How to reconcile GST Return GSTR-2A Online

Yes, you read it correctly. You can now reconcile your GSTR2A data with your Purchase Register in few seconds.

We have made a simple easy to use excel which process your entire data in a click and shows you the result with status.

Steps to reconcile:

1. What to reconcile under GST?

GST reconciliation primarily involves matching the data uploaded by the suppliers with those of the recipient’s purchase data. This basically includes comparing the GSTR-2A auto-populated from suppliers data and the purchase data recorded by the receiver of the supplies. This matching concept also ensures that all the transactions which took place in a particular period have been recorded.2. Why is it important to reconcile under GST?

It is very important to reconcile GST returns data because :

a. Under new GST returns, the taxpayers will only be able to claim ITC if the particular invoice is present in the GSTR-2A or supplier’s data. This requirement forces the businesses to reconcile and claim ITC correctly.

2. Why is it important to reconcile under GST?

It is very important to reconcile GST returns data because :a. Under new GST returns, the taxpayers will only be able to claim ITC if the particular invoice is present in the GSTR-2A or supplier’s data. This requirement forces the businesses to reconcile and claim ITC correctly.

b. Sometimes, it happens that the vendor has declared his GST liability and credit has not been availed by the purchaser in his GST returns. So, not to lose the claim of ITC, the data should be reconciled on a regular basis. This reconciliation process will ensure no ITC loss on any invoices.

c. To avoid any duplication, taxpayers must consolidate and reconcile the values. This will ensure the correct declaration and maximise the credit of input taxes.3. Steps to reconcile

Follow these steps for reconciliation in ClearTax GST using its advanced reconciliation tool:

a. Log in to ClearTax GST and click on the ‘Reconciliation’ tab.

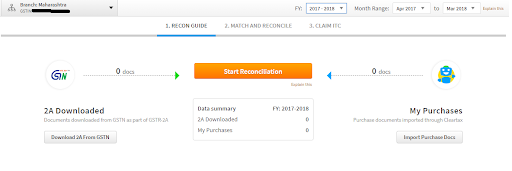

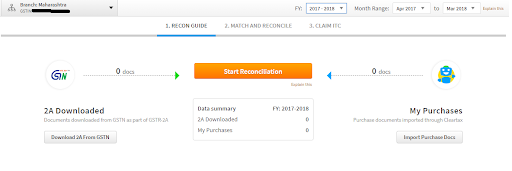

b. After clicking on the reconciliation tab, the screen below appears. Select the financial year and the tax period you want to reconcile for.

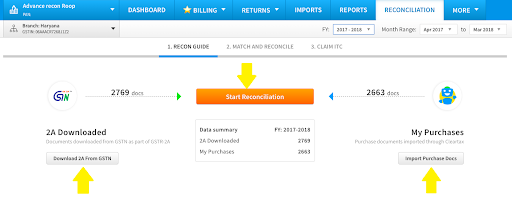

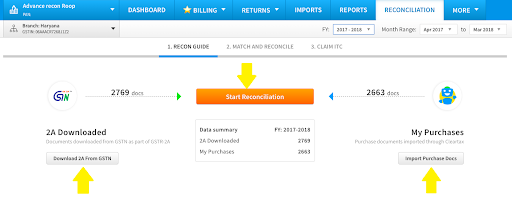

c. Download GSTR-2A from GSTN for all periods in one go.

c. Download GSTR-2A from GSTN for all periods in one go.

d. Import the purchase data either in ClearTax/government/custom templates.

