Guide to Check Income Tax Return Status

1. Overview

The ITR Status service is available (pre-login) to the following registered users:

- All taxpayers for ITRs filed against their PAN

- Authorized Signatory, ERI, and Representative Assessee for ITRs filed by them in such a role

This service allows the above users to view the details of the ITRs filed:

- View and download the ITR-V Acknowledgement, uploaded JSON (from the offline utility), complete ITR form in PDF, and intimation order

- View the return(s) pending verification

2. Prerequisites for availing of this service

Pre-Login:

- At least one ITR filed on the e-Filing portal with a valid acknowledgement number

- Valid mobile number for OTP

3. Process/Step-by-Step Guide

3.1 ITR Status (Pre-Login)

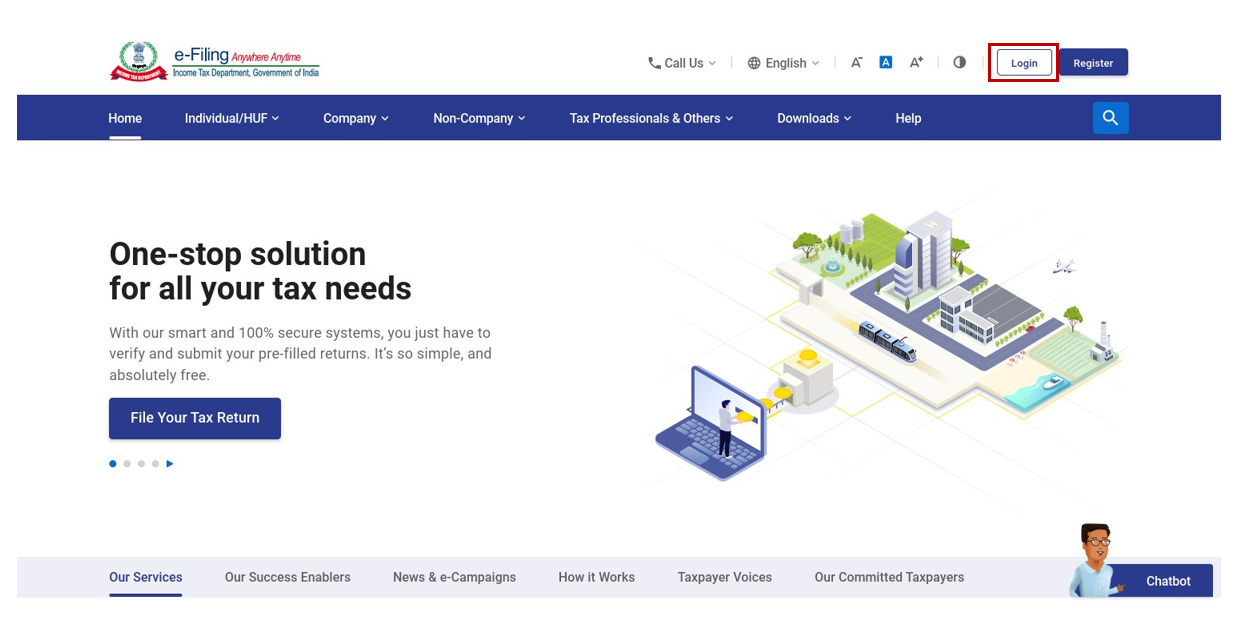

Step 1: Go to the e-Filing portal homepage.

Step 2: Click Income Tax Return (ITR) Status.

Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue.

Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on the screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

On successful validation, you will be able to view the ITR status.

Related Articles

Know your ITR Status on new Income Tax Portal

Manual on How to Know your ITR Status on new Income Tax Portal 1. Overview The ITR Status service is available (pre-login and post-login) to the following registered users: All taxpayers for ITRs filed against their PAN. Authorized Signatory, ERI, ...How to Check Income Tax Return Filing Status?

An income tax refund is due to a taxpayer if he has paid taxes higher when compared to his actual tax liability. When a taxpayer claims a refund in his return of income, the tax department processes such a return and the taxpayer would receive an ...How to check income tax refund status

You require to ensure that you filed the right details of the bank account during filing your return of income tax. A person can check the status of the refund of income tax online through two methods. On the official website of Income Tax India ...Income Tax Refund Not Received Yet - Status Check

You require to ensure that you filed the right details of the bank account during filing your return of income tax. A person can check the status of the refund of income tax online through two methods. On the official website of Income Tax India ...Income Tax Refund Status

The Income Tax Department offers an online facility for tracking your Income Tax Refund and its status. Taxpayers can view the status of refund 10 days after their refund has been sent. It is important to know the PAN and assessment year in order to ...