Table 6A of GSTR-1 : Refund on Export

Table 6A of GSTR-1 needs export details to be reported. Under GST, exports are considered to be zero-rated supplies. The suppliers of zero-rated supplies enjoy certain benefits under the GST law very similar to customs law.

Latest Update

29th August 2021

Company taxpayers can continue filing GSTR-1 and GSTR-3B using EVC or DSC up to 31st October 2021 via the CGST notification number 32/2021 dated 29th August 2021.

26th August 2021

From 1st September 2021, taxpayers will not be able to file GSTR-1 or use the IFF for August 2021 on the GST portal if they have pending GSTR-3B filings. It applies if GSTR-3B is pending for the past two months till July 2021 (monthly filer) or for the last quarter ending 30th June 2021 (quarterly filer) as per CGST Rule 59(6).

28th May 2021

The GST Council recommended in its 43rd meeting the following:

(1) The monthly filing of GSTR-1 for May 2021 will be extended from 11th June 2021 to 26th June 2021.

(2) Filing of B2B sales invoices in IFF by QRMP taxpayers for May 2021 is extended from 13th June 2021 to 28th June 2021.

(3) Companies that are GST taxpayers have been given permission to authenticate returns using EVC instead of digital signature up to 31st August 2021.

(4) Late fee has been rationalised for future tax periods as follows:

(i) If the annual turnover in the previous financial year is up to Rs.1.5 crore then the late fee of a maximum of Rs.2,000 per return can only be charged (i.e Rs.1000 each for CGST and SGST).

(ii) If the turnover ranges between Rs.1.5 crore and Rs.5 crore then the maximum late fee of Rs.5,000 per return can only be charged (i.e Rs. 2500 each for CGST and SGST).

(iii) If the turnover is more than Rs.5 crore then a late fee of a maximum of Rs.10,000 (i.e Rs. 5000 per CGST and SGST) can be charged.

1st May 2021

(1) The due date to file GSTR-1 for April 2021 is extended from 11th May 2021 to 26th May 2021.

(2) The time limit to furnish B2B supplies on the IFF (optional facility), for April 2021 has been extended from 13th May to 28th May 2021.

9th January 2021

If a taxpayer with an annual aggregate turnover of Rs.5 crore does not opt into the QRMP scheme, he will be considered as a monthly filer of GSTR-1 and GSTR-3B from the January 2021 tax period onwards. Hence the due date for GSTR-1 shall be the 11th of next month and GSTR-3B shall be the 20th of next month.

Meaning of exports under GST

Export of goods under GST means taking the goods out of India to a place outside India. The law and procedure for export of goods are primarily governed by the Customs Act.

Export of services takes place under GST on the fulfilment of five conditions. The law and procedure of export of services are solely provided by the Indian GST law. The five conditions are as follows:

- Service provider is in India,

- Service recipient is outside India,

- Place of supply is outside India,

- Payment is received in convertible foreign exchange or otherwise in Indian rupees if permitted by RBI, and

- The relationship between the service provider and recipient must not be that of a distinct person, as defined by the GST law.

(This condition implies that any taxable transaction between the head office and the branch office, either of which is outside India, will not be called exports but is considered only an interstate supply. So, export benefits are not available)

Taxes and duties charged on exports

Usually, exports of goods are subject to the following taxes and duties (Similar to the import of goods):

- Basic customs duty at the applicable rate based on the classification of goods charged on the assessable value.

- Social welfare surcharge at the rate of 10% on basic customs duty charged on the basic customs duty.

- IGST at 18% or such rate notified under GST law and charged on the total of assessable value plus basic. customs duty plus social welfare surcharge, only if not specifically exempted under customs or GST law.

- Cess, if any at the notified rate under GST law and charged on the total of assessable value plus basic customs duty plus social welfare surcharge. Export of service is subject to two taxes – IGST and cess, if any.

Note: All exports are deemed as inter-state under the Indian GST law. Only IGST is applicable for exports and not CGST or SGST/UTGST.

Benefits available to exporters under GST Exporters can claim the refund of IGST paid on all types of exports except where specifically not available. Alternatively, where IGST was not paid on exports under the cover of LUT or bond, exporters may still be able to claim the refund. In such a case, the accumulated input tax credit on raw materials or input services used for making such exports will be refunded.

GST Refund procedure for exports of goods and services

Taxpayers who export goods or services can choose either of the following options for GST refund:

- Refund of accumulated input tax credit that was not utilised where the goods or services were exported without payment of IGST and under the bond/letter of undertaking (LUT)

- Refund of IGST paid on exports after setting off the input tax credit without the cover of bond/LUT, except in the following cases:

- Where the goods exported out of India are subjected to export duty.

- If a drawback is claimed for the taxes paid for the export of goods or services.

