Register on Unified Shram Suvidha Portal

EPF Registration: How to Register for EPF

After registering with EPF, an establishment needs to contribute a certain percentage to the fund. This contribution gets deducted from the salary of the concerned employee. Also, an employer needs to initiate EPF registration for the employees. Employees cannot carry out this registration on their own.

If you want to know how to register for EPF as an employer, read on to understand the simple steps involved in its procedure and other related details.

Steps to Register for EPF

If you are an employer willing to register, go through the steps for the EPF registration process given below:

Step 1: Registering Company for EPF

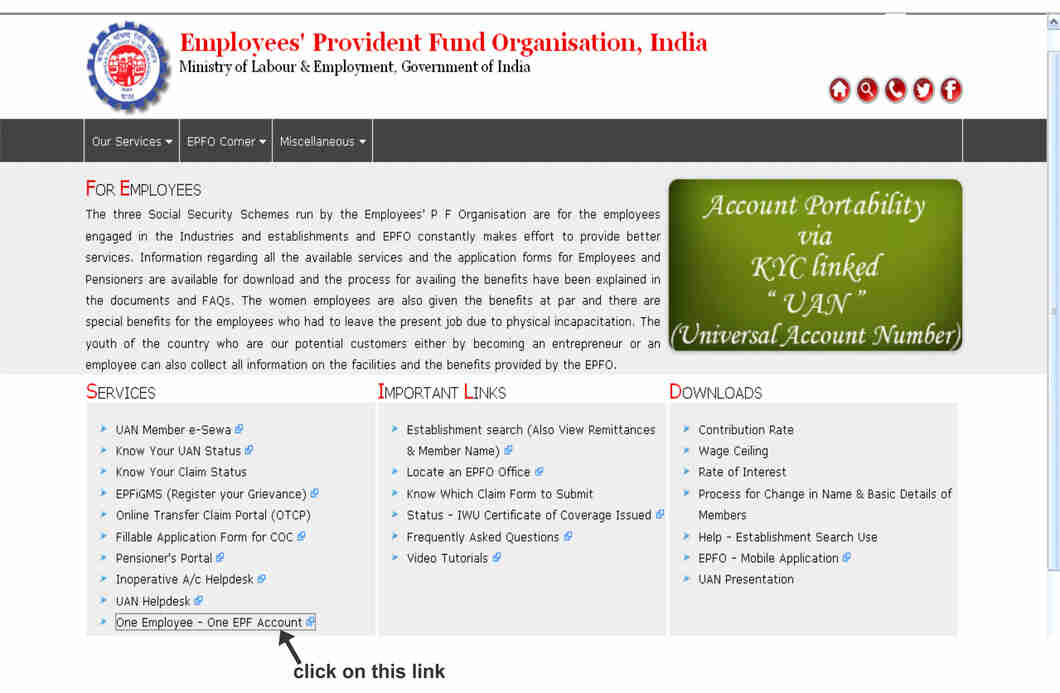

Visit the EPFO web portal for registering your company. Select the option stating ‘Establishment Registration’ present on the home page of this unified portal.

Step 2: Download User Manual

On clicking the ‘Establishment Registration’ option, the page would be redirected to the link https://registration.shramsuvidha.gov.in/user/register. Here on this link, there is a user manual available which you must download. This manual should be read thoroughly before registration if you are new to this process.

Step 3: Register on Unified Shram Suvidha Portal

After thoroughly reviewing this user manual, sign up on Unified Shram Suvidha Portal (USSP) of EPFO. The sign-up page of USSP would open when you click on the ‘Establishment Registration’ tab present on the home page. Then, click on the tab marked ‘Sign Up.’

On clicking the 'Sign Up button, you will be asked for your name, mobile number verification code, and email. Input all required details to create an account.

Step 4: Fill Up the Registration Form

Login to USSP and locate a tab stating ‘Registration for EPFO-ESIC v1.1’ situated on the screen’s left side. After this, choose an option displayed as ‘Apply for New Registration’ on the screen’s right side.

