Scam 1992 Explained: Harshad Mehta Scam

The irregularities in securities transactions of the banks and financial companies known as securities scam, which came to light in the second quarter of 1992 are unprecedented in many respects. Both the volume and the involvement of individuals and the institutions were various and stupendous. It embraces among others foreign banks, financial and other public/private sector corporations, the principal stock exchanges, select brokers, and persons occupying high offices.

- Joint Parliamentary Committee Report

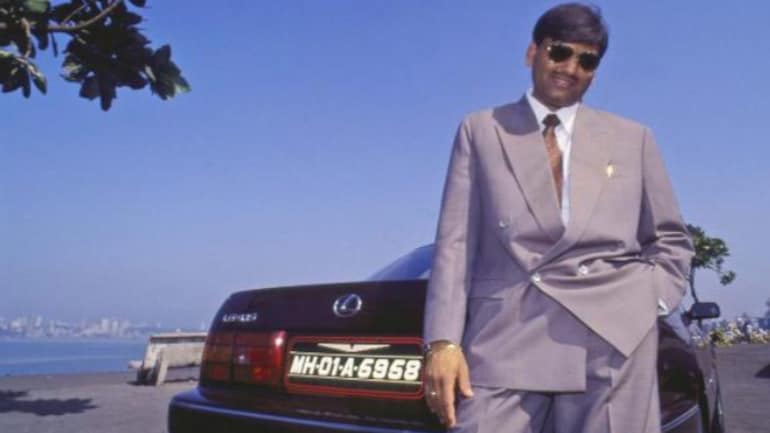

The securities scandal of 1992, with Harshad Mehta as its main player, is back in collective consciousness nearly three decades after it was perpetrated, thanks to Sony LIV's popular web series Scam 1992.

While the series has been praised for its largely accurate portrayal of the events that transpired -- down to a fleeting mention of the fiscal deficit in the Budget 1986 speech, as is shown when a character is watching it on TV -- there are only so many details that it can capture given the scope of the medium.

Here's a detailed FAQ that takes an in-depth look at the Securities Scam 1992.

At its core, what was the Securities Scam 1992 about?

Stockbrokers wanted to borrow funds to deploy in the market. Stringent RBI regulations restricted them from borrowing from banks, the cheapest source of funds. Brokers found a workaround built on trading in government securities, colluding with banks, circumventing RBI rules, getting their hands on bank funds and diverting it to the stock market.

Brokers and banks got help from public sector undertakings (PSUs), which we're looking for avenues to deploy their temporary surpluses. In violation of rules, PSUs started taking positions in the securities market through the portfolio management services (PMS) schemes run by banks.

This wall of money fuelled massive speculation in stocks between April 1991 and May 1992 and caused a nearly fourfold jump in the BSE Sensex.

How did stockbrokers come into the picture?

Stockbrokers needed funds to finance their stock market trades. These brokers took up proprietary positions in stocks or were financiers for vyaj badla trades.

Many of them were also brokers in the money market, where corporate bonds and government securities were traded.

What is vyaj badla?

Back in the 80s, stock market trades were settled once in two weeks. But buyers had the option to roll over their position to the next settlement cycle if they could find somebody to finance it. The financier would charge an interest, which was higher than the rates in the bond markets, as well as the deposit rates offered by banks. Many big brokers were badla financiers as well.

And when they were not financing other traders, the brokers would need funds to roll over their positions, if the market was in an uptrend.

So brokers found it profitable to access funds from the banking system and use it for their stock market operations. They found a loophole in the banking system that was there for everyone to see. They exploited it to the hilt. This was to do with banks’ trading in debt securities.

Why did banks trade in securities?

For two reasons. One, to meet the RBI regulations of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). CRR, as the term implies, required banks to park a certain portion of their deposits with the RBI at zero interest. For SLR, banks had to park a certain portion of their deposits in government securities and other approved securities.

The second reason was to boost their profits, which were quite low at that time.

What is the link between securities trades and compliance with CRR and SLR requirements?

When the RBI raised CRR, some banks would find themselves short of cash. Similarly, some banks would find themselves short of securities to meet SLR requirements. This meant there was both a buyer and a seller, a prerequisite for any market.

But banks in need of cash could have directly borrowed from the call money market where banks lend to each other?

Till 1988, the interest rate in the money market was capped at 10% by the Indian Banks Association. So banks with surplus cash were not keen to lend in the call market. To circumvent the IBA rule, banks devised the ‘ready forward’ mechanism, and so could lend at a rate higher than the call money rate.

What is a ‘ready forward’ deal?

