How to Check GSTIN Number Validity?

GST Registration Check – How to Check GSTIN Validity?

GST Registration Validity

GST registration for regular taxpayers do not have an expiry date and is valid until it is surrendered or cancelled.

Only the GST registration for non-resident taxable persons and casual taxable persons are valid until the date mentioned on the GST registration certificate.

Also Read: How to Apply for GST Registration

Who needs to file GST Registration?

GST registration is mandatory in most states for businesses having an aggregate annual turnover of more than Rs.20 lakhs per year.

In addition to the aggregate turnover criteria, businesses involved in import or export, interstate supply, ecommerce and other such conditions are required to obtain GST registration mandatorily irrespective of annual aggregate turnover.

In this article, we look at the procedure for checking GST registration validity in detail.

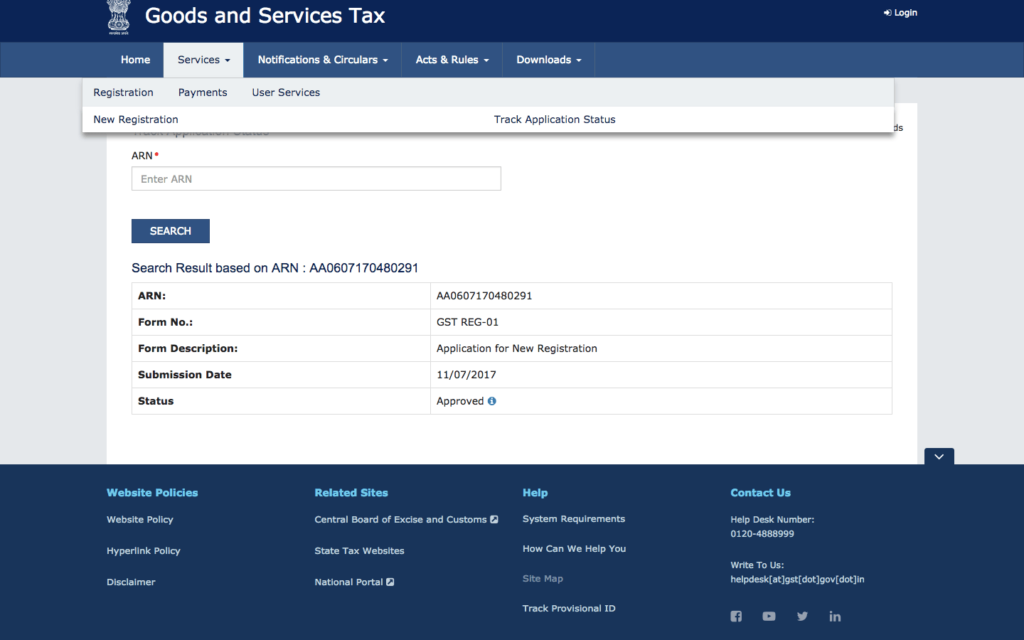

How to Check GST Registration Application Status

If you have applied for GST registration, it normally takes about 7 working days for the provisional GSTIN to be allotted and 10 days to obtain the final GSTIN with GST registration certificate. From the time of submission of GST registration application, the status can be checked on the GST portal.

You can follow the below steps to find the status of a GST Registration application:

Step 1: Go to GST Portal

Step 2: Enter the ARN Number

Enter the ARN number of GST registration application in the place provided and complete the CAPTCHA.

