How to Revoke GST Cancellation Application if already filed?

Revocation of GST Registration Cancellation

The GST Act is comprehensive and covers various situations a taxpayer may face with provisions and procedures. This article looks at the process for revocation of GST registration cancellation order along with the application forms. The requirement for revocation is contained under rule 23 of the CGST Rules, 2017.

Time Limit for Revocation

Any registered taxable person can apply for revocation of cancellation of GST registration within 30 days from the date of service of the order of cancellation of GST registration. It must be noted that the application for revocation can be made only during the circumstances when the proper officer has canceled the registration on his motion. Hence, the cancellation cannot be used when a taxpayer cancels GST registration voluntarily.

Application for Revocation

Application in FORM GST REG-21 needs to be filed by the registered person for revocation of GST registration, either directly or through a facilitation center notified by the Commissioner.

Online Revocation Procedure

Following are the steps which a registered person needs to be followed who wants to apply for revocation online through the GST Portal:

- Access the GST Portal at www.gst.gov.in.

- To enter into the account, enter the username and appropriate password.

- In the GST Dashboard, select services, under services, select registration, and further under particular registration application for revocation of canceled registration option.

- Select the option of applying for revocation of canceled registration. Enter the Reason for revocation of GST registration cancellation in the select box. You need to select the verification checkbox, select the name of the authorized signatory, and fill up the place filed box. Further, you need to choose an appropriate file to be attached for any supporting documents.

- The final step would be to select SUBMIT WITH DSC OR SUBMIT WITH EVC box.

Processing of Application

If the proper officer is satisfied with the Reason provided by the taxpayer for revocation of registration, the officer shall revoke the cancellation of registration.

The period of revocation by the proper officer is 30 days from the date of application. The excellent officer must pass an order revoking the cancellation of registration in FORM GST REG-22.

Rejection of Application

If a GST officer is not satisfied with the revocation application, the officer will issue a notice in FORM GST REG-23. On receipt of the information, the applicant must furnish a suitable reply in FORM GST REG-24 within 7 working days from the date of service of the notice. On receipt of a timely response from the applicant, the officer must pass a suitable order in FORM GST REG-05 within 30 days from the date of receipt of a reply from the applicant.

Ineligible Applicants

UIN Holders (i.e., UN Bodies, Embassies, and Other Notified Persons), GST Practitioners, or if the registration is canceled on the taxpayer's request or legal heir of the taxpayer, cannot apply for revocation of canceled registration.

Online Application Procedure for Revocation of Cancellation

The taxpayers must follow the below following steps for the Revocation of Cancellation of GST Registration online.

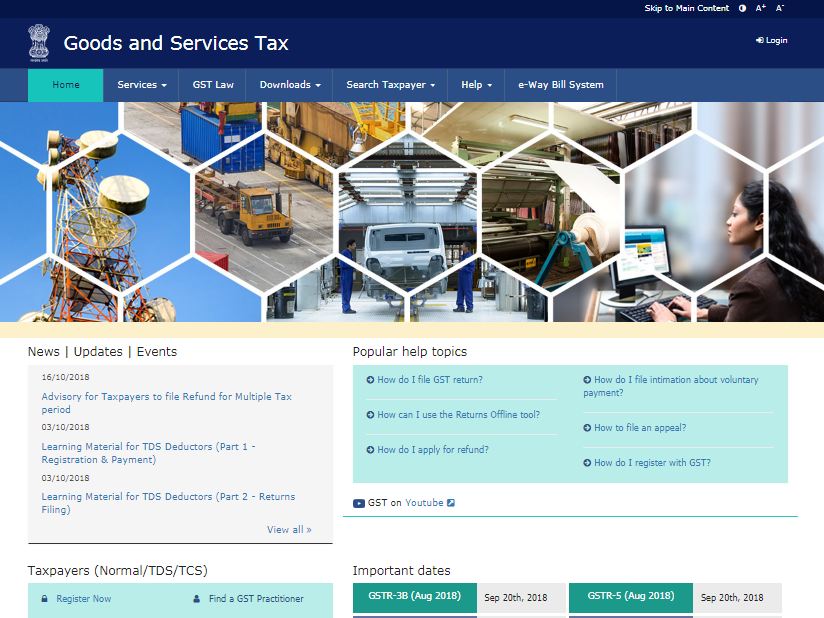

Visit GST Portal

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal for the Revocation or Cancellation of GST Registration.