Bank A, which temporarily required cash to meet the CRR rule, would sell securities to Bank B. After a few days, Bank A would buy the securities back from Bank B at a slightly higher rate. The difference in the purchase and sale price of securities was the interest paid for borrowing the funds. This would be higher than the call money rate. Note, the coupon rate or yield on the securities had no connection to the trade, which was a pure financing deal.

What was the reason for banks’ profits being low?

In the 80s, banks had to park 63.5 percent of their deposits with RBI, in cash or specified securities to comply with the CRR and SLR requirements. This earned either no interest or interest way below market rates. Around 40 percent of the remaining deposits were earmarked for priority sector lending. That left banks—both public sector and private sector--with little funds for commercial lending.

Also, there was a cap on the interest rate that banks could offer their depositors. So bank deposits were not the first choice for corporates with surplus funds.

Bank receipts are said to be at the heart of the scam? What exactly were they?

This was the era of paper trading. Often, there would be a delay in the seller bank handing over the physical securities. Sometimes, the delay was because of the certificates lying at a different centre. In many cases of PSU bonds, the actual issue of certificates was delayed for several years and the holders' evidence of ownership was only an 'allotment letter'. Also, for large ready forward transactions, physical delivery could be cumbersome since the trades were to be reversed shortly.

So the seller bank would issue a ‘bank receipt’ (BR) to the buyer of the securities, till such time the shares were physically handed over. Once the buyer got delivery of the securities, the BR would no longer be valid.

What were the rules regarding BRs?

Among the main ones, BRs could not be issued for government securities, they could only be issued when PSU bonds or mutual fund units were traded.

The record of government securities held by banks was maintained by the RBI’s Public Debt Office in what was known as the Securities General Ledger (SGL). When a bank wanted to sell government securities, it only had to give an SGL transfer form to the buyer. The buyer would hand the transfer form to the PDO, which would then credit the securities to the buyer’s account and debit the seller bank’s securities account.

The other key rule was that BRs were valid for up to a maximum of 90 days.

How were BRs misused?

There were multiple violations that eventually led to BRs becoming accepted currency, being traded as securities with the underlying securities rarely changing hands.

Was RBI aware of the misuse of BRs?

Yes. Six years before the scam came to light, an RBI inspection report of October 1986 found Andhra Bank and Syndicate Bank guilty of misusing BRs. Andhra Bank had issued BRs without having the underlying securities, and Syndicate Bank had issued an SGL transfer form without having adequate balance in its government securities account.

Did RBI take any steps to prevent the misuse of BRs by banks?

In July 1991, as the misuse of BRs became rampant, RBI issued a circular to banks forbidding sale transactions unless they held the actual securities in their investment account. Also, all transactions put through by the banks either on an outright basis or on a ready-forward basis had to reflect on the same day in their investment accounts.

However, the banks ignored the circular and continued to flout the rules on BRs.

How did brokers access funds from the banks?

There was a close nexus between some banks and some brokers, which allowed the brokers to have unauthorized access to banks’ funds, as well as put through transactions not always authorized by the banks.

Banks lent the funds to the brokers in the guise of ready forward transactions. The rules clearly said that ready forward transactions could be done only between banks and that too for government securities. To circumvent this, transactions were recorded as being entered into with counterparty banks. But the beneficiaries of these transactions were the brokers. In short, certain banks acted as 'routing' banks for brokers.

How were the trades routed?

The 'routing' banks purchased securities in their own name or sold securities in their own name without indicating that they were acting for the brokers. Where securities were not readily available, they even issued their own BRs.

So when Bank A bought securities from Bank B, the cheque would be made out in the name of Bank B. However, in many instances, the funds would be credited to the individual accounts of brokers. This was possible because every bank dealing in securities had their favoured set of brokers, for whom they were willing to bypass rules.

The brokers would then play the stock market with the funds, earn profits and return the money to the bank.

Why were banks willing to accommodate brokers?

Brokers helped banks meet regulatory requirements and also earn profits on their securities transactions. In addition, brokers also accommodated banks by temporarily taking losses off their books. For instance, when the RBI hiked interest rates, the value of the bonds held by banks would decline, and this would affect their profits. So the banks would temporarily park some of the loss-making bonds with brokers, to minimize the blow to their profits. The brokers would absorb losses on some transactions and would be compensated for those in some other trades. It was a classic ‘you-scratch-my-back-I-scratch-yours’ arrangement between banks and brokers.

What about the role of foreign banks?

The special scrutiny conducted by RBI in 1989 and 1990 revealed gross irregularities in the PMS operations by the foreign banks and non-compliance of RBI circulars. A few of these violations were noticed by the Ministry of Finance as early as 1986, according to an MoF representative’s statement to the JPC.

