ICICI Netbanking – Register, Login, Reset Password, Transfer Limits

ICICI bank is one of the leading private sector banks in India with consolidated total assets standing at Rs.12.5 trillion as of 30 June 2019. It offers a wide range of financial products services to retail as well as corporate customers through a variety of delivery channels. One such channel is internet banking, the fastest and most convenient way to access the bank’s services. In addition, the bank offers a dedicated login page for its NRI customers.

Founder | Industrial Credit and Investment Corporation of India |

CEO | Sandeep Bakhshi |

Headquarters | Mumbai |

Customer service | 1860 120 7777 |

Founded | June 1994 |

1. How do I register for ICICI netbanking services?

Step 1: Visit the official website of ICICI netbanking portal at https://www.icicibank.com/Personal-Banking/insta-banking/internet-banking/index.page.

Step 2: Click the ‘Login’ button seen next to the text ‘Personal Banking’.

Step 7: Now, visit the login page again and click ‘Generate Password’.

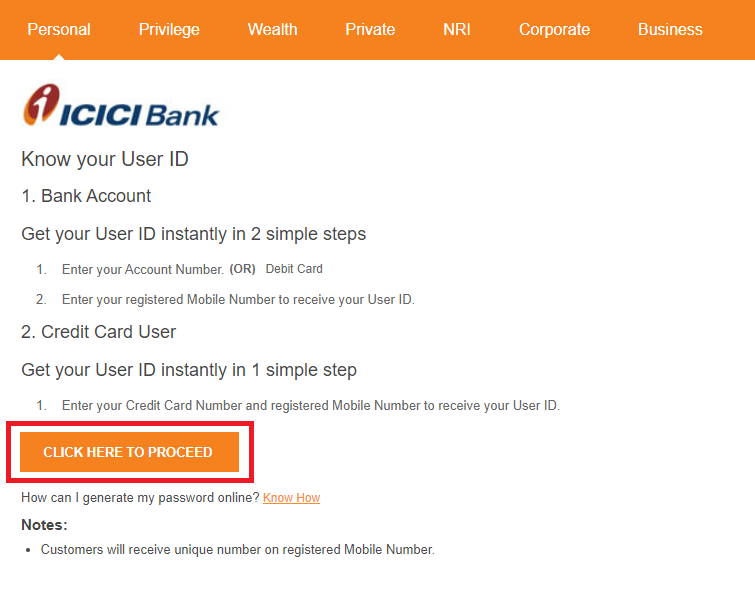

Step 8: In the next screen, click the button labelled ‘Click Here to Proceed’.

Step 9: Enter the user ID and click ‘Go’.

Step 10: Enter the mobile number registered with the account to receive the OTP.

Step 11: Enter the OTP received so that the system will generate a password for you to access the internet banking services.

2. How to login to ICICI netbanking portal?

Step 1: Visit the official website of ICICI netbanking portal at https://www.icicibank.com/Personal-Banking/insta-banking/internet-banking/index.page.

Step 2: Enter the user ID and password.

Step 3: Click the ‘Login’ button to access your internet banking account.

3. How to check my account balance on ICICI netbanking portal?

In order to check the account balance online, you must register for the netbanking services and login to your account with the user ID and password on the netbanking portal. Upon logging in, you can check the account balance on the dashboard. The account balance for all the accounts registered with the netbanking portal will be displayed on the dashboard. In addition, you can check the recent transactions and download the account statement as well.

4. How to transfer funds via ICICI netbanking?

Step 1: Log in to your internet banking account on the ICICI netbanking portal.

Step 2: Select the ‘Funds Transfer’ option under the ‘Payments & Transfer’ tab.

Step 3: Choose the relevant option under the various transfer types listed and click the ‘Transfer Now’ button.

Step 4: Select the account from which you wish to transfer money and the beneficiary account to which you wish to transfer money.

Step 5: Enter the details such as the amount to be transferred, the date of the transaction, and the payment type such as NEFT, RTGS, and IMPS.

Step 6: Click the ‘Next’ button.

Step 7: A screen with all the transaction details will appear for verification.Upon verifying, click the ‘Submit’ button to complete the transaction.

