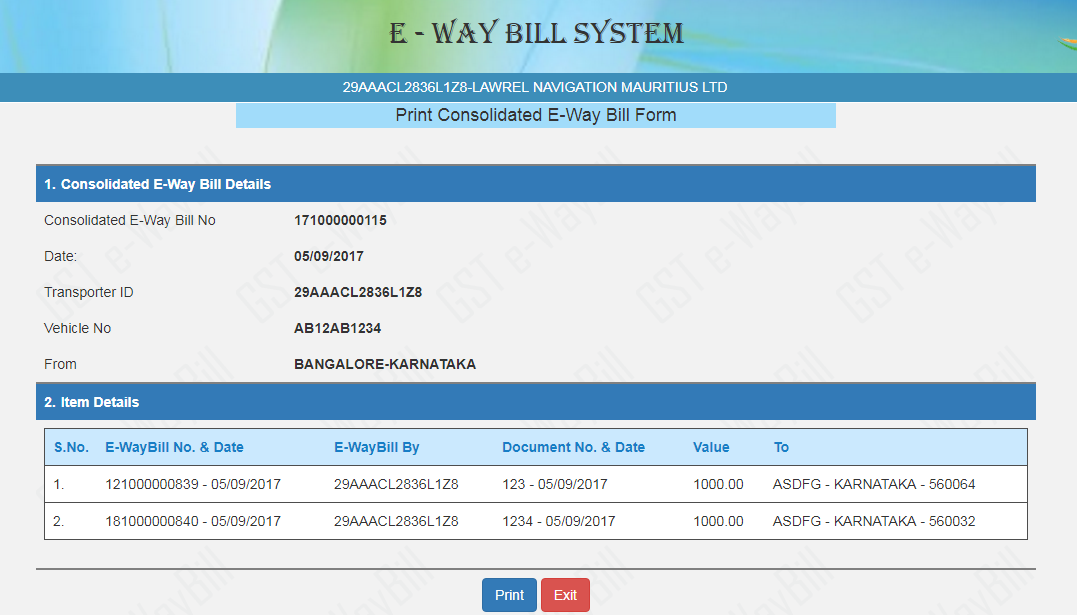

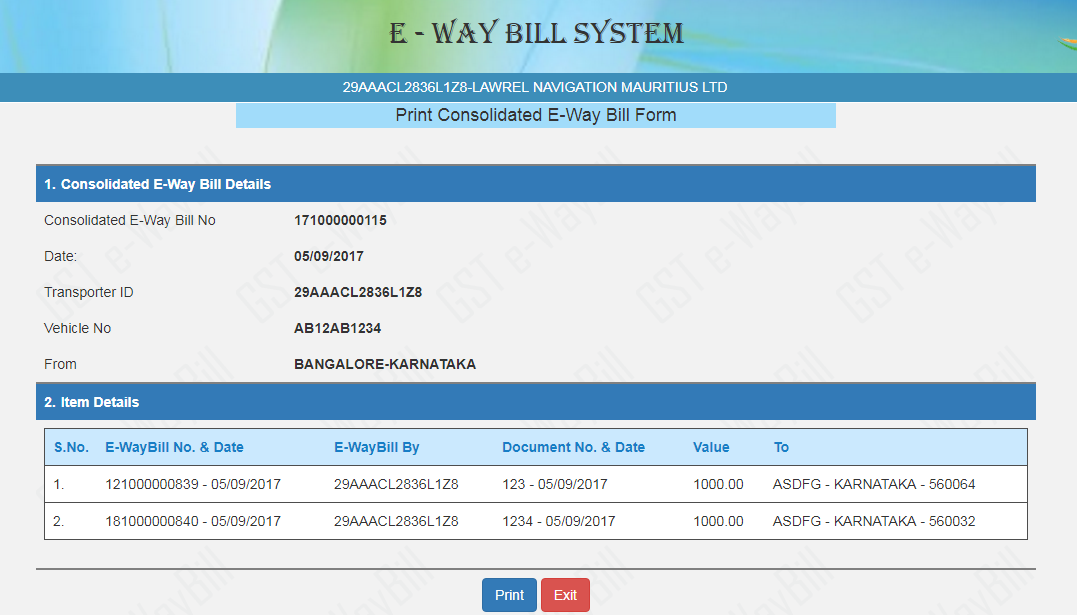

Enter the details and Click on ‘Submit’ On submitting, following screen appears: E-way bill in Form EWB-02 with a unique 12 digit number is generated. Print and carry this for transporting the goods in the selected mode of transport and the selected conveyance.

You can print the Consolidated EWBs as follows

Step 1: Click on ‘Print EWB’ sub-option under ‘e-Waybill’ option or ‘ Consolidated EWB’ option

Step 2: Enter the relevant e-way bill number/ Consolidated EWB -12 digit number and click on ‘Go’

Step 3: Click on ‘Print’ or ‘detailed print’ button on the EWB/ consolidated EWB that appears:

Re-generate Consolidated Eway bill

Transporters/taxpayers can use this option to update the vehicle details for the particular consolidated Eway bill. Click ‘Re-generate’ is available under Consolidated EWB option.

Related Articles

E-Way Bill under Goods & Service Tax - All You Need to Know.

E-Way Bill under GST An E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the ...How to Generate e way bill in Tally Prime

e-Way Bill in TallyPrime The e-Way Bill system was introduced by the government to simplify and streamline the process of GST compliance. An e-Way Bill document has to be carried while shipping the goods from one location to another. This document ...Prerequisites for e-Way Bill Generation

Prerequisites for e-Way Bill Generation There are some prerequisites for generating an eway bill (for any method of generation): Registration on the EWB Portal The Invoice/ Bill/ Challan related to the consignment of goods must be in hand. If ...How to generate e-way bill for multiple invoices belonging to same consignor and consignee?

If multiple invoices are issued by the supplier to recipient, that is, for movement of goods of more than one invoice of same consignor and consignee, multiple EWBs have to be generated. That is, for each invoice, one EWB has to be generated, ...How to Generate e way Bill for Unregistered Buyer

E-Way Bill in case of Sale by Unregistered Person In case the movement of goods is done by a person who is not registered under GST, either in his own conveyance or through a hired conveyance or through a transporter, the e-way bill in such a case ...