What is Procedure of closing LLP ?

Winding Up a LLP

The penalty for LLPs defaulting in filing of any statutory return is Rs.100 per day, without any maximum limit. Hence, its is often best to windup dormant LLPs so that there is no requirement to file LLP Form 11, LLP Form 8 and Income Tax Return for the LLP each financial year to maintain compliance and avoid penalty.

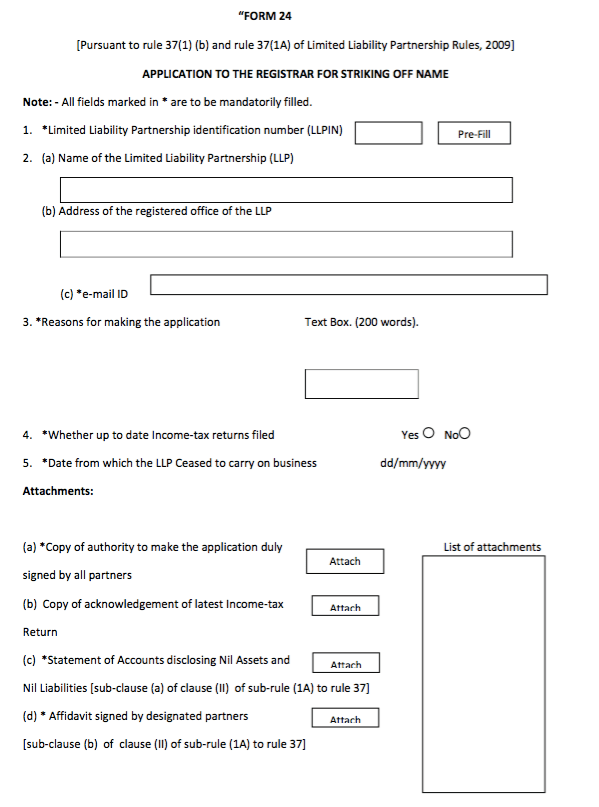

Before the introduction of the Limited Liability Partnership (Amendment) Rules, 2017, the procedure for winding up a LLP used to be long and cumbersome. However, with the introduction of LLP Form 24, the procedure has been made easy and simple.

Hence, its best for Entrepreneurs having dormant or defaulting LLPs that are accruing penalty to use this opportunity to close the LLP.

Procedure For Closure Of LLP

The following procedure can be followed for closing a LLP by filing Form 24:

Step 1: Cease Commercial Activity

LLP Form 24 can be filed only by LLPs that never commenced business or have ceased commercial activity. Hence, if the LLP is operational and the promoters wish to close the LLP, the LLP must first cease all commercial activity.

Step 2: Close Bank Account(s)

LLP Form 24 can be filed only by those LLP that have no creditors and no open bank account. Hence, prior to filing LLP Form 24, any bank account opened in the name of the LLP must be closed and a letter evidencing closure of the bank account in the name of the LLP must be obtained from the Bank.

Step 3: Prepare Affidavits & Declaration

All the Designated Partners of the LLP must first execute an affidavit, either jointly or severally, that the Limited Liability Partnership ceased to carry on commercial activity from (Date) or has not commenced business.

Further, the LLP Partners must also declare that the LLP has no liabilities and indemnify any liability that may arise even after striking off its name from the Register. The liability of the Partners would not be extinguished even after closure of a LLP while using Form LLP 24.

Step 4: Prepare Documents

Along with Form LLP 24 the income tax return of the LLP and LLP deed must be enclosed. In case the LLP has not filed any income tax return and it has not carried on any business activity, then it is not required. Else, a copy of the acknowledgement of the latest Income-tax return filed must be attached with the application for closing the LLP.

Step 5: File Any Pending Documents

After incorporation of a LLP, the LLP agreement must be filed with the MCA within 30 days of registration. In case this compliance was missed and LLP agreement was not filed, then the initial LLP agreement, if entered into and not filed, along with any amendments must be filed.

Also, any overdue returns in Form 8 and Form 11 up to the end of the financial year in which the limited liability partnership ceased to carry on its business or commercial operations must be filed before filing LLP Form 24. The date of cessation of commercial operation is the date from which the Limited Liability Partnership ceased to carry on its revenue generating business and the transactions such as receipt of money from debtors or payment of money to creditors, subsequent to such cessation will not form part of revenue generating business.

Step 6: Obtain Chartered Accountant Certificate

Once all the documents for filing of LLP Form 24 is prepared, a statement of accounts disclosing NIL assets and NIL liabilities, that is certified by a practicing Chartered Accountant up to a date not earlier than thirty days of the date of filing of Form 24 must be obtained.

Step 7: File LLP Form 24

The above mentioned documents along with LLP Form 24 (Download LLP Form 24) can be then filed with the MCA to strike off name of LLP. On processing the application, if found acceptable, the concerned Registrar of Companies would cause a notice to be published on the MCA website announcing the striking off of the LLP.

Posted By Twinkle

Related Articles

What is the Process to Close LLP in India?

A business may be required to be closed due to various reasons, like non-operation, closure of business, recurring losses, the passing of the key managerial person, the dispute among promoters, un-ability to pay debts of the LLP, etc. Closing or ...What are the documents required for Closing a LLP?

Limited Liability Partnership (LLP) is a usual partnership form in which each partner has limited liabilities. An LLP is a firm under which certain legal terms and documents take place. There is a pre-defined process as to how one can register or ...How to Close Private Limited Company

Often, we register a company for a business idea we wanted to implement and for some reasons it does not work, we do not even start the work. Also, there are times when we register a company for a future project and hence those companies are not ...How to dissolve an LLP voluntarily?

How to Dissolve an LLP Voluntarily? ?? Introduction ? A Limited Liability Partnership (LLP) is a popular business structure offering the benefits of limited liability and flexible management. However, there may come a time when partners decide to ...Complete process of Company Closure

It is very easy to start any company, as for registering a company the applicant only needs to submit the application form along with relevant documents and fees but to close a company certain requirements are there that are needed to be followed. ...