You would find two options on clicking, namely, ‘Employees’ Provident Fund and Miscellaneous Provision Act 1952’ and ‘Employees’ State Insurance Act 1948.’ As an employer, you would have to select the option stating ‘Employees’ Provident Fund and Miscellaneous Provision Act 1952’ and then click the 'Submit.'

On clicking the button stating ‘Submit,’ the page featuring ‘Registration Form for EPFO’ would be displayed. Here you need to input employment details, branch or division, contact persons, establishment details, activities and identifiers.

Step 5: Attaching DSC

After filling out the above registration form and attaching all required documents, the employer’s DSC or Digital Signature Certificate needs to be uploaded and affixed on this form. The Unified Shram Suvidha Platform would email you to confirm that EPF registration has been successfully completed on uploading the DSC.

What are the EPF Registration Eligibility Criteria?

The EPF registration is compulsory for establishments meeting the following criteria:

• A factory that is engaged in an industry bearing workforce strength of 20 or higher.

• Other establishments having 20 or greater number of employees or a class of similar establishments that are specified on this behalf by the central government through a notification.

An employer should obtain EPF registration within 1 month of recruiting twenty employees, or it might lead to a penalty. At the same time, if the employee strength of a registered organisation becomes lower than the minimum threshold, it also remains under the range of the norms of the Act.

The Central Government might apply provisions to an organisations having employee strength of lower than 20 after handing over a notice of 2 months regarding mandatory registration.

It would also be necessary for some organisations with fewer than 20 employees to obtain EPF registration, but that comes under voluntary registration.

List of Documents Required for EPF Registration

The documents necessary for EPF registration which employers should affix to ‘Registration Form for EPFO’, are listed below:

• Bank statement or cancelled Cheque of entity

• Digital signature of Director, Partner or Proprietor

• Leased, hired or rented agreement (if applicable)

• PAN card of Partner, Director or Proprietor

• Aadhar card of Director, Partner or Proprietor

• GST certificate or shop and establishment certificate or any license issued for the establishment by the government.

• Address proof like water bill, electricity bill, or telephone bill of the registered office (must not be older than two months).

•

Why is it Important for an Employer to Register for EPF?

As TDS gets deducted from the salary of employees, the EPF registration is a vital process on the part of employers. Moreover, they would be required to process remittances only after the employers generate challans from the EPFO employer portal. Hence this process is mandatory for them.

With this article coming to an end by now, you must be aware of the EPF registration method. So go ahead, check the eligibility for EPF registration and carry out the entire procedure if your establishment is eligible.

Created & Posted By Kiran

Marketing Expert at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Contact: 8961228919 ; 8802812345 | E-Mail: connect@taxaj.com

Related Articles

Step by Step guide for EPF Registration for Employer

EPF Registration Online Process for Employer Online registration is important for employers as they deduct the TDS from employees’ salary. In order to register online, you will be required to create an account first. PF registration is obligatory for ...EPF Registration For Employers

EPF Registration For Employers Employees Provident Fund [EPF] is a scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It is regulated under the purview of Employees’ Provident Fund Organisation (EPFO) which is one of ...ESIC Registration–Process, Benefits, Documents Required

ESIC Registration – Process, Benefits, Documents Required ESI stands for Employee State Insurance managed by the Employee State Insurance Corporation (ESIC) which is an autonomous body created by the law under the Ministry of Labour and Employment, ...What are the List Of Documents Required For GST Registration

List Of Documents Required For GST Registration The GST registration process is a long one that involves business-related documents. For registration, you need to submit different types of documents according to the type of company registration. Find ...EPF Voluntary Registration Process & Filings

Employees Provident Fund (EPF) is a scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It is regulated under the purview of the Employees’ Provident Fund Organisation (EPFO) which is one of the world’s largest social ...