- Deemed exports except for capital goods exported under Export Promotion Capital Goods Scheme. (Notification 48/2017-Central Tax, dated the 18th October 2017)

- Exporter of goods or services on which concessional tax is paid for intra-state purchases and is being used in making such exports. (Notification 40/2017-Central Tax (Rate), dated 23rd October 2017)

- Where the IGST is exempted for such export of goods or services from the designated areas like Export Oriented Unit (EOU)/Software Technological Park (STP)/Hardware Technological Park (HTP) as notified under the customs law. (Notification 78/2017 and 79/2017-Customs, dated 13th October 2017)

- In both the above cases, the GST refund must be claimed by filing the details in Table 6A of the GSTR-1* and thereafter by filing the monthly summary return in GSTR-3B. In case of export of goods with IGST payment, the export document which is the Bill of Export or the Shipping Bill itself is considered as the application for refund of IGST.

The GST Officer verifies the shipping bill details declared by the exporter in GSTR-1 with the details appearing on the ICEGATE portal. Accordingly, if he is satisfied with the declaration made, the officer shall credit the refund amount into the bank account declared by the taxpayer at the time of GST registration. However, exporters of services who paid IGST on exports should complete their refund claim by applying in form RFD-1 on the GST portal in addition to GSTR-1 and GSTR-3B. An important prerequisite is to report the Bank Realisation Certificate (BRC/FIRC) number for the export invoice. An application reference number is generated after online submission and the GST officer shall process the refund claim after due verification. The process mostly remains the same for claiming the refund of the accumulated ITC without IGST payment on exports of goods and services. It begins with the exporter filing the Letter of Undertaking (LUT) prior to affecting the exports, within fixed deadlines. The exporter must fill ‘Tax amounts’ as ‘zero’ while making the declaration in Table 6A and Table 6B of GSTR-1. Thereafter, on successful completion of export, the details of accumulated ITC shall be reported to GST portal by filing form RFD-01 to apply for its refund.

*Note: Filled invoice-wise in form ANX-1 and auto-populated into returns -RET-1 or RET-2 or RET-3 under the new GST returns system proposed to come into effect from April 2020.

Timelines for claiming GST refund on exports

| Sl no. | Type of refund | Relevant date |

| 1 | Goods exported out of India where a refund of tax paid is available– | |

| a) Goods are exported by sea or air | The date on which the ship or aircraft in which such goods are loaded, leaves India | |

| b) Goods are exported by land | Date on which such goods pass the frontier | |

| c) Goods are exported by post | Date of despatch of goods by the Post Office concerned to a place outside India | |

| 2 | Services exported out of India where a refund of tax paid is available– | |

| a) Supply of service is completed before payment receipt | Date of receipt of payment in convertible foreign exchange | |

| b) Services received in advance prior to the date of issue of invoice | Date of issue of invoice | |

| 3 | Refund of the unutilised input tax credit on inputs on account of taxes not paid at the time of export of goods or services | End of the financial year in which such claim for refund arises |

Guide to fill table 6A of GSTR-1 on GST portal

Step 1: Login to GST portal.

Step 2: Go to ‘Services’ > ‘‘Returns’ > ‘Return Dashboard’ > ‘GSTR-1’

Step 3: Select the month for which you want to file Table 6A of GSTR and click on ‘SEARCH’.

Step 4: Click on the ‘Table 6A of FORM GSTR-1’ tile.

Step 5: Click on the button ‘ADD INVOICE’ to start filing the return.