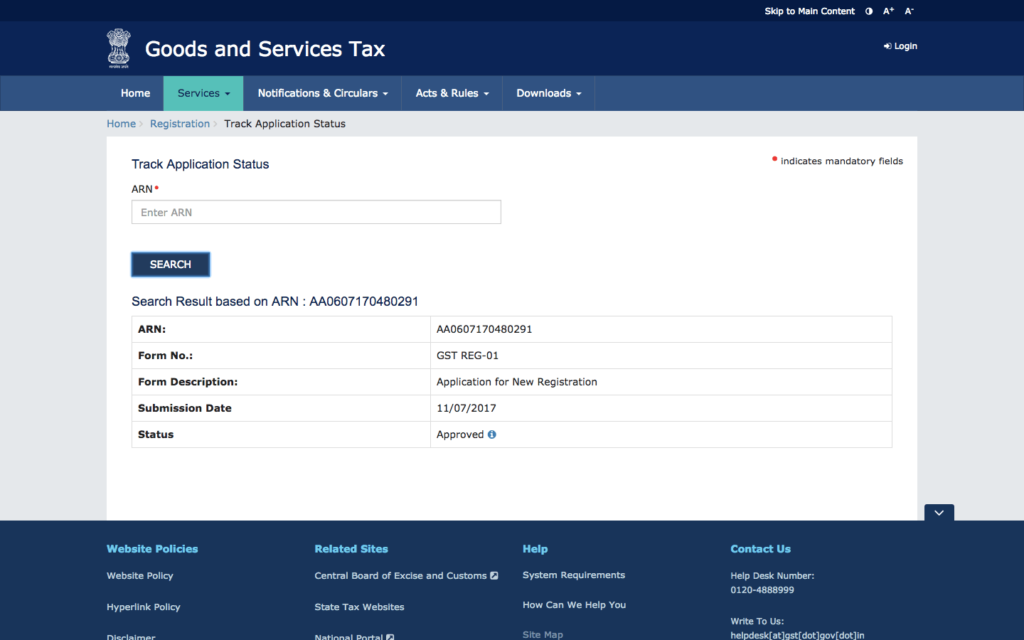

Step 3: GST Registration Application Status

On clicking search, the portal displays the GST registration application status, as below. After the approval of the GST registration application, the portal shall display the approval status next to the status.

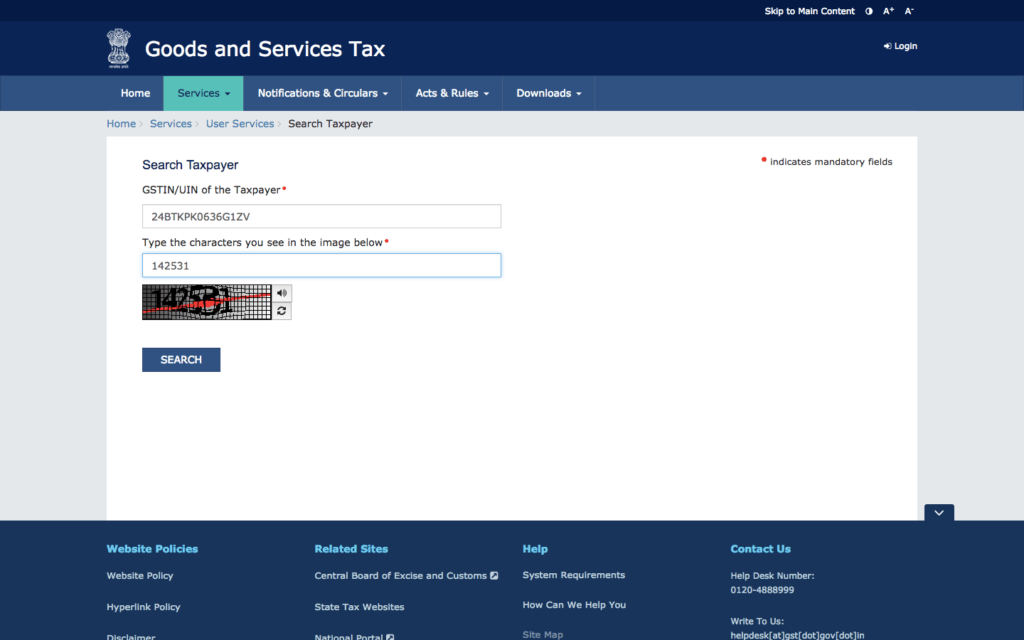

How to Check Existing GST Registration Status

In case you would like to check the status or validity of an existing GST registration, then the following steps can be used.

Step 1: Go to GST Portal

Visit the GST Portal. You can also go to gst.gov.in and select Services -> User Services -> Search Taxpayer

Step 2: Enter the GSTIN Number

Enter the GSTIN number of the supplier or customer in the place provided and complete the CAPTCHA.

