Section 8 Companies must have shares in Demat form by 30th September 2024

A Private or Public Company licensed under section 8 of the Indian Companies Act 2013 (or Section 25 of the Indian Companies Act 1956 as the case maybe), could be limited by shares or limited by guarantee. If limited by shares, such shares must be dematerialized by 30th September 2024. A Section 8 Company limited by guarantee of its members is not required to do anything in this regard.

The Ministry of Corporate Affairs (MCA) had issued Notification Dated: 27th October 2023 regarding Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023. In accordance with the said rules, Non-Small Private Limited Companies are required to dematerialize their existing securities and ensure that further issue of securities and transfers are only in dematerialized form. The Rules will be effective from 30th September 2024.

The provisions of dematerialization are not applicable to the following Companies.

- Nidhi Company

- Government company

- Wholly owned subsidiary of a public company

- Small Private Limited Company

The provisions of dematerialization are applicable to the following Companies:

- Public limited companies

- Non-small private limited companies

- Section 8 Company

- Subsidiary of a Foreign or Indian Company

- Producer Company (non-small)

- Dormant Company (non-small)

- Wholly owned subsidiary of a private company

- NBFC

Small Companies are exempt, but, Section 8 company is excluded from definition of ‘small company.’

The Companies Act 2013 created the concept of small companies to provide benefits to small enterprises that operate as private limited companies.

The Ministry of Corporate Affairs however introduced further modifications to the definition of a small company on September 15, 2022. This change was implemented through the Companies (Specification of Definitions Details) Amendment Rules, 2022. The refreshed definition of a small company is detailed in Section 2(85) of the Indian Companies Act, 2013. According to this definition, a small company is a non-public entity meeting the following criteria:

- Paid-up Share Capital: It possesses a paid-up share capital equal to or below Rs. Four crores or such higher amount as specified, not exceeding, Rs. Ten crores.

- Turnover: The Company maintains a turnover equal to or below Rs. Forty crores or such higher amount as specified, not exceeding Rs. One hundred crores.

However, the concept of small companies does not extend to certain types of firms, including holding or subsidiary companies, those registered under section 8, and entities governed by special acts.

Hence, even though a Section 8 company may meet the criteria of ‘small company’ with regard to having share capital equal to or below Rs. Four crores, the revised definition of a ‘small company’ has excluded Section 8 Companies.

Penalties

Non-compliance will entail penalties of Rs. 10,000 plus Rs. 1,000 for each day the violation continues, with a maximum of Rs. 200,000. Every officer of the company in default also faces the same penalties, with a maximum of Rs. 50,000.

Applicability of Present Amendment

Question: 1. Which firms are surrounded by the Present Amendment?

Answer: To all private companies, the amendment is applicable apart from small companies and government companies.

Question: 2. Whether the Present Amendment apply to small companies?

Answer: Particularly the present amendment does not include small companies. As described u/s 2 (85) of the act small companies, are a company, other than a public company, including paid-up share capital not surpassing Rs. 4 crores and turnover not surpassing Rs. 40 crores. But, a holding company or a subsidiary company, a company registered u/s 8, or a company or body corporate controlled by any special Act will not be regarded as a small company. Therefore, such companies will need to follow the mandatory demat norms.

Question: 3. Whether a Section 8 Company with Share Capital Counted Beneath the Present Amendment?

Answer: Yes, under the Present Amendment, Section 8 companies will get covered irrespective of the quantum of share capital.

Question: 4. Whether a Section 8 Company Restricted by Guarantee is Counted Beneath the Present Amendment?

Answer: No. Since there is no share capital for section 8 company restricted by guarantee, the Present amendment shall not be applicable.

Question: 5. Whether a Private Company Which is a Holding/Subsidiary Company of Another Private Company is in the Present Amendment?

Answer: When a private company is a subsidiary of another private company or is a holding company of another private company then even when the paid-up and turnover counted within the parameters shows for a small company then the same shall not be regarded as a small company, consequently will be needed to follow with the Present amendment.

Question: 6. After 1st April 2023 What if a Company Ceases to be a Small Company?

Answer: The position is mandated to be investigated on the final day of a fiscal year. After 1st April 2023 if a company ceases to be a small company it will be needed to adhere to the provisions within 18 months from the closure of the fiscal year i.e. from 31st March 2024, and ought to adhere by 30th September 2025.

Question: 7. Whether the Present Amendment Apply to wholly-owned Subsidiaries?

