Section 8 Company Annual Compliances

What is Section 8 Company?

A Section 8 Company is a Company that is incorporated with the intention to promote social welfare, charity, protection of the environment or any such related activities. Section 8 Company is a legal form of Non- Governmental Organization. These Companies are treated as Limited Companies without adding the phrase limited to it. Section 8 Company Provides no income or dividend to its members.

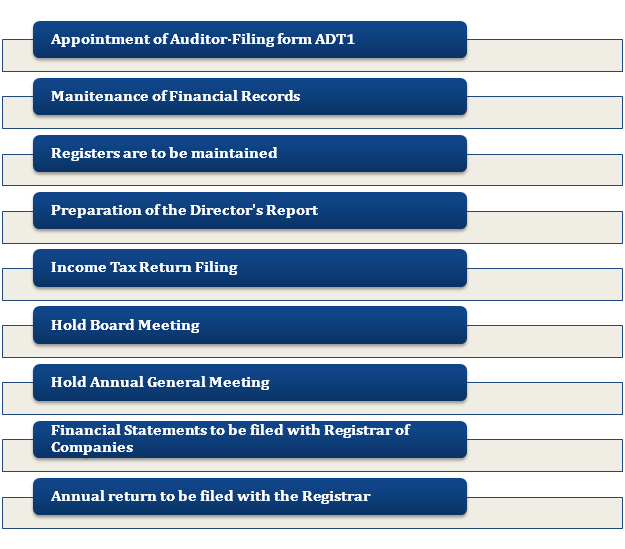

What are the mandatory Compliances for section 8 Company?

The Compliances which are mandatory for section 8 Companies are listed below:

Appointment of Auditor by filing Form ADT-1

- The Auditor is appointed as per Section 139 of the Companies Act.

- The first auditor in a section 8 Company is to be appointed within 30 days from the date of its incorporation.

- The auditor can be an individual or a firm.

- The auditor needs to check all the financial filings of the company.

- The Auditor is to be appointed in the first Annual General Meeting.

- The Auditor shall hold office from the conclusion of the First Annual General Meeting to the conclusion of the sixth Annual General Meeting that is for five years.

- A notice of Auditor’s appointment must be filed with the Registrar within fifteen days of the Auditor’s appointment.

- All the criteria’s mentioned in Section 141[1] for eligibility of the auditor must be fulfilled.

Maintenance of Financial Statements

- Section 8 Company has to prepare its financial records on an annual basis.

- After preparation of the financial records and statements, it must be produced to the registrar.

- The financial records shall contain financial statements such as Trading Account, Profit and Loss Account and Balance sheet.

Registers are to be maintained

- All Section 8 Companies are expected to have statutory records in registers.

- Registers are to be maintained on a yearly basis to check how active the company has been annually.

- The Register will contain the details of members, charges, loans and investments.

Preparation of the Director’s Report

- The Directors Report is to be filed in Form AOC-4 as per Section 134 of the Companies Act, 2013.

- A Directors Report is prepared with the intention to explain to the shareholders the exact financial position of the company and the scope of its business.

- The signed ‘minutes of meetings need to be maintained at the Registered Office.

Income Tax Return Filing

- A Section 8 Company has to file Income Tax Returns on or before 30th September of the next financial year.

- To give a complete overview of the income of the company, it is necessary to file Income Tax returns online.

- But, it can claim certain income to be excluded from income tax.

- If the company gets registered under Section 12A and 80G it can claim tax exemption.

Hold Board Meeting

- Board meetings of every company should be held twice a year in the case of small companies.

- The gap between the two meetings should not be more than 90 days.

Hold Annual General Meeting

- Annual General Meeting is to be held every year on or before 30th September.

- All the Directors, members, and auditors should be notified about the meeting.

- The notice should be sent to the directors, members, and auditors by giving not less than 21 days’ notice.

- The notice of the Annual General Meeting should be published on the Company’s Official website.

- A report of the Annual General Meeting must be submitted within 30 days of the meeting in Form MGT- 15.

