How to Track GST Application Status?

Instant Check your ARN status of GST Application, all over India

ARN number is generated on the GST Portal after submission of a GST registration application. Once the GST ARN number is generated, it can be used to track the status of the GST registration application.

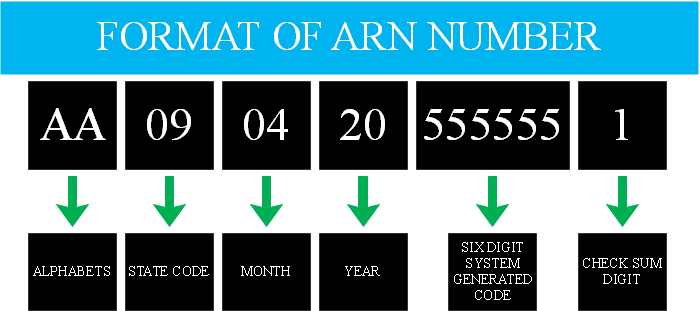

Please Note: Application Reference Number or simply "ARN" is consisting of 15 digits.

What is ARN number?

ARN refers to Application Reference Number. It is a unique number assigned to each transaction completed at the GST Common Portal. It will also be generated on submission of the Enrolment Application that is electronically signed using DSC. ARN can be used for future correspondence with GSTN.

What are the different ways in which you can track the status of Registration Application?

You can track the status of registration application in following ways:

Pre-Login: You can track the status of any application related to registration (like new registration, core amendment of registration, cancellation of registration etc.), using ARN at pre-login stage, once the application is submitted on the Portal.

Post-Login: You can track the status of any registration application (like new registration, core amendment, cancellation of registration etc.) at post-login stage, once new registration application is submitted on the Portal, using ARN or submission period.

Using TRN: You can track the status of new registration application using ARN, once Part B of new registration application is submitted on the GST Portal, post-login (using TRN).

Using SRN: You can track the status of new registration application using SRN, which was generated on submission of the registration application on the MCA Portal, at pre-login stage.

I have not yet received the Application Reference Number (ARN). What should I do now?

If you don’t receive ARN within 15 minutes of submission of the Enrolment Application, an e-mail will be sent to you with detailed instructions for further course of action.

How to track GST application status?

On submission of the gst registration application, you will be given an Application Reference Number (ARN).

You can track status of your application by tracking this ARN. To view status of your ARN perform the following steps:

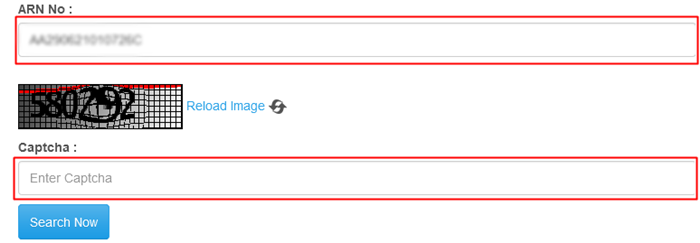

1. Goto: https://services.gst.gov.in/services/arnstatus

2. In the ARN field, enter the ARN received on your e-mail address when you submitted the registration application.

3. In the Captcha, the characters you see in the image below the field, enter the captcha text.

4. Click the SEARCH button.

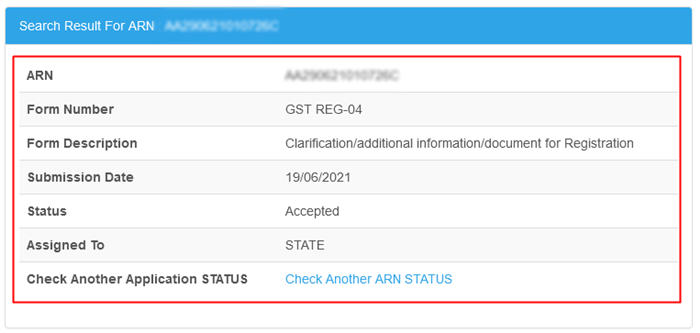

The Application Status Show like this.

What are different status types for Registration Application?

Pending for Processing

When new registration application is filed successfully and is pending with Tax Officer for Processing.

Site Verification Assigned

When application for registration is marked for Site visit and verification to the Site Verification Officer.

Site Verification Completed

When Site verification report is submitted by Site Verification Officer to the tax officer.

Pending for Clarification

When Notice for seeking clarification is issued by Tax Officer to the applicant.

Clarification filed

Pending for order – When clarification is filed successfully by the applicant to the tax officer and its pending order by the officer.

Clarification not filed – Pending for order

When clarification is not filed by the applicant within ----days and its pending order by the officer.

Approved - Application is Approved

When Registration ID and password is emailed to applicant once new registration application is approved by the Tax Officer.

Rejected

When new registration application is Rejected by Tax Officer.

Created & Posted by Kiran

Marketing Expert at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

How to Check GST Cancellation Status

How to check GST registration cancellation status There is a difference between cancelling a GST registration and modifying a GST Registration. We’ll go through the steps involved in cancelling your GST registration in this article. # What Is ...How to Check GSTIN Number Validity?

GST Registration Check – How to Check GSTIN Validity? GST Registration Validity GST registration for regular taxpayers do not have an expiry date and is valid until it is surrendered or cancelled. Only the GST registration for non-resident taxable ...How to do Self GST Number Registration

GST Registration process is online based and must be carried out on the government website gst.gov.in. Every dealer whose annual turnover exceeds Rs.20 lakh (Rs.40 lakh or Rs.10 lakh, as may vary depending upon state and kind of supplies) has ...Different Types Of GST Returns in India

GST returns are different forms that a taxpayer has to file for every GSTIN to which he is registered. What are GST Returns? GST Returns are a type of form that a taxpayer has to file. There are around 22 types of GST forms available. From these 22 ...GST Refund for Exporters & Application Time Limit

Introduction - GST Refunds The word refund, in simple terms, means an amount of money that is given back to a person upon happening or occurring of some event. In taxation parlance, refund refers to any amount that is due to the taxpayer from the tax ...