Section 8 Company Registration Process

What is Section 8 Company Registration in India?

Documents for Section 8 Company Registration

- PAN Card of the Directors and Shareholders

- Aadhaar Card

- Latest Bank Statement

- Telephone Bill or Electricity Bill

- Voter ID or Passport or Driving license

- Passport size photograph of all the directors and shareholders

- Copy of the Rental agreement, in case the property is on rent for the registered office

Benefits of Section 8 Company Registration

- There are certain advantages of registering an NGO or NPO under Section 8 of Companies Act 2013. Some of them are as follows:

No minimum capital: There is no minimum capital requirement for a Section 8 Company Registration in India.

Tax Benefits: There are numerous tax benefits under the Section 8 Company Registration in India.

No Stamp Duty: No stamp duty is imposed on the incorporation of Section 8 Company in India as it is against the provision of the payment of stamp duty on the MoA and AoA of the private limited company.

Separate Legal Identity: Section 8 Company registration has a separate legal entity. It acquires a distinct legal identity from its members.

Credibility: Section 8 Company has more credibility than any other form of a charitable organisation. It is under the strict provision of the Companies Act which requires a mandatory audit every year.

Exemption to the donators: Under Section 80G, the exemption is granted to the donators if the section 8 company is registered under section 80G.

Section 8 Company Registration Eligibility Criteria

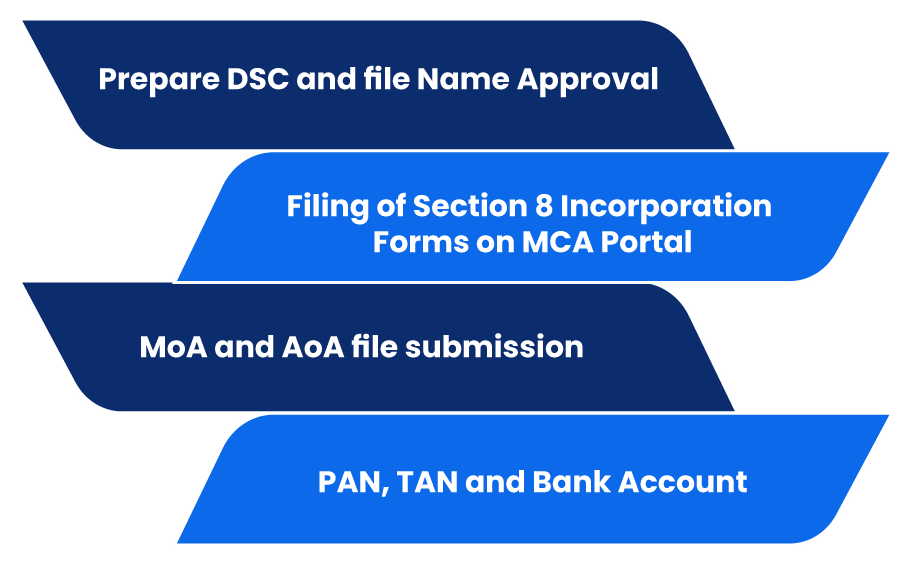

Process for Registering a Section 8 Company in India

- The following process can be utilised for registering a section 8 company in India:

Prepare DSC and file Name Approval

Filing of Section 8 Incorporation Forms on MCA Portal

MoA and AoA file submission

PAN, TAN and Bank Account

Prepare DSC and file Name Approval

Apply for Section 8 Company registration license from Regional Director, MCA (INC-12)

After Name approval, we will apply for Section 8 company registration license from Regional director.

The regional director will review the objectives, plans and will grant a permit for Section 8 Company registration. RD usually takes 15 days to issue a license to operate as a section 8 company.

Filing of Section 8 Incorporation Forms on MCA Portal

After getting approval from the regional director, we will proceed to file the section 8 company registration application with the requisite documents before ROC.

Once all clarifications are provided to ROC, the ROC shall issue a Certificate of Incorporation along with a Company Identification Number (CIN).

MoA and AoA file submission

Once you get the License, you need to draft the Memorandum of Association (MoA) and Article of Association (AoA) to file section 8 company registration applications.

The Object of the company will be detailed in the MoA and the rules, and the by-laws will be mentioned in the AoA.

PAN, TAN and Bank Account

Related Articles

Section 8 Company Registration Fees

Register Section 8 Company (NPO/NGO) 24,710/- (inclusive of all taxes & fees) Important Points - Section 8 registration in 25 to 30 days with License. - No minimum capital requirement. - Best substitute for trust, society registration. What is a ...Section 8 Company Incorporation

As per the Companies Act, 2013, Section 8 Company refers to a corporation that incentivises arts, sciences, sports, education, environment preservation, social welfare, charity, or other similar objectives. The ultimate objection of registering ...Section 25 Company Registration - Benefits, Documents Requirement and Procedure

Section 25 Company Registration - Benefits, Documents Requirement and Procedure Section 25 Company or a Non-Profit organization (NPO) is a Company established for promoting commerce, art, science, religion, charity or any other useful object, ...How to Register Section 8 Company

The Procedure of Section 8 Company Registration Section 8 Company is a non-profit organization involved in social work to develop society and the country. Let us know the steps of the Section 8 company registration process : Obtain DSC (Digital ...Step by Step guide for EPF Registration for Employer

EPF Registration Online Process for Employer Online registration is important for employers as they deduct the TDS from employees’ salary. In order to register online, you will be required to create an account first. PF registration is obligatory for ...