How to Check E-Way Bill Status

There are many scenarios, where a tax payer may want to reject e-way bill generated against his GSTIN, by other parties – be it recipient, supplier or transporter. The reasons could either be an e-way bill raised by mistake or as a recipient, you may not have got the consignment as per the details mentioned in the e-way bill. In such a case, the right option to adapt for you would be to reject e-way bills. Also, it is important for you to track e-way bills, so that you are clear about the various e-way bills you are involved in.

How to Reject E-way Bills

In order to use this option, you need to follow the steps given below:

- Be ready with the e-way bill number which you want to reject, and also be aware of the date on which that was raised

- Log on to ewaybill.nic.in

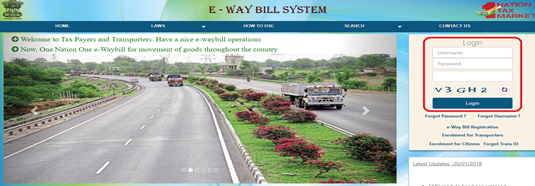

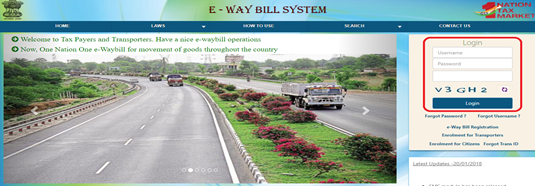

- Enter your User Name and Password, then the Captcha Code, and then click “Login”, as shown in the picture below:

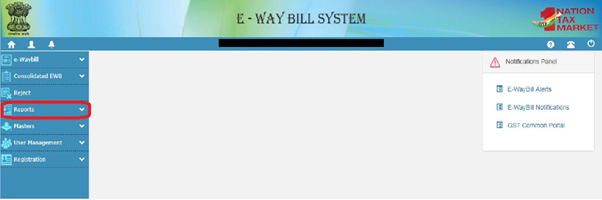

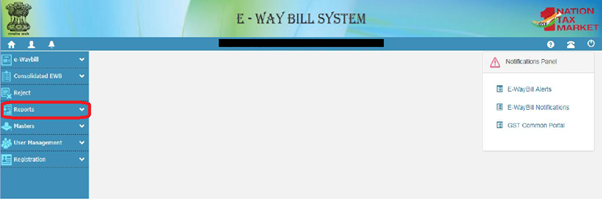

- On successful authentication of your credentials, the main menu of the e-way bill portal will open up. On the left hand side, click the option “Reject”, as shown below:

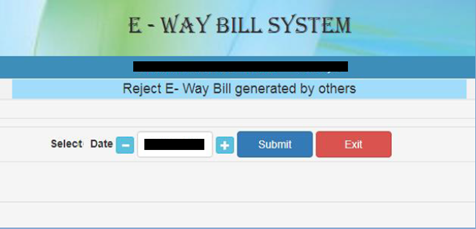

- On doing so, the following screen is shown:

- Select the date on which the concerned e-way bill was raised, and feed that into the “Select Date” field

- Click “Submit”

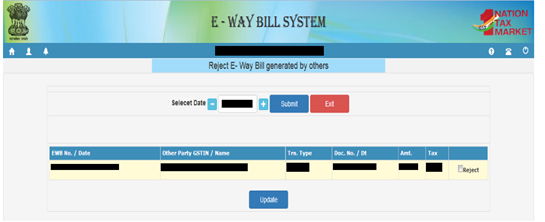

- On doing so, the system will show all the e-way bills generated on that particular date. Select the concerned e-way Bill and reject it by checking the check box on the right side, which you will see on the right hand side of all the listed e-way bills, as shown below:

However, the process of e-way bill rejecting is time-bound. As a recipient, one can communicate the acceptance or rejection of consignments as specified in the e-way bill. If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-way bill, it will be deemed that he has accepted the details, and the option for rejecting e-way bill will no longer be available.

Now, that we have gone through the various methods to generate, modify, cancel and reject e-way bills, it obviously becomes important for any business to do e-way bill tracking. In short, some kind of a report needs to be there, which should be a one-stop guidance to the business owner or decision maker in the business, about the various e-way bill actions, which have taken place.

In order to generate various reports pertaining to the e-way bill, i.e. for tracking e-way bills, you may follow the steps given below:

- Log on to ewaybill.nic.in

- Enter your User Name and Password, then the Captcha Code, and then click “Login”, as shown in the picture below:

- On successful authentication of your credentials, the main menu of the e-way bill portal will open up. On the left hand side, click the option “Reports”, as shown below:

- On doing so, the following screen will emerge, which will give you the option to generate reports based on the various masters i.e. clients, suppliers, transporters and products:

- You will be able to generate the following reports using this facility, as shown below:

- EWB generated by me – This will give you a list of e-way bills generated by you for a particular date. This will include details of rejected EWBs, cancelled EWBs and verified EWBs

- EWB generated by others - This will give you a list of e-way bills generated by others against your GSTIN for a particular date

- Outward Supplies - This will generate the list of e-way bills which have been shown as outward supplies from you for a particular date

- Inward Supplies - This will generate the list of e-way bills which have been shown as inward supplies to you for a particular date

- Masters – This generates the list of master entries under the different categories i.e. clients, suppliers, transporters and products

Related Articles

E-Way Bill under Goods & Service Tax - All You Need to Know.

E-Way Bill under GST An E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the ...Prerequisites for e-Way Bill Generation

Prerequisites for e-Way Bill Generation There are some prerequisites for generating an eway bill (for any method of generation): Registration on the EWB Portal The Invoice/ Bill/ Challan related to the consignment of goods must be in hand. If ...How to Generate e way bill for multiple invoices?

How to Generate E-Way Bill for Multiple Invoices Consolidated E-Way Bill (EWB-02) is a single document that contains details of all the E-Way Bills related to the consignments. If you are a transporter/ supplier who wants to transport multiple ...Cases When E-Way Bill is Not Required

Cases when an Eway bill is not required The Goods and Services Tax (GST) law was introduced in India to correct the erstwhile law’s several wrongs. One of the main problems was a lack of transparency concerning both the taxpayers and the government. ...How to Generate e way bill in Tally Prime

e-Way Bill in TallyPrime The e-Way Bill system was introduced by the government to simplify and streamline the process of GST compliance. An e-Way Bill document has to be carried while shipping the goods from one location to another. This document ...