Filing of Financial Statements with RoC

- A copy of financial statements should be filed in e-form AOC-4.

- It should be filed within thirty days from the date on which the annual general meeting is held.

Filing of Annual return with RoC

- The annual return is to be filed in Form MGT-7.

- It should be filed within 60 days from the conclusion of the Annual General Meeting.

- Where in any year no Annual General Meeting is held, the annual return should be filed within sixty days from the days on which the annual General Meeting should have been held that is 30 September.

- It should be attached with the statement mentioning the reasons for not holding the Annual General Meeting.

Event-Based Annual Compliances of Section 8 Company

Some Compliance is event-based. These Compliances need to be filed on the occurrence of certain events. Below is the checklist of event-based compliances:

| 1. | Appointment, re-appointment or Removal of Directors |

| 2. | Appointment, re-appointment or Removal of Auditors |

| 3. | Appointment of the Key Managerial person |

| 4. | Transfer of shares |

| 5. | Change in the Company’s name |

| 6. | Any amendment in the Memorandum of Association |

| 7. | Change of Registered Address. |

| 8. | Any other changes in company’s policy. |

Know about the Due dates for filing Section 8 Company Compliances

Section 8 Company should follow compliances within the below mentioned time:

| Form No | Compliance | Due Date |

| MGT-15 | Annual General Meeting | 30th September |

| AOC-4 | Directors Report | Within 30 days of the Annual General Meeting |

| MGT-7 | Annual Returns | Within 60 days of the Annual General Meeting |

| Form ITR -6 | Income Tax Returns | 30th September |

Penalties for Non-Compliance

The Ministry of Corporate Affairs has set up penalty for section 8 Company not complying with the procedures:

- The Central Government may revoke the license granted to the company if it finds that the company is working fraudulently or in a manner violative to the object of the company.

- The companies will be punishable with a fine, which shall not be less than ten lakh rupees and can be extended to one crore rupees.

- The directors and every officer of the company who is in default shall be punished with imprisonment for a term that may extend to twenty-five lakh rupees or both.

- If it is found that the affairs of the company were conducted fraudulently, every officer in default shall be liable for action under section 447.

What is the benefit of following annual compliance of Section 8 of the Company?

The basic reason for meeting the compliance of Section 8 Company is to avoid penalties. Also, it ensures the smooth functioning of the company. Below are some of the listed points:

- Better Credibility of the Companies.

- Avoid getting into any legal trouble.

- To build trust amongst the customers.

- To avoid penalties.

Related Articles

Annual Filing (AOC-4 And MGT-7) - Applicability & Due date

COMPANIES THAT ARE REQUIRED TO COMPLY ANNUAL FILING:- Category-I Every Company registered under Companies Act, 2013 of Companies Act, 1956 is required to file their Financial Statements in e-Form AOC-4 including Directors Report along with other ...MCA Extends Annual Filing Due Date to 15th Feb 2021

The Central Government has received representation seeking extension of Annual General Meetings for Financial Year 2020-21 citing many difficulties faced by stakeholders during the second wave of Covid-19 and consequent lockdown etc., accordingly, ...Annual Filing of LLP after Incorporation

LLP or the Limited Liability Partnership is a hybrid combination of a Private limited company and a partnership Firm. A minimum of two partners are required to incorporate an LLP, there is no such upper limit. Every LLP has to file certain mandatory ...Annual Return Under GST Filing Process

How to File GST Annual Return for 2021 Implemented in India from 1st July 2017. Over 1.3 crore businesses in India have been registered and issued GST registration under the new GST regime. The entities registered under GST must file annual returns ...MCA Extends Due Date for Holding Annual General Meeting by 2 Months (FY 2020-21)

Reportedly, the MCA has decided to extend the Due Date for Holding of AGM by the companies, by 2 months from the original due date in respect of the financial year 2020-21 ended on 31/03/2021. Accordingly, respective ROCs have been advised to issue ...