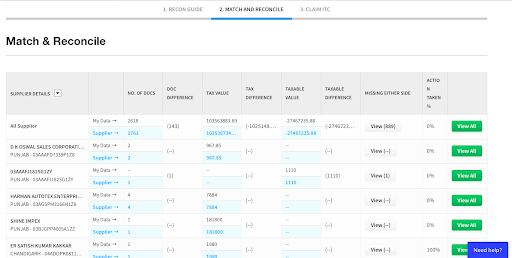

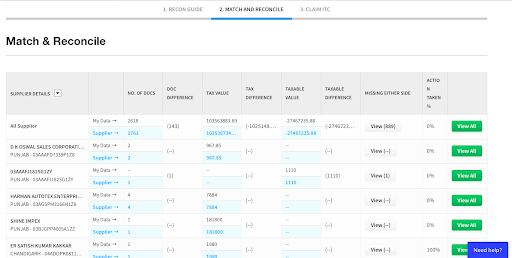

e. Then, click on ‘Start Reconciliation’, the process of the match and reconcile will start. A consolidated invoice data appears supplier wise in the next screen.

Here one can view and act on either of the following:

Click on ‘View all’ against :

– All Suppliers – To view the complete list of invoices

– Individual Suppliers – To view the list of the invoices issued by each supplier

