Cancellation of registration under GST-Why & How?

Cancellation of registration under GST- Why & How?

Meaning of cancellation of GST registration

Cancellation of GST registration simply means that the taxpayer will not be a GST registered person any more. He will not have to pay or collect GST or claim input tax credit and accordingly, need not file GST returns.

Consequences of GST registration cancellation

- The taxpayer will not pay GST anymore

- For certain businesses, registration under GST is mandatory. If the GST registration is cancelled and business is still continued, it will mean an offence under GST and heavy penalties will apply.

Cancellation of GSTIN for Migrated Taxpayers

Every person who was registered under erstwhile indirect tax laws had to mandatorily migrate to GST. Many such persons may have not been liable to be registered under GST. For example, the threshold under VAT in most states was Rs.5 lakhs whereas it is Rs.20 lakh* under GST. However, they had to make sure you are not making inter-state supplies since registration is mandatory for inter-state suppliers except for service providers.

*Rs.40 lakh in case of supply of only goods in some states or Rs.10 lakh in certain special category states/Union Territories. Such a taxpayer had to submit an application electronically in form GST REG-29 at the GST portal.

The proper officer shall, after conducting an enquiry as required would cancel the registration.

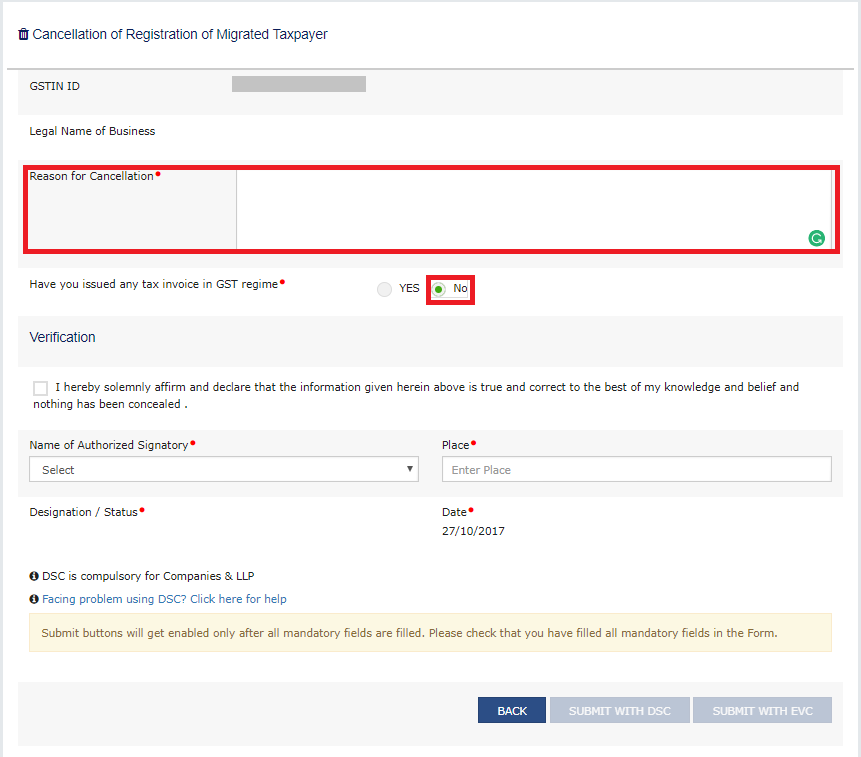

Step 1- Log in to the GST Portal and click the Cancellation of Provisional Registration

Step 2-

- The Cancellation page opens.

- Your GSTIN and name of business will show automatically.

- You are required to give a reason for cancellation.

Note: Taxpayers who have not issued tax invoice can avail above service. If the taxpayer has issued any tax invoice then FORM GST REG-16 needs to be filed. Refer below.

Cancellation by taxpayer (Other than Migrated)

Why does a taxpayer wish to cancel his registration?

- The business has been discontinued

- The business has been transferred fully, amalgamated, demerged or otherwise disposed —The transferee (or the new company from amalgamation/ demerger) has to get registered. The transferor will cancel its registration if it ceases to exist.

- There is a change in the constitution of the business

(For example- Private limited company has changed to a public limited company)

Forms for cancellation

All those who cannot follow the above method must file an application for cancellation in form GST REG 16. The legal heirs of the deceased taxpayer will follow the same procedure as below.

- Application for cancellation has to be made in form GST REG 16.

- The following details must be included in form GST REG 16-

- Details of inputs, semi-finished, finished goods held in stock on the date on which cancellation of registration is applied

- Liability thereon

- Details of the payment

- The proper officer has to issue an order for cancellation in form GST REG-19 within 30 days from date of application. The cancellation will be effective from a date determined by the officer and he will notify the taxable person

Cancellation by tax officer

Why will the officer cancel registration?

The registration can be cancelled, if the taxpayer-

(a) Does not conduct any business from the declared place of business OR

(b) Issues invoice or bill without supply of goods/services (i.e., in violation of the provisions) OR

(c) Violates the anti-profiteering provisions (for example, not passing on benefit of ITC to customers) OR

With effect from 1st January 2021-

(d) Utilisation of ITC from electronic credit ledger to discharge more than 99% of the tax liability for specified taxpayers violating Rule 86B – with the total taxable value of supplies exceeding Rs.50 lakh in the month, with some exceptions. OR

(e) A taxpayer who cannot file GSTR-1 due to GSTR-3B not being filed for more than two consecutive months (one quarter for those who opt into the QRMP scheme) OR

(f) Avails input tax credit in violation of the provisions of section 16 of the Act or the rules.

Procedure

- If the proper officer has reasons to cancel the registration of a person then he will send a show cause notice to such person in form GST REG-17.

- The person must reply in form REG–18 within 7 days from date of service of notice why his registration should not be cancelled.

- If the reply is found to be satisfactory, the proper officer will drop the proceedings and pass an order in form GST REG–20.

- If the registration is liable to be cancelled, the proper officer will issue an order in form GST REG-19. The order will be sent within 30 days from the date of reply to the show cause.

Related Articles

How to Download Gst Cancellation Certificate

A GST (Goods and Services Tax) cancellation certificate is a document issued to businesses or individuals who have cancelled their GST registration. To cancel GST registration, businesses or individuals need to file an application for cancellation on ...How to Revoke GST Cancellation Application if already filed?

Revocation of GST Registration Cancellation The GST Act is comprehensive and covers various situations a taxpayer may face with provisions and procedures. This article looks at the process for revocation of GST registration cancellation order along ...How to Cancel GST Number Online?

Cancellation of GST Application: Complete Guide In 25 steps learn How can you cancel GSTIN registration yourself. The taxpayers must follow the below following steps for the Cancellation of GST Registration: Step 1: Firstly, the taxpayers have to ...How to register for GST in Bangalore?

Introduction Are you a business owner in Bangalore looking to register for Goods and Services Tax (GST)? Making sure your business is GST compliant is essential for its smooth functioning and legal compliance. In this article, we will guide you ...Goods and Services Tax (GST) Compliance in Bangalore

Goods and Service Tax (GST) Registration, GST Returns filing in Bangalore, Karnataka GST or Goods and Services Tax is an indirect tax in Bangalore, Karnataka which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, ...