Answer: Yes, the present amendment applies to wholly-owned subsidiaries. The available exemptions under Rule 9A (11) do not apply to private companies under Rule 9B.

Question: 8. Will the Present Amendment Apply to Nidhi Companies?

Answer: The present amendment is to be undertaken for the private companies that are not counted under the small companies and Nidhi Companies are mandatorily incorporated as public companies. Hence, Nidhi companies are not counted under the present amendment. Also, from the applicability regarding Rule 9A (11) of PAS Rules, Nidhi companies are waived.

Question: 9. Is the Present Amendment Applicable to a Private Company that is Considered to be a Public Company? What if the Stated Company is a Wholly-Owned Subsidiary?

Answer: For the objective of the provision of the act a private company which is a subsidiary of a public company is constitutionally a private company however, it is considered as a public company. Therefore under Rule 9A of PAS Rules a considered public company is covered already. In which these considered public company was a wholly owned subsidiary the same was waived from the Rule 9A applicability. In the opinion of the present amendment being a private company, the same shall be needed to adhere to the rule 9B. Concerning Rule 9A the exemption will cease to be applicable.

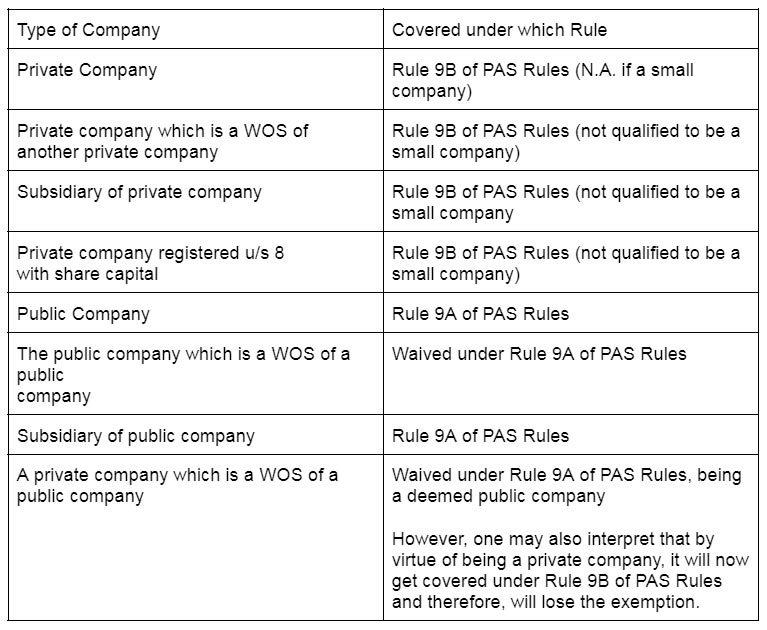

The examination on the foundation of the company and holding structure has been stated below-

Question: 10. Whether the Amendment Apply Only to Shares or other Securities as Well?

Answer: The Present Amendment utilizes the word “securities” and thus, it applies to all sorts of securities i.e., equity shares, preference shares, debentures, warrants, etc.

Actionable Emerging via Present Amendment

Question: 11. What are the Quick Actionables Emerging out of the Amendment?

Answer: A private company that is counted under the present amendment will be needed to

- Receive ISIN for all the current securities issued via the company,

- Streamline dematerialisation of all existing securities (as and when the request is obtained via the holder of such securities),

- Assure that the holding of its promoters, directors, and KMPs are held in dematerialised form exclusively, before making any offer for issuance or buyback of securities on or after September 30, 2024

- Only in the dematerialised form issue all securities

Question: 12. What is the Methodology for Dematerialising the Securities?

Answer: The procedure of Dematerialisation is where the physical certificates are converted into electronic form with an equivalent number of securities and credited into the beneficial owner’s demat account. The process for dematerialisation is as under:

Question: 13. Whether the Company Needed to Appoint a Registrar and Share Transfer Agent (‘RTA’)?

Answer: For streamlining dematerialisation the role of RTA is to act as an intermediary between the issuer and the depository and corporate measures are performed via the issuer subsequently. The same verifies the request obtained for the dematerialisation via the depositary participant and forwards it to the Company.

Under the Act, the same is not compulsory to appoint the Registrar and Share Transfer Agent when the company secures an in-house arrangement. As per that where an RTA is not hired the company shall be needed to undergo the cited activities to enable the dematerialisation of securities kept through the investors.