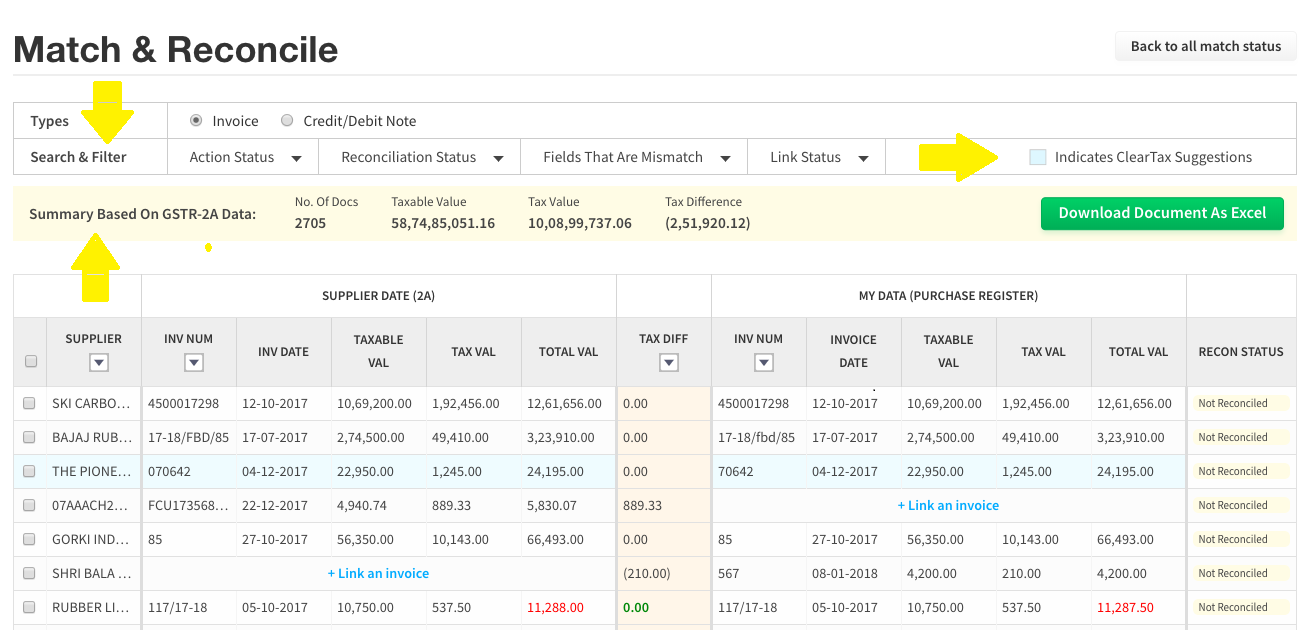

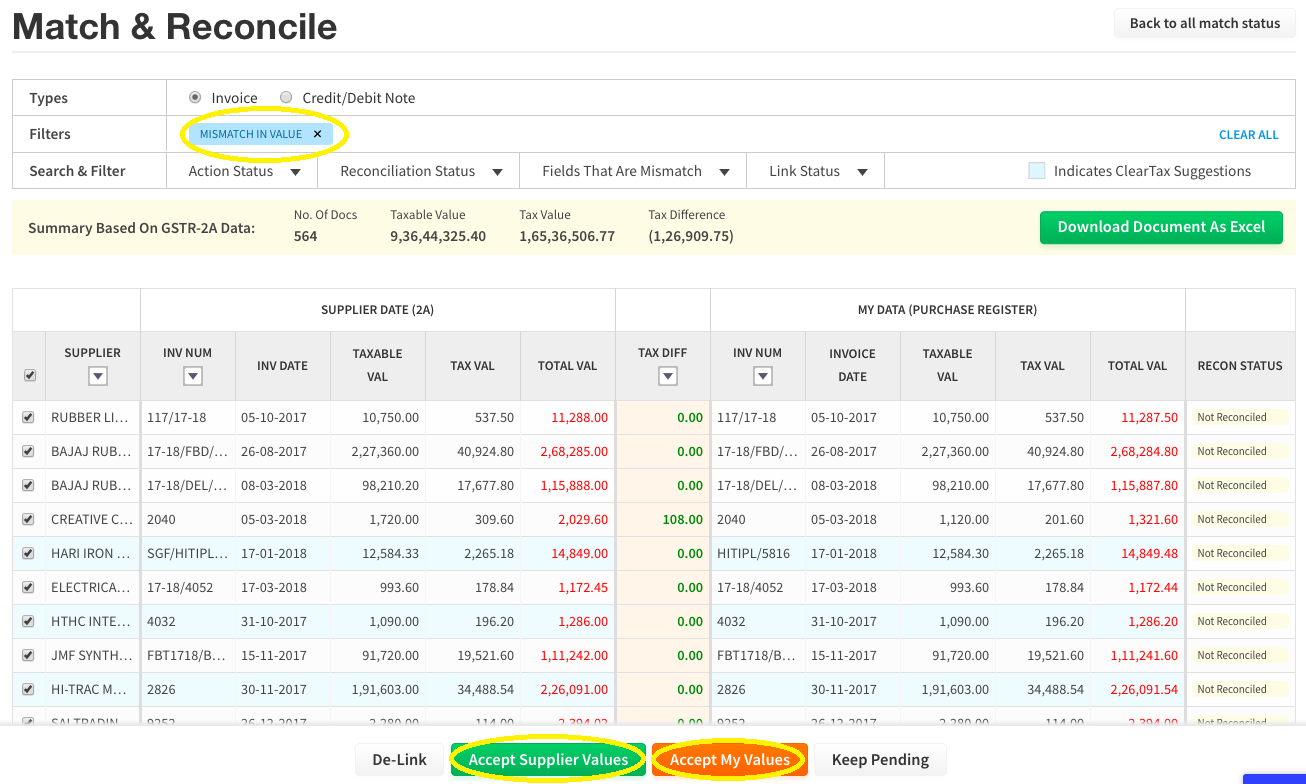

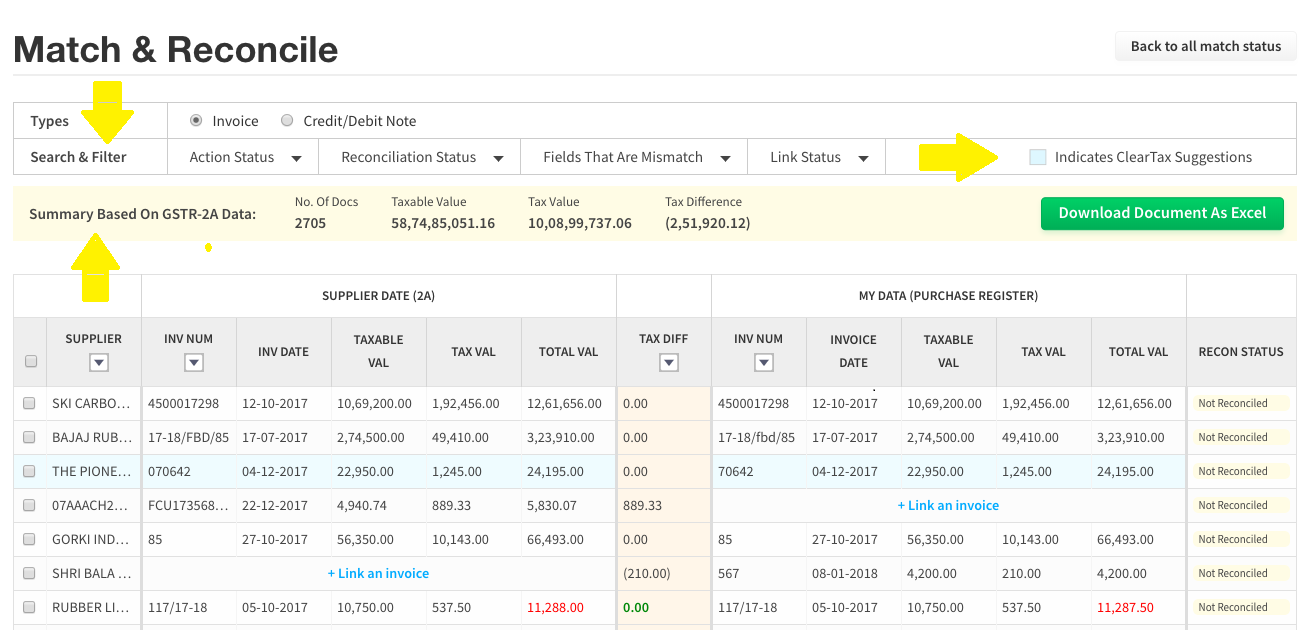

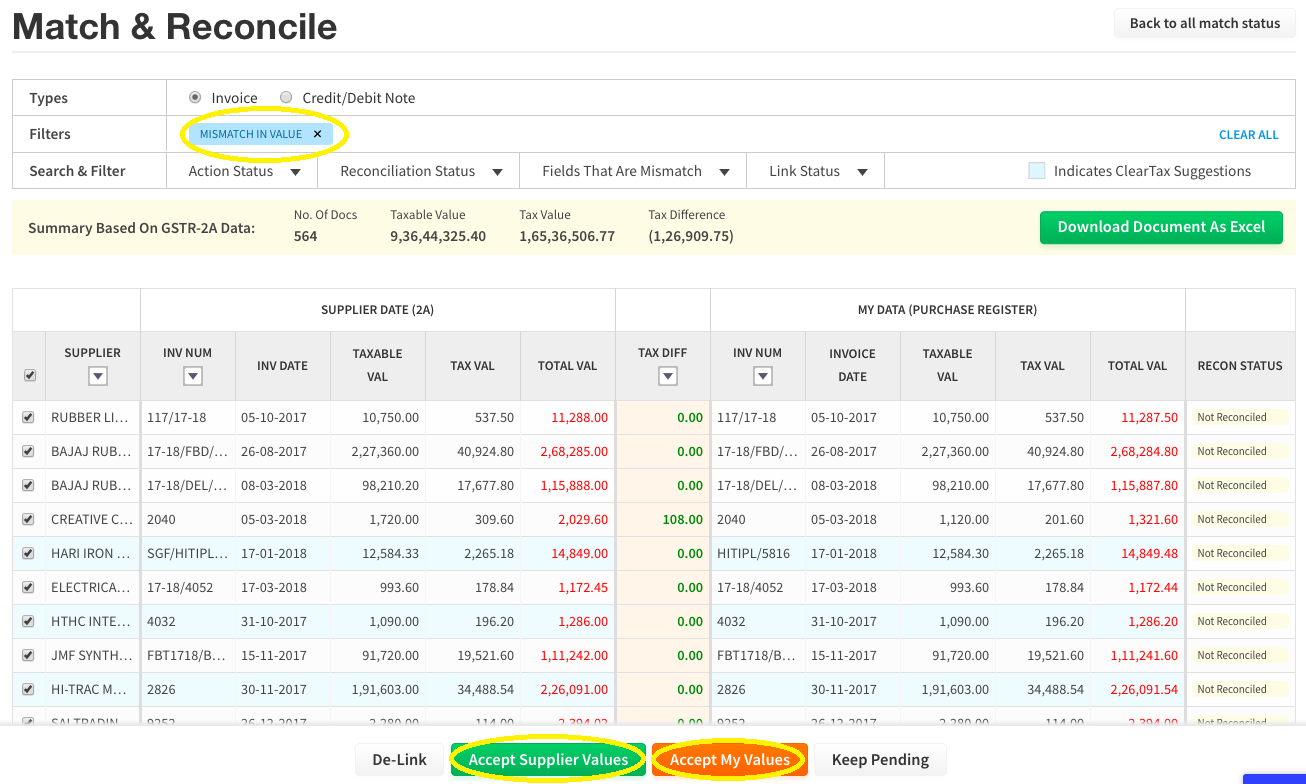

f. On clicking ‘View All’ appearing against all invoices, ‘Match & Reconcile’ window opens:

Here one can,

– Use filters to view data according to his needs

– Summary of GSTR-2A data is displayed

– Get suggestions for matching from ClearTax