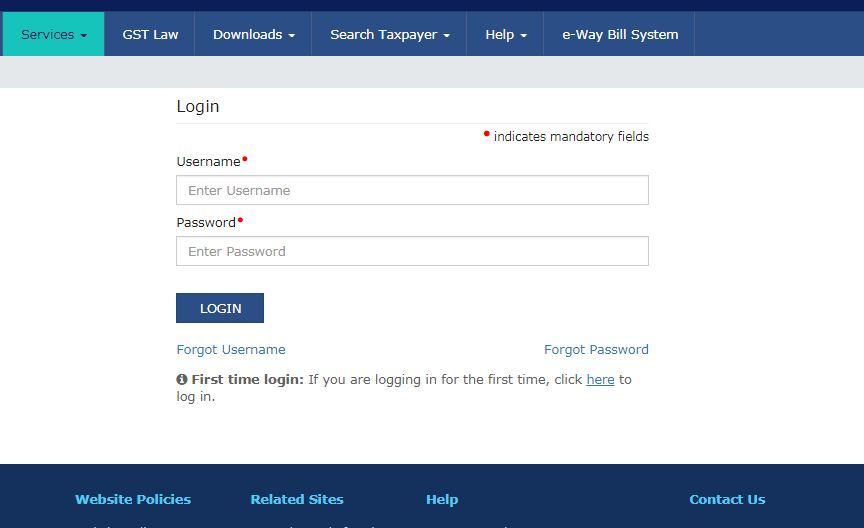

Login into Portal

Step 2: Click on the ‘Login’ button to access the username and password page.

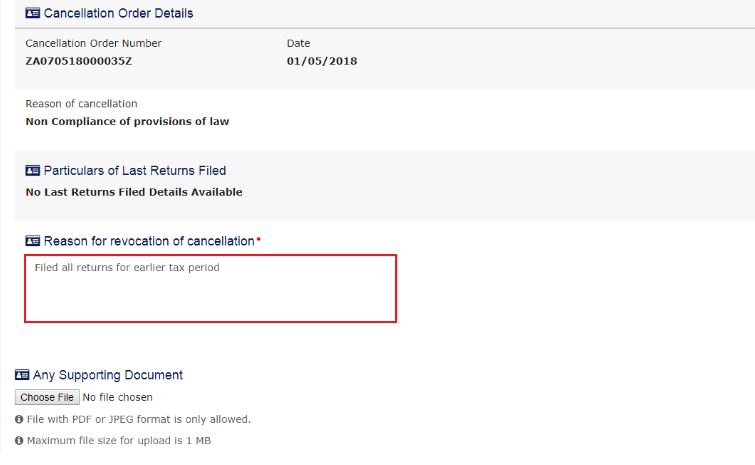

Application for Revocation

Step 4: You have to click on the Revocation of Cancellation of GST Registration link under the services tab visible on the home page.

Step 6: You have to click the “Choose File” button to attach any supporting documentation.

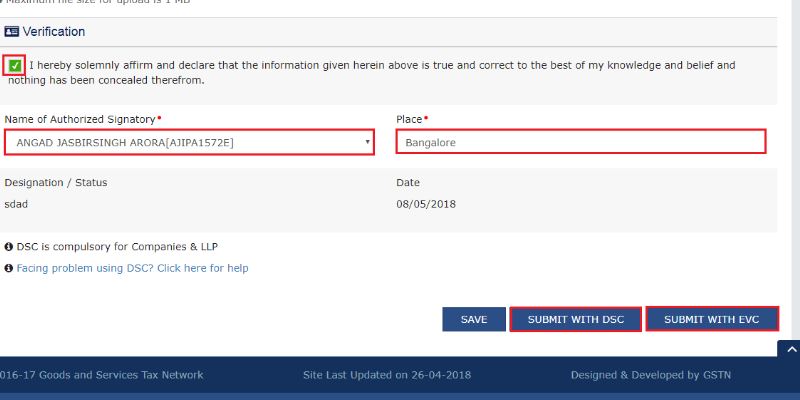

Step 8: Select the name of the authorized signatory in the Name of Authorized Signatory drop-down list.