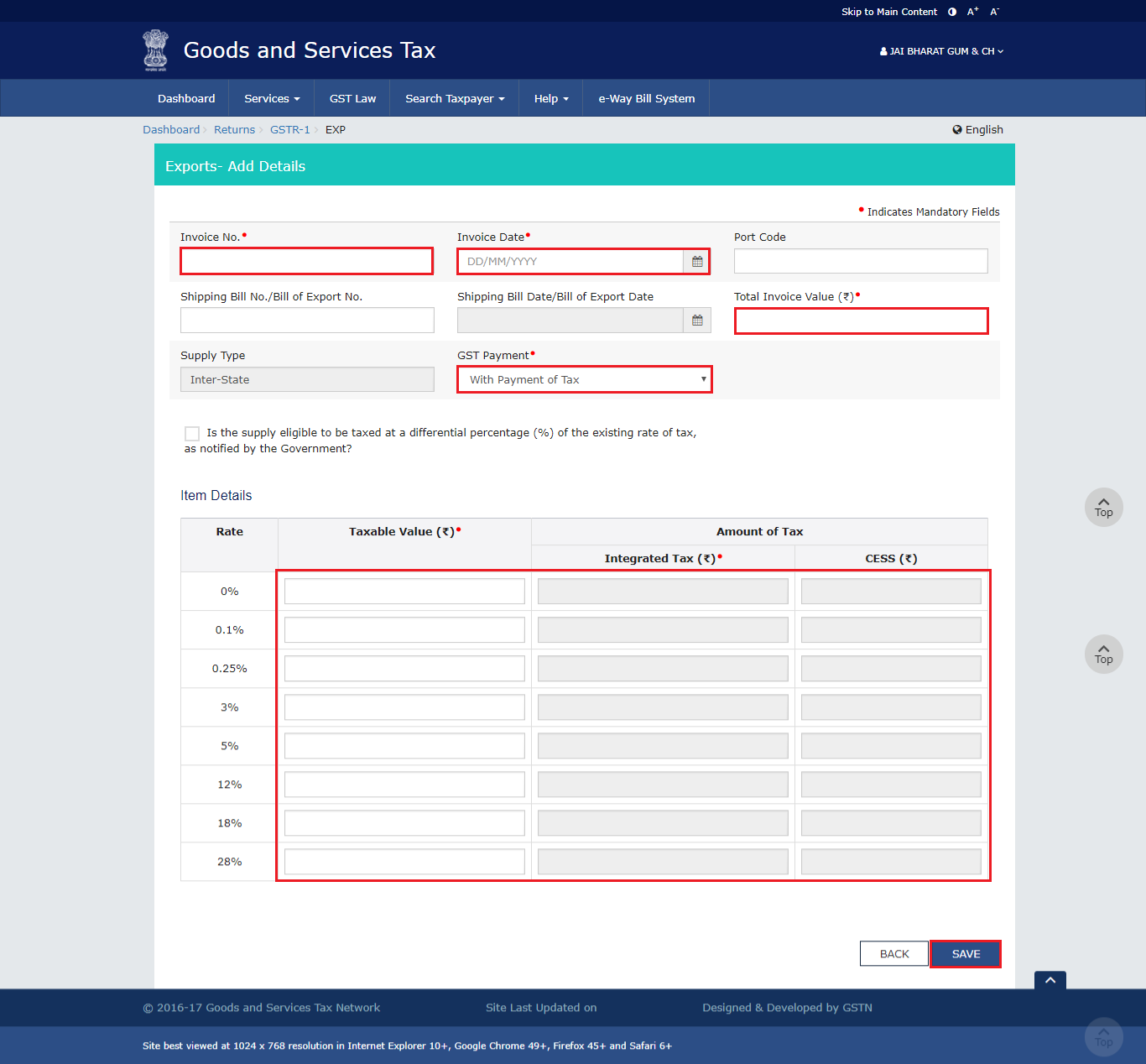

Step 6: Enter details of every invoice on the ‘Exports – Add Details’ page and click on ‘SAVE’. The tile will reflect the number of such invoices added. The taxpayer has the option to edit the invoices too.

- Enter the date of generation of invoice in the ‘Invoice Date’ field.

- Fill in the ‘port code’ which is alphanumeric six-character code as prescribed by ICEGATE.

- ‘Shipping Bill No./Bill of Export No.’ field must contain the unique number of the shipping bill with location code generated while shipping. This can be considered as the invoice number. It must be a minimum of three digits and maximum 15 digits numerics.

- ‘Shipping bill date’ must be filled in the respective field.

- Report the ‘total invoice value’ being the total amount of all goods or services supplied.

- Select either ‘WPAY’/‘WOPAY’ (with payment or without payment of IGST on exports) from the ‘GST payment’ dropdown list for each invoice.

- To the question -’Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the government?’ – Either checkmark to agree or leave it blank.

- Enter the ‘Taxable Value’ field with the value that is subjected to GST (net of GST).

Note: The ‘amount of tax’ fields are auto-populated based on the values entered in ‘Taxable Value’ fields respectively with an option to edit such tax amounts. It appears only in the case where export is done with the payment of tax.

Step 7: Fill in other tiles of GSTR-1 before submitting the return.

Step 8: The saved invoices reflect under ‘Processed Invoices’. You can edit or delete invoice by clicking on the edit and delete buttons under ‘Actions’. Verify all the invoices entered and click on ‘FILE RETURN’ button.

Step 9: Click on the verification checkbox and select the ‘Authorised Signatory’ from the drop-down. File the return using DSC or EVC

Related Articles

Forms under New GST Returns for claiming a refund on Exports

The new GST return filing system is expected to make the process of filing regular returns and tracking ITC smooth and easier. In this article, we analyse in detail the process for claiming GST refunds on exports. It includes both goods and services. ...Exports Under GST: How to Use Bond or LUT?

LUT and bonds are instruments that evidence an undertaking by the taxpayer for exports. Here we give an insight into the details about when to opt for LUT and when to opt for Bond. Not only this but also how to claim the refund of IGST paid on ...GST Refund for Exporters & Application Time Limit

Introduction - GST Refunds The word refund, in simple terms, means an amount of money that is given back to a person upon happening or occurring of some event. In taxation parlance, refund refers to any amount that is due to the taxpayer from the tax ...Unique Challenges in Filing GSTR-1 for Freelance Aggregators

? Introduction Filing GSTR‑1 is often challenging for freelancers—especially those working through aggregator platforms like Upwork, Fiverr, Toptal, or niche marketplaces. Unlike conventional businesses, freelance aggregators juggle multiple ...GST Applicability & Tax Rates on Export of Goods & Services

?✈️ A clear guide for exporters under India’s GST regime India’s Goods and Services Tax (GST) regime has significantly reshaped the landscape of indirect taxation. For exporters, the rules are notably favorable, aiming to make Indian goods and ...