After matching and reconciling, the status of each and every invoice as reconciled or not is shown under the column ‘Recon Status’.

g. Apply filter on ‘Reconciliation Status’ to view all the results appearing in the ‘Recon Status’ tab.

The following results will appear :

1. Matched: Here, purchase invoices uploaded and GSTR-2A data downloaded from the GSTN portal matches based on default and suggestions from ClearTax.

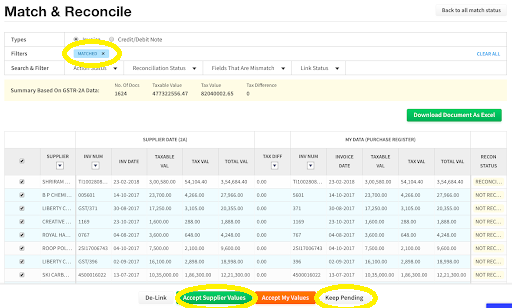

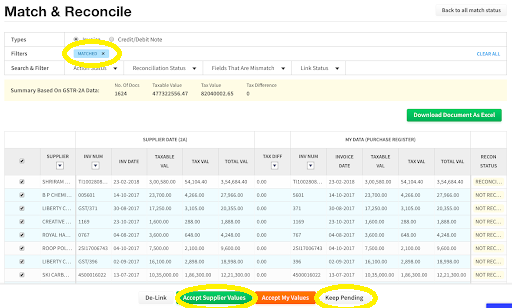

2. Mismatch in values: Here, purchase invoices uploaded and GSTR-2A data downloaded from the GSTN portal doesn’t match in one go.

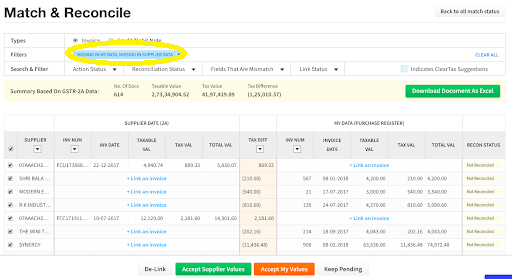

3. Missing in my data: Here, a purchase invoice is not uploaded but the same appears in the GSTR-2A downloaded from GSTN portal.

4. Missing in Supplier Data: Here, a purchase invoice is uploaded but the same is not present in the GSTR-2A downloaded from GSTN portal.

