Mergers and Acquisitions Options for Foreign Subsidiaries

🌍Introduction: Why Foreign Subsidiaries Choose M&A

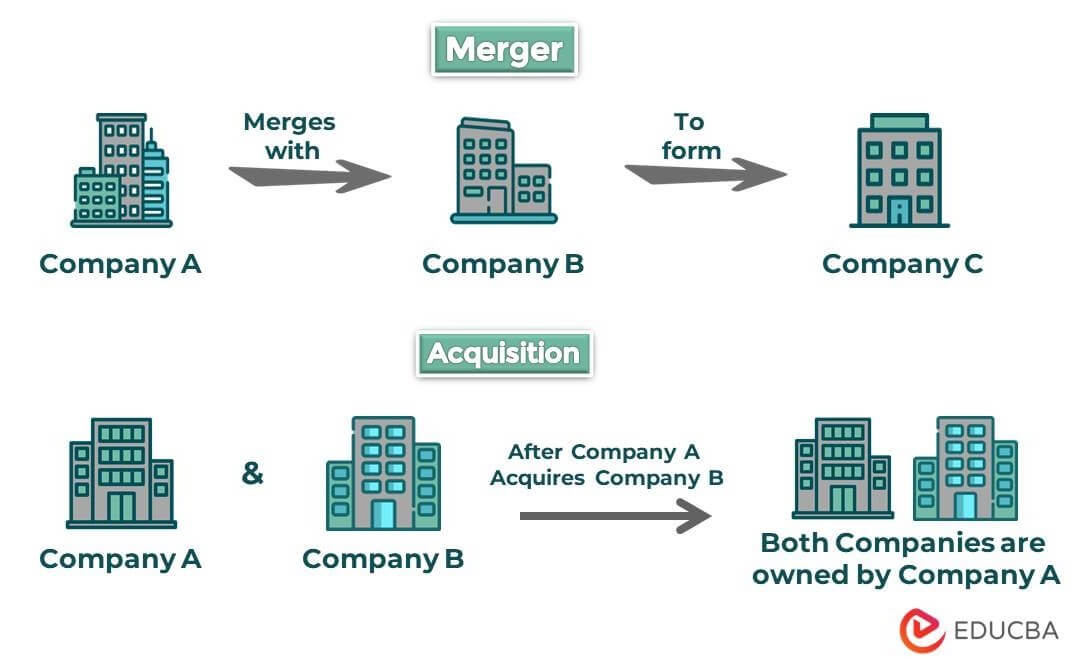

🔍Understanding the Basics: What is M&A?

🔍Understanding the Basics: What is M&A?- A foreign entity is acquiring or merging with a domestic company.

- A foreign subsidiary is being merged or absorbed into a parent or another entity.

Type of Transaction | Description |

Horizontal Merger | Between competitors in the same industry. |

Vertical Merger | Between companies at different stages of the supply chain. |

Conglomerate Merger | Between unrelated business activities. |

Reverse Merger | Subsidiary merges into parent (common in foreign subs). |

Cross-border Acquisition | Acquisition involving foreign

investors or assets. |

🏛 Legal Structures Available for Foreign Subsidiary M&A

🏛 Legal Structures Available for Foreign Subsidiary M&A- The foreign parent or acquirer purchases shares of the Indian (or host) subsidiary.

- Control transfers through equity ownership.

- Useful when the goal is to retain current structure and licenses.

- Specific assets (or liabilities) are acquired.

- Often preferred when avoiding liabilities or specific obligations.

- Regulatory approvals depend on industry and sector.

- Governed under Companies Act, 2013 (India).

- Requires approval from:

- National Company Law Tribunal (NCLT)

- Shareholders

- Creditors

- Scheme-based mergers allow tax-neutral treatment in some jurisdictions.

- Inbound:Foreign company merges into Indian subsidiary.

- Outbound:Indian company merges into foreign parent.

- Must comply with Foreign Exchange Management Act (FEMA) and RBI guidelines.

📊Infographic: M&A Pathways for Foreign Subsidiaries

📊Infographic: M&A Pathways for Foreign Subsidiaries- Arrows showing:

- Foreign Parent ↔ Indian Subsidiary (Stock/Asset Purchase)

- Two Subsidiaries → Merge → One Entity

- Indian Company → Foreign Parent (Outbound Merger)

✅Strategic Considerations Before Choosing an M&A Option

✅Strategic Considerations Before Choosing an M&A Option- Is the goal to restructure, exit, consolidate, or expand?