Question: 14. Whether the Private Companies Covered Under Rule 9B Ought to Maintain a Register of Members?

Answer: No. As per Section 88 (3) of the Act, the register and index of beneficial owners maintained by a depository u/s 11 of the Depositories Act, 1996 (22 of 1996), will be regarded to be the corresponding register and index for the Act.

Question: 15. If the Company loss to Adhere to the Provisions of the Present Amendment then what will be the Result?

Answer: No specific penalty was established u/s 29 of the Act and thus, the penalty as per Section 450 of the Act will apply.

According to section 450 of the act, the company and every officer of the company who is in default shall be obligated to a penalty of Rs 10,000. If there is a continuous case of violation, with an additional penalty of Rs 1000 for each day post the first during which the breach carried on, within the maximum of Rs. 2,50,000 in case of a company and Rs. 50,000 in case of an officer who is in default or any other person.

Issue of Securities By Private Companies

Question: 16. Can a Private Company Provide Securities in Physical Form Before 30th September 2024?

Answer: Yes, private companies are enabled to issue securities in physical form before 30th September 2024, but the same will ensure such securities are dematerialised on or before 30th September 2024.

Question: 17. Can a Private Company Provide Securities Post 30th September 2024 if all the Securities have not been Dematerialised via the Shareholders/Investors?

Answer: As per Rule 9B of PAS Rules, if the promoters, directors, and key managerial personnel have dematerialised their holding, the company is qualified to make an offer for the issue of securities in dematerialised form. Only where the securities are aimed to be kept in dematerialised form the subscribers will be able to apply.

Transfer of Securities

Question: 18. Can a Holder of Securities of a Private Company Transfer these Securities in Physical Form before 30th September 2024?

Answer: Yes, it is possible that a securities holder of a private company can transfer the securities in physical form before 30th September 2024. Hence, it can be attained in dematerialised form only.

Question: 19. Can a Shareholder Persist to keep the Shares in Physical Form even after 30th September 2024?

Answer: A shareholder, unless a promoter, director, or KMP, may continue to hold shares in physical form even after 30th September 2024. The said shares are unable to be transferred until dematerialised. Additionally, the shareholder is enabled to subscribe to any issue only after ensuring the dematerializing of the securities.

Question: 20. Whether Dematerialisation of Shares Consequence in Free Transferability, Violating Section 2 (68) of the Act?

Answer: Section 2 (68) of the Act stipulates a private company and a feature of a private company is the right to restrict the transfer of shares. Under Section 58 (1) of the Act, a private company has the authority to reject registration of transfer of shares. Dematerialisation of shares under Rule 9B of PAS Rules cannot be said to follow the Company as non-compliant with Section 2 (68) read with Section 58.

Depositories propose an optional facility to uphold the ISIN under the status ‘Frozen for Debit’ to private companies to ensure that the holders do not transfer the securities in dematerialised form.

Continual Compliances

Question: 21. What are the Additional Compliances to be Ensured via Private Companies?

Answer: It is obligated for the private companies to ensure the compliances subjected to be applied to the unlisted company under sub-rules (4) to (10) of Rule 9A which are summarised as under:

- Rule 9A (4): Streamlining of dematerialisation of all its current securities via making

- Critical application to a depository and secure International Security Identification Number (ISIN) for each type of security. Report all its current security holders regarding such facility

- Rule 9A (5): Timely payment of fees (admission as well as annual) needs to be assured to the depository and Registrar to issue and share Transfer Agent (‘RTA’) under the agreement. Keep a security deposit of not less than 2 years’ fees with the depository Registrar and Transfer Agent at all times. Adhere to the statutes or directions/guidelines or circulars, if any, administered by SEBI or Depository over the time concerning the dematerialisation of shares and matters incidental or corresponding thereto

- Rule 9A (6): Prohibiting making any offer or buyback or issue of any bonus or right

- shares till the payments are induced to depositories or RTA.

- Rule 9A (7): Adhere to the applicable provisions of Depositories Act 1996, SEBI (Depositories and Participants) Regulations, 2018 and SEBI (Registrars to an Issue and Share Transfer Agents) Regulations, 1993.

- Rule 9A (8): Filing eForm PAS-6 to the ROC within 60 days from the judgment of each

- half-year duly certified via a company secretary in practice or chartered accountant in practice.