Following are the actions which can be taken once you filter the above results one-by-one :

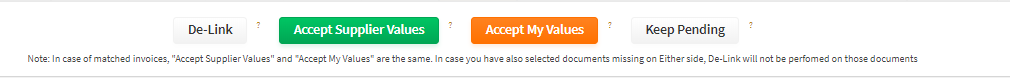

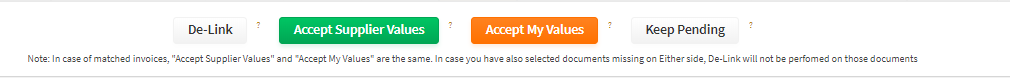

1. De-link: The linked invoices can be de-linked. Once de-linked, invoice falls in either ‘Missing In My Data’ or ‘Missing In Supplier Data’ depending upon which bucket they belong to.

Note: If you have bulk selected invoices from multiple buckets, you would not be able to de-link invoices for either ‘Missing In My Data’ or ‘Missing In Supplier Data’.

2. Accept supplier values: Accept the values uploaded by the supplier to claim ITC on the selected invoices.

3. Accept my values: Accept your own values to claim ITC on the selected invoices.

4. Keep pending: Once the invoice is marked as ‘Keep pending’, the same will not be available for ITC in a particular month.

5. Link Invoices: You can suggest invoices that you want to link to a respective document.

1. Matched Invoices :

Considering these are matched invoices (identical invoices), you can take the following actions on these invoices:

a. Accept Supplier Values

b. Keep Pending

In case an invoice has to be de-linked, it will shift to missing in supplier data or missing in my data respectively.

2. Mismatch In Values:

2. Mismatch In Values:

The following actions can be taken on the invoices with high tax difference:

a. Accept supplier values or accept my values, in case of mismatch in values when the tax difference is very low respectively.

b. Keep pending, in case one not wants to claim ITC of that particular invoice.

c. De-link invoices first and then link it to different invoice in case of exact values tallies.

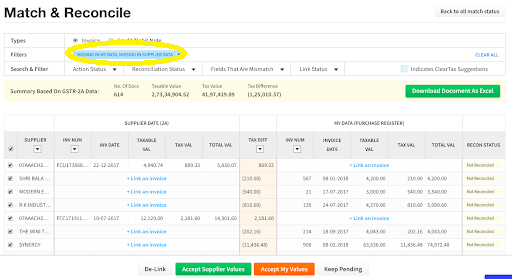

3. Missing In My Data:

3. Missing In My Data:

These are the actions that can be taken in this case :

a. Accept supplier values, when the supplier has uploaded the correct invoices.

b. Link invoices which are present in GSTR-2A with the suggested purchases from the respective suppliers.

c. Keep pending

4. Missing In Supplier Data (Not In 2A):

These are the actions that can be taken in this case :

a. Accept my values when you have uploaded the correct invoices.

b. Link invoices, which are present in your data with the suggested purchases from the respective supplier GSTIN

c. Keep pending

Further, click on ‘+link an invoice’ to link a particular unmatched invoice with the suggested invoices with the respective supplier.

a. Log in to ClearTax GST and click on the ‘Reconciliation’ tab.

b. After clicking on the reconciliation tab, the screen below appears. Select the financial year and the tax period you want to reconcile for.

c. Download GSTR-2A from GSTN for all periods in one go.

c. Download GSTR-2A from GSTN for all periods in one go.d. Import the purchase data either in ClearTax/government/custom templates.

e. Then, click on ‘Start Reconciliation’, the process of the match and reconcile will start. A consolidated invoice data appears supplier wise in the next screen.

Here one can view and act on either of the following:

Click on ‘View all’ against :

– All Suppliers – To view the complete list of invoices

– Individual Suppliers – To view the list of the invoices issued by each supplier

f. On clicking ‘View All’ appearing against all invoices, ‘Match & Reconcile’ window opens:

Here one can,

– Use filters to view data according to his needs

– Summary of GSTR-2A data is displayed

– Get suggestions for matching from ClearTax

After matching and reconciling, the status of each and every invoice as reconciled or not is shown under the column ‘Recon Status’.

g. Apply filter on ‘Reconciliation Status’ to view all the results appearing in the ‘Recon Status’ tab.