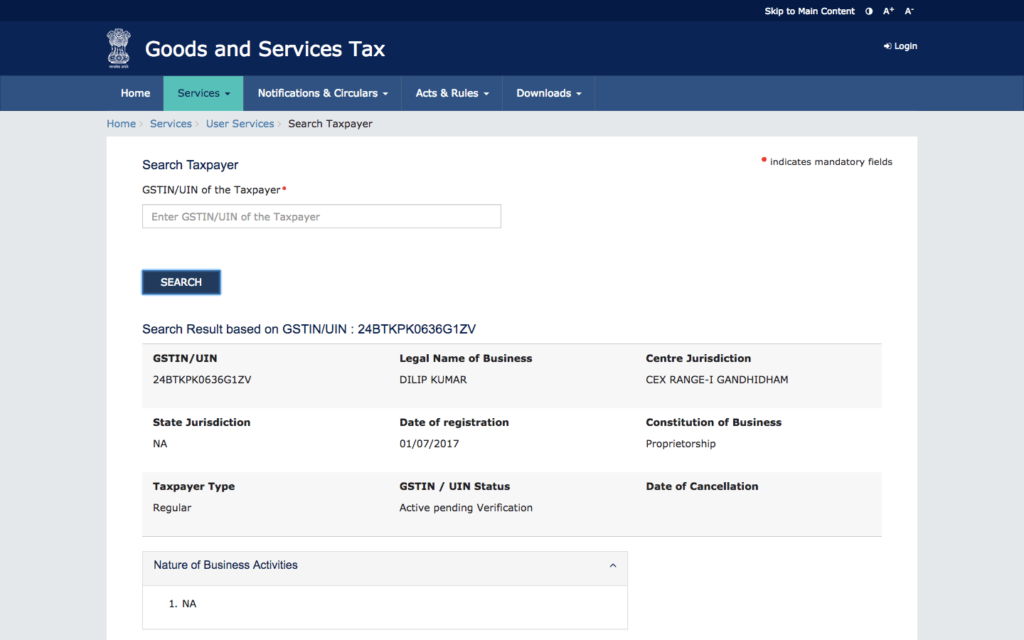

Step 3: GST Registration Application Status

On clicking search, the portal displays the GST registration status along with the status of registration, as shown below:

In case you require GST registration for your business, visit Taxaj or get in touch with an Taxaj Advisor.

Created & Posted By Ravi Kumar

CA Article at TAXAJ

TAXAJ is a consortium of CA, CS, Advocates & Professionals from specific fields to provide you a One Stop Solution for all your Business, Financial, Taxation & Legal Matters under One Roof. Some of them are: Launch Your Start-Up Company/Business, Trademark & Brand Registration, Digital Marketing, E-Stamp Paper Online, Closure of Business, Legal Services, Payroll Services, etc. For any further queries related to this or anything else visit TAXAJ

Watch all the Informational Videos here: YouTube Channel

TAXAJ Corporate Services LLP

Address: 1/11, 1st Floor, Sulahkul Vihar, Old Palam Road, Dwarka, Delhi-110078

Related Articles

Goods and Service Tax Registration

Find Complete Details of GST Registration Procedure GST registration applies to all individuals and entities supplying goods or services in India. GST registration becomes mandatory when the aggregate value of supply exceeds Rs.20 lakh. The Ministry ...GST Compliance Checklist in India

The Goods and Services Tax (GST) is an indirect tax system that has revolutionized the Indian tax structure. Implemented in July 2017, GST has brought about a significant transformation in the country's taxation landscape. To ensure smooth compliance ...E-Way Bill under Goods & Service Tax - All You Need to Know.

E-Way Bill under GST An E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the ...Blocking and Unblocking of GSTIN Reasons and Remedies

The Goods and Services Tax (GST) has streamlined India’s indirect taxation system, but strict compliance requirements mean that businesses must follow rules carefully. One of the most impactful consequences of non-compliance is the blocking of GSTIN ...How to do Self GST Number Registration

GST Registration process is online based and must be carried out on the government website gst.gov.in. Every dealer whose annual turnover exceeds Rs.20 lakh (Rs.40 lakh or Rs.10 lakh, as may vary depending upon state and kind of supplies) has ...