Some foreign banks like Citibank were found to be short-selling government securities, which meant that it sold securities not owned, in violation of RBI rules.

Four foreign banks—Standard Chartered, ANZ Grindlays, Bank of America and Citibank—accounted for 56 percent of all securities transactions by banks between April 1991 and May 1992.

The JPC report said, “ANZ Grindlays, Citibank, American Express Bank, Bank of America and SCB have not only been the major players in the scam but have initiated the entire process of the scam.”

Why then did the RBI not take action against foreign banks?

India’s foreign exchange situation was quite fragile in the late 80s and early 90s. “We have to depend on loans and credit from foreign banks in the international market,” the then RBI Governor S Venkitaramanan told the JPC when asked about RBI’s inaction against foreign banks.

How did PSU firms get sucked into shady dealings in the securities market?

As the government gradually withdrew budgetary support, PSUs started raising huge sums from the bond markets even when they did not have any capital expenditure plans. Sometimes the large public issues made by the PSUs did not find enough takers. So the PSUs struck deals with banks: the banks subscribed to a significant part of the issues and in turn, the PSUs placed the funds in the PMS schemes of the banks who subscribed to the issues. In some cases, the returns from the PMS schemes were lower than the interest that the PSUs had to pay on the bonds.

Were there other reasons as well for PSUs to money in PMS schemes?

Yes. Even when PSUs were able to raise money without help from banks, they needed to generate enough returns to be able to pay interest to the bondholders. Many PMS schemes promised handsome returns. Banks offering PMS were not supposed to guarantee returns, but there was an unwritten understanding between the PSUs and the banks, on the expected rate of return.

What was the extent of PSUs’ involvement in the securities market?

Between April 1990 and December 1992, PSUs invested around Rs 36,000 crore in the portfolio management services (PMS) schemes run by foreign banks and NBFC arms of nationalized banks. There were two violations here. Government rules said that PSUs could only invest in government securities, public sector bonds and treasury bills. Having handed over the funds to banks, the PSUs never bothered to check where their money was being invested.

Secondly, PSUs were given permission to transact with foreign banks only in January 1992. But PSUs were dealing with foreign banks even before the formal approval.

How did the PMS arrangement help banks and brokers?

The funds raised through PMS schemes would be loaned to brokers, and even corporates, in the guise of ready forward transactions. If the banks were to directly lend to brokers and corporates, RBI guidelines would apply. But when done through the PMS route, they were technically investing the funds on behalf of their customers.

Funds for CAPEX being diverted to PMS schemes delayed certain PSU projects because the PMS schemes had a lock-in clause of one year.

What effect did the irregularities in the banking system have on the stock market?

Between April 1991 and May 1992, the securities transactions by banks totalled close to Rs 13 lakh crore. Of these, barely 5 percent of the deals by value involved outright purchases or sales of securities. The rest were financing deals.

During the same period, the BSE Sensex rallied from around 1200 to a record high of 4467.

Clearly, the money from the banking system was flooding the stock market and driving stock prices higher.

Was there any other dimension as well to the Securities Scam?

A lesser-known aspect is the irregularities in bill discounting by banks. Many banks flouted the RBI guidelines on bill discounting, and advanced funds to corporates and NBFCs even though the bills were not genuine or did not conform to RBI rules. The corporates often use the funds to buy shares of group companies.

What was Harshad Mehta’s role in the Securities Scam?

Harshad Mehta was a stock market player as well as a money market broker. He was the favoured broker of State Bank of India and its subsidiaries, National Housing Bank, UCO Bank and ANZ Grindlays. While the banks were supposed to be trading securities with other banks, the funds were mostly credited to Harshad Mehta’s individual account. Harshad used the funds for his stock market operations, and peddling the replacement cost theory, sent stock prices soaring to dizzying highs.

What exactly is the replacement cost theory, and Harshad’s version of it?

Replacement cost is the cash that a firm needs to replace an old asset at the current market price. In Harshad’s view, a manufacturing company’s stock market value should be equal to the investment required to set up a similar capacity. For example, if it took Rs 500 crore to build a new cement or steel plant of a certain capacity, then an existing company with that capacity should be valued at Rs 500 crore.

Thanks to this theory gaining acceptance in the market, the share price of cement major ACC rallied from Rs 300 to Rs 10,000 in less than two years. A similar spike was witnessed in many other stocks as well.

What was the tussle between Harshad and the bear cartel?

A group of brokers, mainly rivals of Harshad, had short sold many shares, convinced that the exuberance in the stock market was not supported by fundamentals and that the rally would not sustain. Thanks to the banking funds at his disposal, Harshad was able to carry forward his buy positions, and push prices even higher. The continuous rise in prices bled Harshad’s rivals financially. To square up their short positions, they had bought shares in the open market, which further fuelled the rally, and cost them more money.