The following results will appear :

1. Matched: Here, purchase invoices uploaded and GSTR-2A data downloaded from the GSTN portal matches based on default and suggestions from ClearTax.

2. Mismatch in values: Here, purchase invoices uploaded and GSTR-2A data downloaded from the GSTN portal doesn’t match in one go.

3. Missing in my data: Here, a purchase invoice is not uploaded but the same appears in the GSTR-2A downloaded from GSTN portal.

4. Missing in Supplier Data: Here, a purchase invoice is uploaded but the same is not present in the GSTR-2A downloaded from GSTN portal.

Following are the actions which can be taken once you filter the above results one-by-one :

1. De-link: The linked invoices can be de-linked. Once de-linked, invoice falls in either ‘Missing In My Data’ or ‘Missing In Supplier Data’ depending upon which bucket they belong to.

Note: If you have bulk selected invoices from multiple buckets, you would not be able to de-link invoices for either ‘Missing In My Data’ or ‘Missing In Supplier Data’.

2. Accept supplier values: Accept the values uploaded by the supplier to claim ITC on the selected invoices.

3. Accept my values: Accept your own values to claim ITC on the selected invoices.

4. Keep pending: Once the invoice is marked as ‘Keep pending’, the same will not be available for ITC in a particular month.

5. Link Invoices: You can suggest invoices that you want to link to a respective document.

1. Matched Invoices :

Considering these are matched invoices (identical invoices), you can take the following actions on these invoices:

a. Accept Supplier Values

b. Keep Pending

In case an invoice has to be de-linked, it will shift to missing in supplier data or missing in my data respectively.

2. Mismatch In Values:

2. Mismatch In Values:The following actions can be taken on the invoices with high tax difference:

a. Accept supplier values or accept my values, in case of mismatch in values when the tax difference is very low respectively.

b. Keep pending, in case one not wants to claim ITC of that particular invoice.

c. De-link invoices first and then link it to different invoice in case of exact values tallies.

3. Missing In My Data:

3. Missing In My Data:These are the actions that can be taken in this case :

a. Accept supplier values, when the supplier has uploaded the correct invoices.

b. Link invoices which are present in GSTR-2A with the suggested purchases from the respective suppliers.

c. Keep pending

4. Missing In Supplier Data (Not In 2A):

These are the actions that can be taken in this case :

a. Accept my values when you have uploaded the correct invoices.

b. Link invoices, which are present in your data with the suggested purchases from the respective supplier GSTIN

c. Keep pending

Further, click on ‘+link an invoice’ to link a particular unmatched invoice with the suggested invoices with the respective supplier.

Related Articles

How to Handle ITC Mismatch in GSTR-2B and GSTR-3B

Introduction With the growing reliance on automation in GST filing, taxpayers are expected to match their Input Tax Credit (ITC) claims in GSTR-3B with the details available in GSTR-2B. However, mismatches between the two are common — and if not ...Unique Challenges in Filing GSTR-1 for Freelance Aggregators

? Introduction Filing GSTR‑1 is often challenging for freelancers—especially those working through aggregator platforms like Upwork, Fiverr, Toptal, or niche marketplaces. Unlike conventional businesses, freelance aggregators juggle multiple ...GST Compliance for Traders in India

The Goods and Services Tax (GST) is an indirect tax system that has been implemented in India since July 1, 2017. It replaced multiple indirect taxes such as excise duty, service tax, and value-added tax (VAT), bringing them under a single unified ...GST compliance for Retailers in India

The Goods and Services Tax (GST) is a unified indirect tax system implemented in India on July 1, 2017. It replaced multiple state and central taxes, streamlining the taxation process and fostering a more transparent and efficient business ...Filing GSTR-9 and GSTR-9C for Mumbai Businesses

Filing GSTR-9 and GSTR-9C for Mumbai Businesses As Mumbai’s vibrant business landscape continues to grow, so does the importance of maintaining seamless GST compliance. The annual return filing under GST – GSTR-9 and GSTR-9C – is a critical part of ...