Professional Tax Registration Karnataka

Profession Tax is levied by the state government which is applicable to salaried employees and individuals. Employees working in an organisation or establishment such as a factory would also have to go for the registration process of professional tax in Karnataka.

Registration of Professional tax in Karnataka is mandatory for the business within 30 days of employing staff and for professionals within 30 days of starting their practice. The professional tax has to be deducted from the salary/wages paid. However, the amount of professional tax varies from state to state which is capped at Rs. 2500 per annum. If you have employees in more than one state then in each state professional tax registration is required to be obtained.

Eligibility Criteria for Registration of Professional Tax in Karnataka?

If the salary of the wages of the employee earned is more than Rs. 10,000/- per month then the employer has to mandatorily go for the process of professional tax registration in Karnataka.

The employer in such circumstances would be liable to deduct some amount of wages under this act.

Before expiry of 20 days of the month, the employer is liable to deduct the professional tax.

If the threshold or the amount of professional tax payable in Karnataka is lesser than Rs. 5000/- per month then the employer can opt for the payment of professional tax within 20 days of the expiry of the quarter of the year.

All employees have to obtain a professional tax registration certificate from the concerned officer.

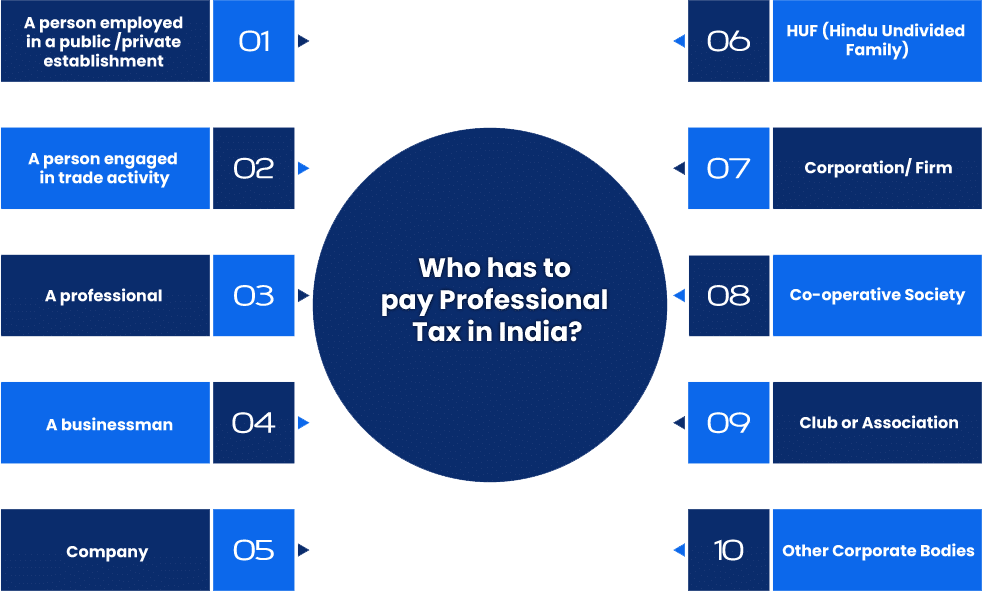

Who has to pay Professional Tax in Karnataka?