- Will the M&A improve tax efficiency or market positioning?

- Cross-border deals must comply with:

- FEMA Regulations

- SEBI Guidelines(if listed)

- Income Tax Act

- Competition Act

- FDI Policies

- Capital Gains Tax

- Stamp Duty on Transfer of Shares/Assets

- Withholding Tax(especially in acquisition payments)

- Transfer Pricingfor intra-group deals

- Legal, financial, tax, operational, and HR audits are critical.

- Understanding encumbrances, liabilities, and ongoing contracts is key.

💼Benefits of M&A for Foreign Subsidiaries

💼Benefits of M&A for Foreign SubsidiariesBenefit | Description |

Market Access | Enter new geography without ground-up investment. |

Consolidation | Simplify group structure, reduce redundancy. |

Tax Optimization | Leverage tax treaties and transfer pricing benefits. |

IP and Talent Acquisition | Gain access to skilled workforce and proprietary assets. |

Regulatory Alignment | Meet evolving compliance and FDI norms efficiently. |

⚠️Key Challenges in Foreign Subsidiary M&A

⚠️Key Challenges in Foreign Subsidiary M&A- Cultural Integration: Managing cross-border workforce expectations.

- Regulatory Delays: Long approval cycles from government bodies.

- Data Localization Laws: Especially in tech-related acquisitions.

- Currency Risks: Forex volatility during deal execution.

- Post-Merger Integration (PMI): Operational alignment and cost synergies take time.

🔧Case Studies: Real-World Examples

🔧Case Studies: Real-World Examples- Deal: 77% stake for $16 billion.

- Strategy: Entering Indian e-commerce through a dominant local player.

- Structure: Stock purchase with significant due diligence.

- Deal: Indian subsidiaries of Vodafone and Aditya Birla merged.

- Strategy: Scale and survival in a competitive telecom sector.

- Structure: Amalgamation approved by NCLT, subject to FDI rules.

📜Regulatory & Tax Approvals: Key Authorities

📜Regulatory & Tax Approvals: Key AuthoritiesAuthority | Responsibility |

RBI | FDI approvals, foreign exchange compliance. |

NCLT | Approval of merger/amalgamation schemes. |

SEBI | If target/acquirer is a listed entity. |

CBDT | Tax rulings and exemptions. |

CCI | Anti-trust and competition clearance. |

📈Pie Chart: What Drives Foreign Subsidiary M&A?

📈Pie Chart: What Drives Foreign Subsidiary M&A?Driver | % Contribution |

Market Expansion | 35% |

Tax Optimization | 20% |

Compliance Restructuring | 15% |

Access to IP/Tech | 10% |

Exit Strategy/Divestment | 20% |

📝Best Practices for Seamless M&A

📝Best Practices for Seamless M&A- Engage Local Advisors: Legal, tax, and compliance experts in the host country.

- Pre-M&A Valuation: Ensure fairness and reduce post-deal disputes.

- Check Double Taxation Avoidance Agreements (DTAA).

- Plan for PMI: Integration planning is as critical as deal execution.

- Use Reps and Warranties Insurance: For risk mitigation in large deals.

🔚Conclusion

🔚Conclusion

Related Articles

Environmental Compliance for Foreign Subsidiaries in India

? Environmental Compliance for Foreign Subsidiaries in India Navigating India's Green Regulatory Maze with Flair and Foresight 1. Introduction: Why Compliance Matters In today’s global business landscape, environmental compliance isn't merely a box ...How to Declare Foreign Assets in Indian Company Filings

Introduction ? In an increasingly globalized world, Indian companies are expanding their footprints abroad through joint ventures, acquisitions, subsidiaries, and investments. While such diversification creates growth opportunities, it also ...Compliance Requirements for Foreign Subsidiaries in India 🌐

India, as one of the fastest-growing economies in the world, is a favored destination for foreign investors ?. To harness its potential, many multinational corporations (MNCs) set up foreign subsidiaries in India. However, running a foreign ...Understanding the Legal Framework for Foreign Subsidiaries in India

?️ Understanding the Legal Framework for Foreign Subsidiaries in India A TAXAJ Guide to Seamless Market Entry India’s robust economic landscape makes it an attractive destination for foreign investors. However, setting up a foreign subsidiary in ...Annual Compliance Checklist for Foreign Subsidiaries in India

Annual Compliance Checklist for Foreign Subsidiaries in India | TAXAJ Expanding into India through a foreign subsidiary is a smart move for global enterprises. India offers a large market, skilled talent pool, and a robust legal framework. But with ...