Naturally, they were in a precarious position and faced ruin if share prices rose further.

How did things start unravelling?

Due to rampant violations in securities trading, 'holes' had developed in the investment portfolio of banks. These holes remained undetected for a long because the portfolio was supported by SGL transfer forms or BRs which were either on hand or would be delivered by brokers. Few bothered to check if the SGL transfer forms or BRs were backed by securities. Books were fraudulently balanced by creating a fresh set of transactions with SGL transfer forms BRs not backed by securities.

What was the event that finally blew the lid off the scam?

In January 1992, RBI began inspecting the books of banks for irregularities in securities transactions. In April, the RBI found a shortfall of Rs 649 crore in SBI’s investment portfolio. The bank did not have the securities it had paid its broker Harshad Mehta for. Under pressure from SBI, Harshad paid up around Rs 620 crore between April 13 and April 24. But the RBI dug deeper and found that Harshad had paid Rs 574 crore from his Grindlay’s Bank account. Of this, Rs 489.75 crores were funded by National Housing Bank cheques drawn in favour of Grindlays Bank and credited to Harshad’s account. That appeared to be a securities transaction between NHB and Grindlays, but NHB did not have any securities to show for it. The cat was finally out of the bag.

Could Harshad have resolved the problem with SBI, without the RBI pinning him down?

Unfortunately for Harshad, the BSE stopped trading operations on April 16, as brokers went on strike protesting against the directive from SEBI asking them to re-register and pay a higher registration fee.

That prevented Harshad from being able to sell a part of his holdings and repay SBI. Under pressure from the broking community, SEBI diluted the hike on April 20.

Old-timers say the bear cartel, aware of Harshad’s problems, prolonged the strike by making other demands. Harshad is said to have approached a foreign bank with close ties to the bear cartel, offering a part of his holdings at a discount. But that deal did not work out.

Trading finally resumed on April 27, but by then it was too late for Harshad.

What happened next?

The discovery of the shortfall in SBI and the subsequent disclosure of the payments by NHB created a crisis in the securities market. Other brokers too were unable to hide the 'holes' in the investment portfolios of some banks by replacement deals. One after the other, fictitious deals at various banks started getting exposed. Bank of Karad and Metropolitan Co-operative Bank, which had issued BRs and SGL forms without any underlying securities, suffered massive losses and went under.

By mid-May, the CBI froze Harshad Mehta’s bank accounts and seized his assets. Three weeks later, Harshad was arrested by the CBI.

With news of the scam becoming public, and the fund flow into the stock market drying up, share prices nosedived. From a high of 4467 in the last week of April, the BSE Sensex crashed to sub-2600 by August.

What was the size of the scam?

The Janakiraman Committee estimated the size of the scam at Rs 4024 crore.

How was this sum arrived at?

This estimate was based on the exposure of seven financial institutions—National Housing Bank, State Bank of Saurashtra, SBI Capital Markets, Standard Chartered Bank, Canbank Financial Services, Canbank Mutual Fund and Andhra Bank Financial Services. These entities had collectively paid Rs 4024 crore to other institutions for government securities and PSU bonds. But they did not have the securities to show for the money paid, and in some cases, were holding forged securities.

For more info visit TAXAJ

Posted By:- Anuj

Related Articles

Apostillation & Notary Meaning Explained

Apostille vs. Notary: What’s the Difference? As our life becomes more intricately connected on a global level, apostilles allow businesses and individuals to ensure the legitimacy of their international proceedings without significant delay. Though ...Niti Aayog Registration - NGO Darpan - Darpan ID - Unique ID

The step towards growth of your NGO is to get registration under NITI AAYOG i.e NGO DARPAN Niti Aayog Registration – This registration helps the trust to get eligibility for various government schemes for welfare activities. It is mandatory for the ...Can you transfer shares from one person to another

Investors tend to open different Demat accounts over time, making it increasingly difficult to keep track of these accounts separately. Consolidating shareholdings into a single Demat account helps investors take a single look at all their stocks and ...Comparison between Crypto Currency & Stocks

It is not a new thing for people to invest their money in a profitable source to build wealth. Although all kinds of investment portals come with a certain degree of risk, some are less volatile and can shield themselves against massive economic ...Softex Compliances & Filing Post Registration

Softex Compliances & Filing Post Registration When Indian IT and ITeS companies export software services or products abroad, they must comply with Softex filing requirements under the Foreign Exchange Management Act (FEMA) and RBI guidelines. While ...