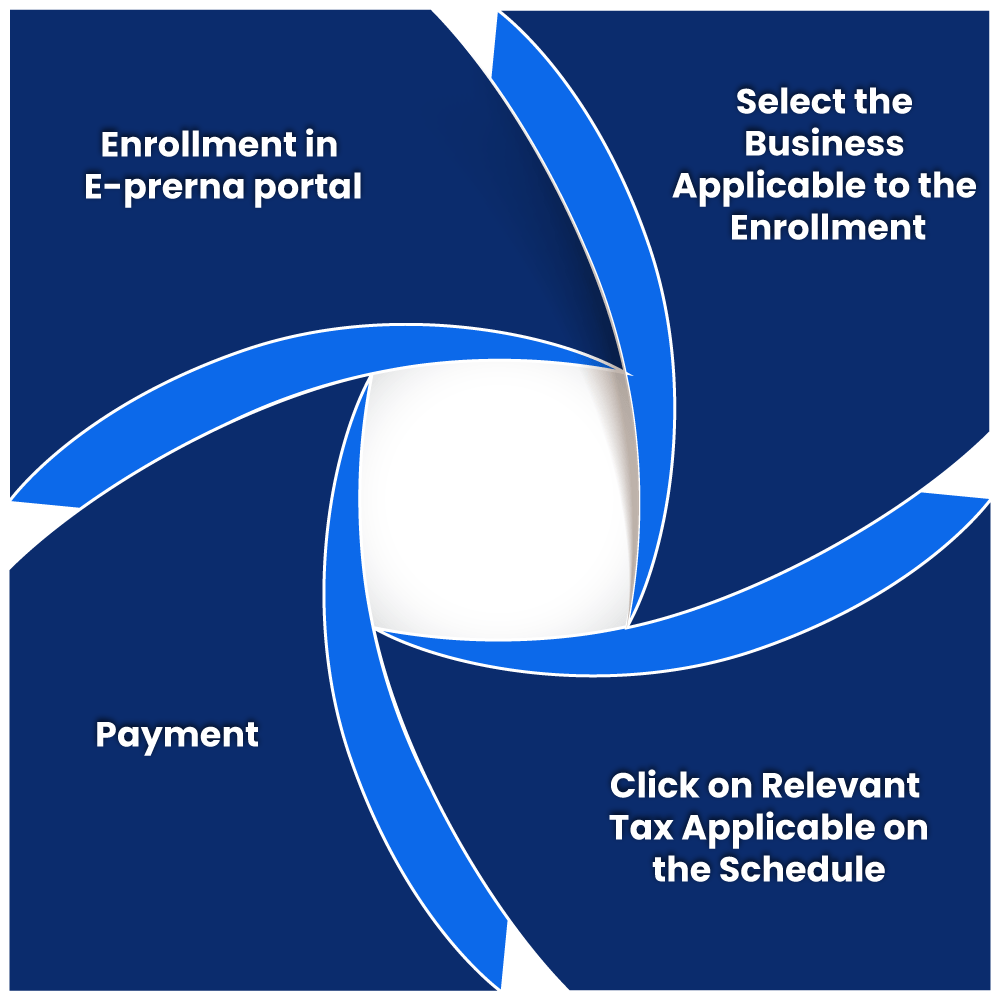

What is the process of Professional Tax Registration in Karnataka?

- Enrollment in the E-Prerna Portal- First and foremost the applicant would have to go online to the following website (https://pt.kar.nic.in/(S(t5zcqklwvzs1h42orkxvrtdv))/Main.aspx) . On the left side bar of the application, the applicant would have to click on Enrollment of Application. If the applicant is enrolling for payment of professional tax for the first time then the enrolment of professional tax must be considered. If the applicant is new, then click and select the new category for enrolment.

- Select the Business Applicable to the Enrollment- In the next step, the applicant has to select the suitable business for enrolment for the professional tax. Here information related to the application must be provided by the employer. With this, the applicant has to enter the financial year for which professional tax has to be paid. If the applicant is already enrolled for the payment of professional tax in Karnataka then the following ‘Enrolled’ must be selected by the applicant. Then the applicant has to input the 9 digit alphanumerical enrolment certificate for professional tax in Karnataka. When choosing the business type and status, personal information related to the business must be mentioned. If the business has multiple branches to carry out activities, then the same must be mentioned in the drop down menu of the form.

- Click on Relevant Tax Applicable on the Schedule- In the next step, the employer has to click on the relevant tax which is applicable on the respective business. For this the professional tax schedule of Karnataka must be considered.

- Payment- In the last step the applicant must select the mode of payment of professional tax. The applicant can either pay online or offline. There is a method for e-payment option for the applicant. If this is not possible then applicant can either pay through cash, cheque or DD. After this the applicant would be provided with a PTN No or a Professional Tax Number. After this the applicant has to enter the professional tax number along with the professional tax data. Then the procedure for registration of professional tax is complete.

Employer Registration for Professional Tax in Karnataka

- First and foremost every employer has to secure the professional tax certificate for payment of professional tax in Karnataka,

- The employer would have to go to the e-Prerna website https://pt.kar.nic.in/(S(t5zcqklwvzs1h42orkxvrtdv))/Main.aspx for professional tax registration in Karnataka. After this the employer would have to go to the new registration section for professional tax in Karnataka.

- All the information related to the business must be filed by the employer – which would include the constitution of the company , type of business of the company and the PAN details of the company.

- Once this is complete, the office of the professional tax department would issue a PIN in the name of the company.

- After this the employer would have to enter the information in the enrolment certificate.

- If the applicant is registered under the Karnataka GST then the 15 digit number must be entered into the system.

- After this the status of Professional tax can be checked online by adding details of the Aadhaar and the registered mobile number.

- The status of the company application can be checked through the drop down menu as stated the status.

Created & Posted By Aashima Verma

Accounts Executive at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLPAddress: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you with a One-Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else, visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

Online Professional Tax Registration

Online Professional Tax Registration Professional tax is a tax that is imposed by the State government on all salaried individuals. Professional tax is applicable to all working professionals like chartered accountants, lawyers, and doctors. It is ...Is Professional Tax Registration mandatory?

Professional Tax Registration is mandatory within 30 days of employing staff in a business or, in the case of professionals, 30 days from the start of the practice. Professional tax needs to be deducted from the salary or wages paid amount. ...Professional Tax Registration Applicability

Professional Tax If you ever pay close attention to your pay slips, you will notice that there is a deduction every month under the category of ‘Professional Tax’. This deduction takes place along with HRA, basic salary, and conveyance charges (if ...Professional Tax Registration Online

What is Professional Tax? Professional Tax is the tax assessment collected by the different State Governments of India on salaried people working in government or non-government elements, or practically speaking of any calling, for example, CAs, ...Tamil Nadu Professional Tax Registration for Chennai

Professional Tax Registration In Chennai Professional tax is very much similar to income tax but the professional tax is collected by the state government. Professional tax registration in Chennai can be obtained through TAXAJ. The maximum amount to ...