Step 9: You have to enter where the application is filed in the Place field.

Step 10: You can also click the ‘save’ button to save the application form and retrieve it later.

Using DSC Option

Step 13: If using a DSC, the taxpayer should select the registered DSC from the designer pop-up screen and proceed accordingly.

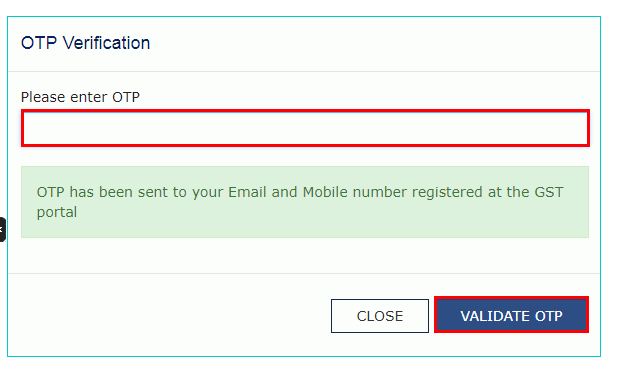

Using EVC Option

Step 14: Enter the OTP you have received and click on the Validate OTP button.

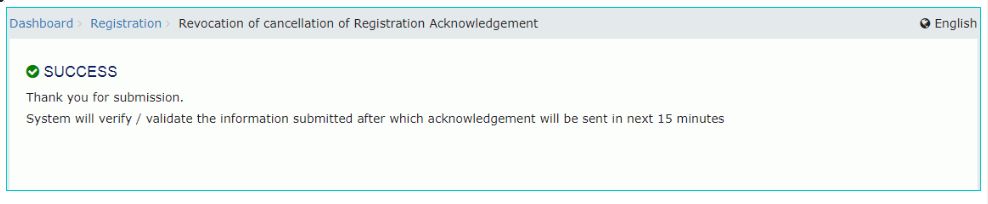

Acknowledgment Message

Step 15: On successfully applying for cancellation of registration, the system generates the ARN and displays a confirmation message.

Step 17: After this process, the concerned Tax Official will review the application and decide accordingly.

Approval by the Tax Official

Step 18: After receiving all the necessary information and being satisfied with the information provided, the proper officer may revoke the cancellation of the GST registration.

Step 19: On approval by the Tax Official, the system generates an approval order and sends the notification to the applicant, the Primary Authorized Signatory of the taxpayer, via e-mail and SMS, about the same.

Step 20: Consequent to the approval of the Application for Revocation of Cancelled Registration, the GSTIN Status of the taxpayer shall change from Inactive to Active status with effect from the effective date of cancellation.

Rejection by the Tax Official

Step 21: When the Tax Official rejects an application for canceled registration revocation, the rejection order will be generated.

Step 22: The GSTIN status will remain “Inactive” on the GST Portal. The taxpayer shall receive the Primary Authorized Signatory through SMS and e-mail stating the rejection of the application.

CA-Article at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Related Articles

How to Download Gst Cancellation Certificate

A GST (Goods and Services Tax) cancellation certificate is a document issued to businesses or individuals who have cancelled their GST registration. To cancel GST registration, businesses or individuals need to file an application for cancellation on ...Cancellation of registration under GST-Why & How?

Cancellation of registration under GST- Why & How? In case you want to cancel your GST registration because GST does not apply to you or you are shutting down your business or profession, or the tax officer calls for cancellation, this article will ...Trademark Registration Cancellation in India

Trademark Registration cancellation Trademark registration cancellation refers to the legal process of revoking or invalidating a previously granted trademark registration. It is a procedure initiated by an interested party who believes that the ...How to Cancel GST Number Online?

Cancellation of GST Application: Complete Guide In 25 steps learn How can you cancel GSTIN registration yourself. The taxpayers must follow the below following steps for the Cancellation of GST Registration: Step 1: Firstly, the taxpayers have to ...Goods and Services Tax (GST) Compliance in Bangalore

Goods and Service Tax (GST) Registration, GST Returns filing in Bangalore, Karnataka GST or Goods and Services Tax is an indirect tax in Bangalore, Karnataka which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, ...