How to pay Company Income tax online ?

Income Tax Challan - How to Pay Your Company Income Tax Online?

How to e-Pay Tax Online?

Step-by-Step Guide

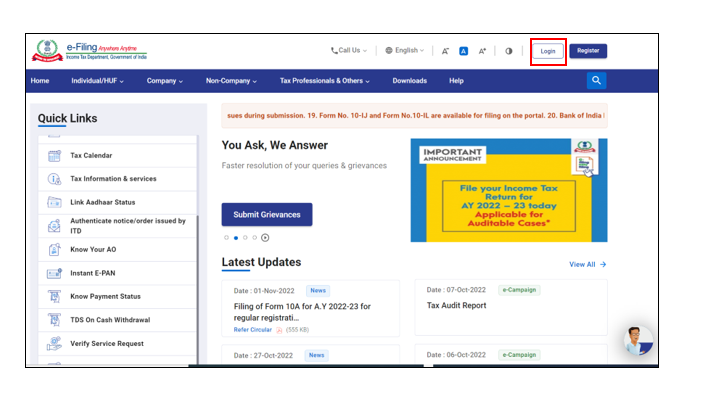

Step 1: Log in to the e-Filing portal with your User ID and Password.

Step 2: On the Dashboard, click e-File > e-Pay Tax. You will be navigated to the e-Pay Tax. On the e-Pay Tax page, click the New Payment option to initiate the online tax payment.

Step 3: On the New Payment page, click Proceed on a tax payment tile applicable to you.

Step 4: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

Step 5: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step :6

Step 7: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

Step 8: Read and Select the Terms and Conditions and Click Submit to Bank. (You will be redirected to the website of Payment Gateway where you can login or enter Net Banking/ Debit / Credit Card / UPI details and make the payment). You may compare transaction charges (as per Annexure 1) of the five payment gateways before selecting the payment option.

Created & Posted by Ravi Kumar

Related Articles

How to Pay Advance TAX through income tax Portal?

On the TIN-NSDL portal, the income tax payment can be made online. Tax is one of the main ways the government makes money and uses the same for public welfare. However, as the Direct Tax TIN 2.0 services have been temporarily disabled by ITD, thus ...

PF online Payment: Process and Steps

The employee Provident Fund Scheme is one of the most useful employee beneficial schemes introduced by the Ministry of Labour. It is one of the ideal retirement funds. It is a type of savings account where both employer and employee contributes an ...

Steps for TDS Payment Online to Government

Procedure for making online TDS Payment To make online TDS Payment, logon to the e-Tax Payment System and follow the steps below: Select the relevant challan online, as applicable Income Tax Challan No ITNS 281 Choose “0020” if you are deducting TDS ...

Online Income Tax Filing In India

In today's digital era, technology has permeated every aspect of our lives, transforming the way we work, communicate, and even pay our taxes. Gone are the days of tedious paperwork and long queues at tax offices. With the advent of online income tax ...

Filing Income Tax Return online India

ITR Login - How to File Income Tax Return The Process to file Income Tax Returns (ITR) by using the internet is called E-filing. The process to e-file ITR is quick, easy, and can be completed from the comfort of an individual's home or office. ...