Income Certificate Online Apply - Application, Procedure & Format

Income Certificate Online Application- Application, Procedure & Format

Reasons to obtain Income Certificate

Some of the reasons for obtaining income certificate are as follows:

- To get admissions in educational institutions under the reserved quota.

- To avail the benefits of certain schemes offered by the State Government.

- To be bestowed with the rights of receiving plots of lands or flats offered by the Government under certain schemes.

- To obtain benefits such as an old-age pension, widow pension and agricultural labour pension.

Required Documents

To obtain income certificate in Delhi, submit the following documents along with the application form:

- One passport size photograph of the applicant

- Aadhar card copy

- Previous income certificate, if any (optional)

- BPL Ration or National Food Security Card

- Relevant document of expenditure such as rent receipts or electricity bill

- The applicant must hold a signed copy of the self-declaration along with the application form

- Address proof

Application Procedure for Income Certificate

The State Government of Delhi has introduced an online application procedure. The eligible applicant can apply using the following steps given below:

Step 1: Visit the home page of District Delhi.

Step 2: Click on the “Download Application Forms” option which can be found on the menu bar of the homepage.

Step 3: Click on “Issuance of Income Certificate” and download the application form in a PDF format. Fill up all the required details in the application form.

Step 4: Submit the duly filled application to the office of Sub-Divisional Magistrate. After submitting the documents concerned authority will conduct a local inquiry to verify the details mentioned in the application.

Income Certificate Status

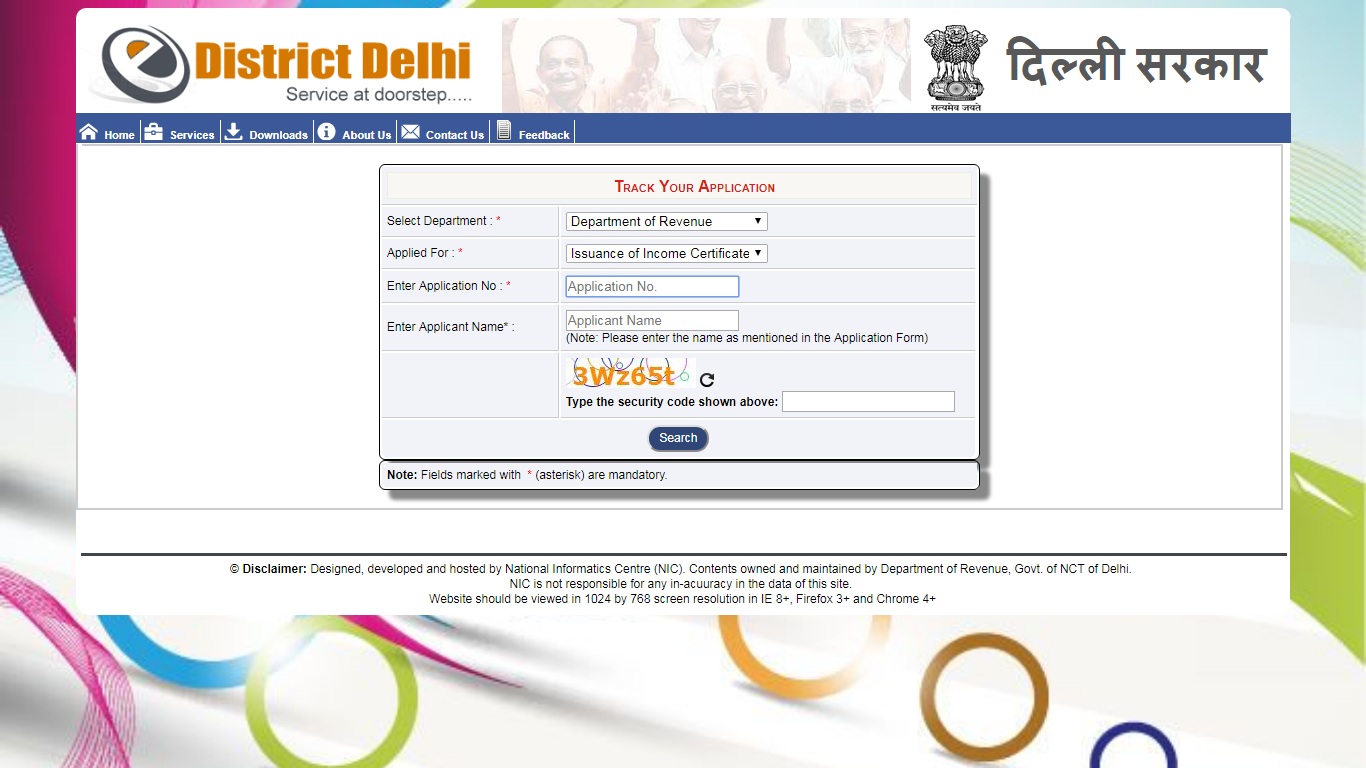

The applicant can check their Income Certificate application status in the official portal by following the below procedure:

Step 1: Click on” Track Your Application” and enter your application number.

Step 2: Select ‘Search ‘and the status of the application will be displayed.

Note:- The concerned authority will issue the Income Certificate within 14 days from the date of application. The validity of Delhi income certificate would be six months from the date of issue.

Related Articles

Tax Residency Certificate & Process to apply

A Tax Residency Certificate is a certificate issued by the Income Tax Department to the Indian Residents who earn Income from Countries with which India has a Double Taxable Treaty Agreement. To avoid tax payment on the same income again, one can ...What is Tax Residency Certificate & How to Apply?

What is a Tax Residency Certificate (TRC)? A tax residency certificate is a document that enables Indian residents to enjoy tax relief under the Double Taxable Avoidance Agreement (also known as DTAA). DTAA is an agreement between two or more nations ...Benefit of Minor PAN Card, Procedure to Apply & Income Tax

Most Indians are under the impression that a PAN Card can only be allotted once a person turns 18 years of age. However, this is a myth as Minors can also apply for PAN Card and the Income Tax department also allots PAN Card to Minors without any ...What is Income Tax E-Assessment Scheme?

The Central Government introduced the Faceless Assessment Scheme to provide greater transparency, efficiency and accountability in Income Tax assessments. All provisions introduced under Faceless Assessment, under the Income Tax Act, 1961, are ...Guide to Claim Income Tax Refund Online

When it comes to an income tax refund, people in India are unaware of what it is and how to claim an income tax refund online. As a matter of fact, when you successfully file your income tax return (ITR), the tax department assesses your file, and ...