🏢 How to Structure a Holding Company for D2C Startups in Ind

📌 Introduction

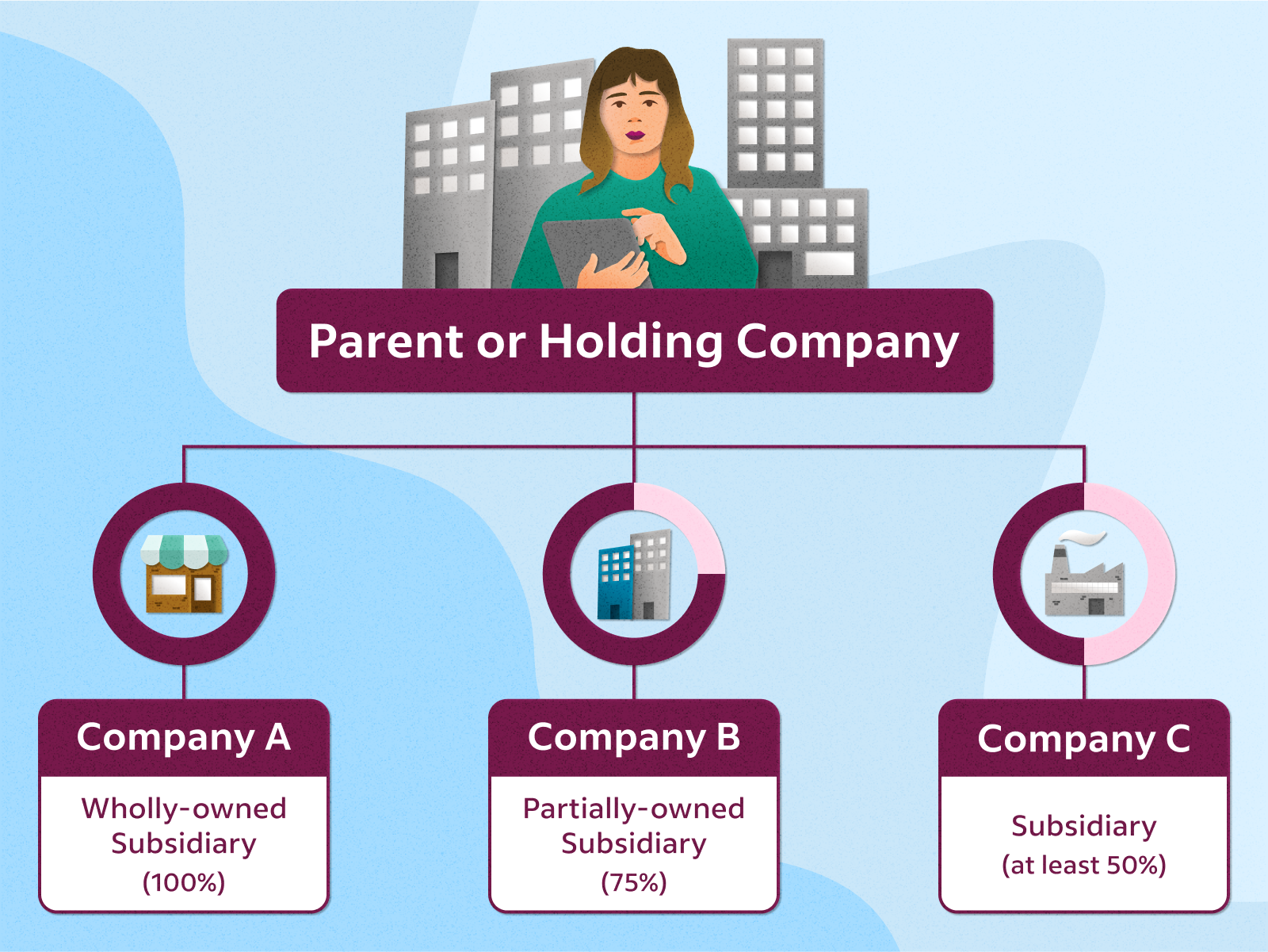

As India’s D2C (Direct-to-Consumer) market surges, many founders are opting to create holding companies to manage multiple brands, raise capital easily, and optimize compliance. A holding company acts as the parent entity for various brand-specific subsidiaries, helping founders scale operations and protect individual ventures from cross-liabilities.

✅ Why Choose a Holding Company?

Here’s why a holding structure makes sense for D2C businesses:

-

Risk Segregation: Isolates liabilities between different product brands.

- Investor Appeal: Investors can fund the main holding entity.

-

Funding Flexibility: Easier capital allocation to specific brands.

-

Tax Planning: Enables intra-group transactions and efficient dividend flow.

-

Exit-Ready: Makes brand-level acquisitions or spin-offs smoother.

🏗️ Ideal Structure for Indian D2C Startups

The recommended approach is:

📊 Structure:

-

The holding company controls 99.99% equity in each subsidiary.

-

Each subsidiary focuses on a specific brand or product category.

📝 Steps to Set Up a Holding Company

1. Register the Holding Company

-

Minimum 2 directors and shareholders

-

Include investment objectives in MOA

-

Apply via SPICe+ Form on MCA portal

2. Form Subsidiaries

-

Register separate Pvt Ltd companies for each brand

-

Holding company owns majority shares (usually 99.99%)

-

Common directors can be appointed across entities

3. Draft Inter-Company Agreements

Clearly define:

-

Capital infusion terms

-

💰 Tax & Compliance Considerations

|

|---|

✅ Avoid direct brand operations in the holding company; keep it strategic and non-operational.

⚠️ Common Mistakes to Avoid

📌 Conclusion

A well-structured holding company is a powerful tool for D2C startups in India. It supports scalable growth, risk isolation, better fundraising, and legal clarity. Founders aiming to build a multi-brand ecosystem should prioritize setting up a Private Limited Holding Company with clear inter-company arrangements and compliance systems.

Related Articles

How to Set Up a Dual Entity Structure in India and Singapore

? Introduction A dual-entity structure—where a company is set up in both India and Singapore—is becoming increasingly popular among startups, tech firms, service providers, and investors. The objective is simple: leverage the best of both ...Using LLPs to Set Up Venture Builder Models in Tier-2 Cities

?️ Using LLPs to Set Up Venture Builder Models in Tier-2 Cities Author: Taxaj Corporate Services LLP Category: Business Structuring | Startup Ecosystem Development ? Introduction India’s Tier-2 cities—such as Indore, Coimbatore, Bhubaneswar, Surat, ...Subsidiary Company Registration in Bangalore

Introduction of Bangalore City for Business Bangalore is India’s fastest-growing city to establish a subsidiary company in Bangalore is a quick, simple, and online process, Bangalore is known as India’s investment capital and the hub for launching ...Case Studies: Successful Foreign Subsidiaries in India

India has emerged as a favored destination for foreign direct investment (FDI), owing to its large consumer base, skilled workforce, and robust regulatory environment. Many multinational companies (MNCs) have established wholly-owned subsidiaries or ...Converting One Person Company (OPC) to Private Limited Company

Converting One Person Company (OPC) to Private Limited Company Introduction: One Person Company (OPC) is a popular business structure that allows a single individual to enjoy the benefits of limited liability and operate as a separate legal entity. ...