- Rule 9A (8A): Bring to the notice of the depositories any distinction marked in its issued capital and the capital held in dematerialised form.

- Rule 9A (9) & (10): If there are any grudges, the security holders will be filed to the

- Investor Education and Protection Fund Authority (IEPFA). IEPFA will create any action

- against a depository participant or RTA/STA after prior consultation with the SEBI.

Question: 22. What are the Filing Essentials?

Answer: Private companies shall be needed to file the needed Form PAS-6 before ROC under 60 days from the finish of each half year. For the half-year duration from April to September, 29th November will be the last date to file Form PAS-6 and for the duration from October to March, the deadline will be 30th May.

Question: 23. Will the Private Companies be Mandated to file Form PAS-6 for the Half-Year Ending September 2023?

Answer: After 18 months from the closure of FY 22-23 i.e., from October 01, 2024, the provisions of the Present Amendment are applicable and thus the companies will be needed to file form PAS-6 for the half year starting from October 2024 hence the first PAS-6 will be filed for half year ended March 2025.

Securities Dematerialisation

Question: 24. In What way does the Company Streamline the Dematerialisation of its Securities?

Answer: The companies can enroll themselves on the NSDL portal which intends to issue or furnish the securities in demat mode, fill the required form along with necessary documents, verify it, and submit the physical copies of such documents. The companies may be directed to the detailed process given on the CDSL & NSDL website.

Question: 25. What does the term ISIN Signifies?

Answer: SEBI FAQs on Dematerialization elaborates on ISIN (International Securities Identification Number) as a unique 12-digit alpha-numeric identification number allotted for security (E.g.- INE383C01018). Additionally, all kinds of securities such as Equity-fully paid up, equity-partly paid up, equity with differential voting /dividend rights, preference shares, and debentures issued via the same issuer will have distinct ISINs.

Question: 26. Who is Mandated to Apply for Dematerialisation of Securities?

Answer: To secure an ISIN with a depository for each type of security and inform all its current security holders for such a facility the company needs to make an application. The shareholders shall need to open a demat account with a Depository Participant and initiate the process of demat by giving the Demat Request Form (DRF) along with the share certificates for dematerialization.

Question: 27. What is the Opening Procedure for a Demat Account?

Answer: The opening method for a demat account is identical to that of opening a Bank account. The investor needs to select a DP 2 who will assist in completing the formalities. The investors are required to fill up a form and submit their PAN card, proof of address, and bank account details.

All the DPs deliver the facility of opening the account online. A demat account can be opened by the applicant from the website of NSDL or via DPs registered with CDSL or NSDL. (Refer to FAQ No. 12 of FAQs on Dematerialisation of shares).

Question: 28. Is there any Need to File the Stamp Duty During an Initial Transaction for a Demat?

Answer: Stamp duty is subjected to get paid during the issue of shares under the provisions of the Stamp Act, 1899, no stamp duty is there that is liable to get paid on the initial transaction for the demat of shares. (Refer to FAQ No. 13 of FAQs on Dematerialisation of shares).

Question: 29. What are the Expenses an Investor Needs to do to Open and Maintain a Demat Account?

Answer: No account opening charges will be there, but distinct additional charges such as account maintenance, transaction charges, pledge creation, pledge closure, etc are charged by DPs. On the website of NSDL, a comparison of fees levied by the DPs can be accessed.

Related Articles

How to do Share Transfer in my Company?

An important characteristic of a company is that its shares are transferable. Shares or debentures are movable property. They are transferable in the manner provided by the articles of the company, especially, the shares of any member of a public ...Share Transfer in Private Limited Company

Share Transfer – Procedure Involved, Time Limits & Penalties An important characteristic of a company is that its shares are transferable. Shares or debentures are movable property. They are transferable in the manner provided by the articles of the ...Process of Transferring of Equity Shares

An important characteristic of a company is that its shares are transferable. Shares or debentures are movable property. They are transferable in the manner provided by the articles of the company, especially, the shares of any member of a public ...Allotment of shares filing with MCA in India

When a company allots shares to its shareholders, it is required to file a return of allotment with the Ministry of Corporate Affairs (MCA) within 30 days of the allotment. This return is filed in Form PAS-3, which is an electronic form that can be ...ISSUING SHARES IN PRIVATE LIMITED COMPANY

When a private limited company is set up, the first shareholder chooses how many shares a private company can issue. But as per the government, there is a minimum requirement, where the company has to issue at least one share in the company. There is ...