5. Transaction limits

Transaction Type | Minimum Transaction Amount | Maximum Transaction Amount |

IMPS (IFSC and Account Number) | Rs.1 | Rs.2,00,000 |

IMPS (MMID and Mobile Number) | Rs.1 | Rs.10,000 |

RTGS | Rs.2,00,000 | Rs.10,00,000 |

NEFT | Rs.1 | Rs.10,00,000 |

6. Charges applicable

Transaction Amount | IMPS | NEFT | RTGS |

<Rs.10,000 | Rs.5 + GST | Rs.2.5 + GST | Not Applicable |

Rs.10,000-Rs.1,00,000 | Rs.5 + GST | Rs.5 + GST | Not Applicable |

Rs.1,00,000-Rs.2,00,000 | Rs.15 + GST | Rs.15 + GST | Not Applicable |

Rs.2,00,000-Rs.5,00,000 | Not Applicable | Rs.25 + GST | Rs.25 + GST |

Rs.5,00,000-Rs.10,00,000 | Not Applicable | Rs.25 + GST | Rs.50 + GST |

7. How to reset the password of ICICI netbanking account?

Step 1: Visit the ICICI netbanking portal at https://www.icicibank.com/Personal-Banking/insta-banking/internet-banking/index.page.

Step 2: Click on the ‘Get Password’ option.

Step 3: Enter the user ID and click on the ‘Go’ option.

Step 4: Enter the mobile number linked with the account so that you can receive the OTP and click on the ‘Go’ option.

Step 5: Enter the OTP received on your registered mobile number in the Unique Number Box and click on the ‘Go’ option.

Step 6: Now, create a new password as per the guidelines and re-enter the new password for confirmation. Click on the ‘Go’ option.

Step 7: A success message will be displayed on the screen stating that your password has been changed.

8. Frequently Asked Questions

Q. Can I get a receipt for the payments made through the netbanking portal?

- Login to your account on the netbanking portal.

- Click on the ‘Payments & Transfer’ option.

- Select the ‘Completed Transactions’ option under the ‘Transaction Status’ tab.

- A list of completed transactions will be displayed. Select the transaction you wish to open the details.

- Print the same to submit as proof of the transaction.

Q. How to stop a scheduled payment?

A. You can stop a scheduled payment if the status is ‘Pending’. Click on the bills that have a status ‘Pending’. Click on the ‘Details’ option and choose ‘Delete’.

Q. What services can I avail through ICICI Internet Banking?

- Apply for a debit/credit card.

- Request for a new cheque book.

- Stop the payment of a cheque.

- Report the loss of ATM card.

- Open a fixed deposit and recurring deposit account.

- Apply for a value-added savings account.

- Register for Phone Banking.

Q. Should I register for ICICI Bank Bill Payments separately?

A. You don’t have to register separately for ICICI Bank Bill Payments service. The service is available for all ICICI Bank account holders and credit cardholders. All you need is the internet banking username and password. At the same time, the biller also must have registered online.

Related Articles

Punjab National Bank Internet Banking – How to Register & Transfer Funds Online

Punjab National Bank (PNB), India’s first domestic bank, was established in 1895. The bank has been updating itself with the latest trends since its inception. That is how the bank has read the minds of its customers and offered internet banking ...Share transfer procedure in Private Company

The company's shareholding decides the ownership of an individual in the businesses that have private limited company registration. The private limited company interest could be sold to attract new investors or pass control of the company. In this ...Technology Transfer and Licensing Agreements in India

Technology transfer and licensing agreements are crucial in driving innovation, industrial growth, and international collaboration. In a rapidly developing economy like India, these agreements provide an essential bridge for accessing cutting-edge ...How to transfer Proprietorship Firm to another person?

A sole proprietorship business is the easiest form of business to start, but it can be one of the most complicated to sell to another party. Starting a sole proprietorship business involves no formal paperwork and no separate income tax return since, ...Transfer Pricing Benchmarking in Bangalore

In today's globalized economy, businesses are increasingly engaging in cross-border transactions. These transactions between associated enterprises, such as parent companies and subsidiaries, often raise concerns about fair pricing. To address this, ...