📜 Appointment and Removal of a Resident Director in India

Under the Companies Act, 2013, every company registered in India must meet certain compliance norms — one of which is the appointment of a Resident Director. This article explains who qualifies as a Resident Director, how to appoint or remove them, and the compliance process involved. ✅

🧍♂️ Who is a Resident Director?

As per Section 149(3) of the Companies Act, 2013, every company must have at least one director who stays in India for a minimum of 182 days during a financial year.

👉 Note: The person can be an Indian or foreign national — residency is based purely on physical presence, not nationality.

🏢 Applicability of the Requirement

This applies to all companies, including:

🆕 For newly incorporated companies, the 182-day requirement is checked proportionately based on the remaining period in the financial year.

✅ Appointment of a Resident Director

🔍 1. Eligibility Criteria

-

✅ Be an individual (not a company)

-

🚫 Not be disqualified under Section 164

-

🗓️ Have stayed in India for at least 182 days in the financial year

📝 2. Procedure for Appointment

📌 Step 1: Get Digital Signature Certificate (DSC)

Used to sign all ROC forms digitally.

📌 Step 2: Apply for DIN (if not already available)

DIN can be applied via SPICe+ during incorporation or Form DIR-3.

📌 Step 3: Obtain Consent

The proposed director must sign Form DIR-2.

📌 Step 4: Board Resolution

Pass a resolution in a Board Meeting for the appointment.

📌 Step 5: File ROC Form

File Form DIR-12 with the ROC within 30 days.

📑 Documents Required

-

🧾 PAN & Aadhaar (for Indian nationals)

-

🛂 Passport (for foreign nationals)

-

🏠 Proof of residence

-

🖼️ Passport-size photo

-

📝 Consent in DIR-2

-

🧾 Board resolution for appointment

📌 Duties & Liabilities

Once appointed, the Resident Director:

⚠️ The Resident Director is equally liable for any non-compliance or fraud committed by the company.

🔁 Removal or Resignation of a Resident Director

👋 1. Resignation by the Director

-

📨 Give written resignation to the company

-

🧾 Company files Form DIR-12

-

🧾 Optional: Director may file Form DIR-11

-

🧷 Board takes note of resignation

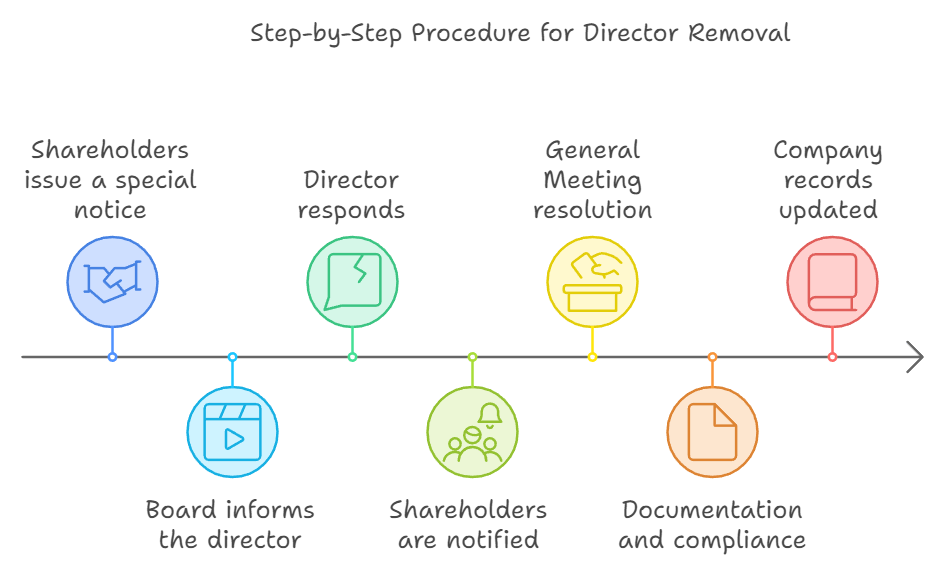

❌ 2. Removal by the Company

🛠️ Step 1: Board Meeting

Hold a Board Meeting to propose removal

📣 Step 2: Special Notice

Issue a special notice and call a General Meeting

🗳️ Step 3: Shareholder Approval

Pass an ordinary resolution

🧾 Step 4: File ROC Form

Submit Form DIR-12 with required documents

⚠️ Important Considerations

-

🧍 You must have at least one Resident Director at all times

-

🔁 If one resigns or is removed, appoint a new one immediately

-

💸 Penalties apply for non-compliance

-

🔄 It’s good practice to appoint more than one resident director as a backup

🧾 Conclusion

The Resident Director is a legal necessity, not just a formality. 🏛️ Their role ensures that the company maintains local presence and legal accountability in India.

Whether you are incorporating a new business or managing an existing one, you must:

-

✅ Know the rules

-

✅ Follow due procedure

-

✅ Stay compliant to avoid penalties

With the right understanding and timely action, the appointment or removal of a Resident Director can be handled smoothly and lawfully. 📈

Related Articles

Director Appointment Filing with MCA in India

Introduction: In India, the Ministry of Corporate Affairs (MCA) plays a crucial role in regulating and overseeing corporate governance practices. One of the key responsibilities of the MCA is to manage the process of director appointments in ...Resident Director Requirement for Joint Ventures and Subsidiaries

? Resident Director Requirement for Joint Ventures and Subsidiaries ? Introduction With the rise in globalization, many foreign companies are expanding into new markets through Joint Ventures (JVs) and Subsidiaries. While setting up such entities ...Who Can Be a Resident Director in India? Eligibility Criteria

Introduction As per the Companies Act, 2013, every company incorporated in India is mandated to have at least one resident director. This requirement is aimed at ensuring legal accountability and ease of compliance with Indian regulatory authorities. ...Appointment of a New Director in Private Limited Company

Appointment of a New Director in Private Limited Company Directors are key person in whom Shareholders of company trusts for their money invested, here in this article we will discuss about how a company can have new Director on its Board ...🧑💼 The Importance of Having a Resident Director for Compliance

In today's fast-evolving corporate world, staying legally compliant is not just good practice—it's a necessity! For companies operating in India, whether foreign-owned or domestic, one key compliance requirement is having a Resident Director. Let’s ...